Let's start with the basics...

Buying and selling shares can be likened to a trip to the supermarket.

The only difference is that rather than buying off the shelf, your transaction is carried out by a broker, a middleman authorised to buy and sell stock.

|

Instead of Tesco, Sainsbury and Asda, think London Stock Exchange, New York Stock Exchange, Hong Kong Stock Exchange and Tokyo Stock Exchange.

These world markets bring together people who want to buy shares and those who want to sell them.

In the UK, the market sub-divides, but we'll leave that until later.

It is part ownership of a publicly-listed company. The company will usually also pay out some of its profits, known as a dividend.

But you may not always get a payout, particularly if the company wants to invest cash in the business, or has fallen on hard times.

British shares are traded on the London Stock Exchange. A record of their daily price movement can be found in the Financial Times.

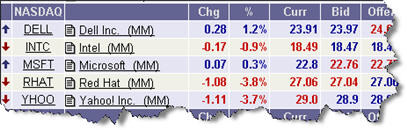

If you want to track minute-by-minute changes, then you'll find them on internet sites such as ADVFN, or Yahoo Finance, albeit with a slight delay.

The market is sub-divided according to the size of a company.

The FTSE 100 is made up of Britain's 100 leading quoted companies - they are sometimes referred to as ' blue-chips' and are usually household names.

Currently, oil giants Shell and BP occupy the top two positions, while HSBC and GlaxoSmithKline are also among the upper echelons. Their worth is measured in billions of pounds.

Below the FTSE 100, is the FTSE 250 made up of medium-sized companies. Saying that, they are valued from around £250m to £2bn.

Moving on down, there's the small-caps (small capitalisation companies). The London Stock Exchange rather oddly refers to them as ex-350 companies, meaning that they rank below the top 350 firms in the market.

There is another wrinkle. The LSE runs a market for new, small companies called the Alternative Investment Market, or Aim. Its entry criteria aren't as arduous as a full listing, but investing on Aim is riskier.

You often hear the stock market likened to a supermarket and indeed we mentioned this earlier. Well it is probably more correct to compare it with a fish market, or the local meat market.

Whether its fish, meat or shares, the market performs the same basic task - matching buyers with sellers.

Prices are dictated by supply and demand.

Taking our food market example, the best cuts and freshest fish will be most in demand and therefore command the highest prices.

In the stock market, the main drivers of the share price are the outlook for profits and the risk associated with the investment.

So if the market reckons a firm's profits are set to balloon over the next few years, its shares will be more sought after than stock in a group whose earnings are forecast to drop.

Information is king when it comes to setting share prices.

While it is impossible to know every minute detail about a company, or predict the sometimes whimsical ebb and flow of markets, news of a firm's fortunes is important in determining whether to buy or sell shares.

So it follows that shares will rise and fall on news - going up on good news and down on bad.

Hope you are with me so far.

Don't make the mistake of believing that share valuations are based on the quoted share price. There is a simple calculation that measures the company's worth. It is known as the price to earnings ratio, or P/E.

Take the example of the supermarket group William Morrison. Its P/E is quoted as 14 in the Financial Times. It means the group is valued at 14 times last year's earnings.

Meanwhile, its rival Tesco has a P/E of 23 - or 23 times last year's earnings. So what do we learn from this?

Well put simply, the market values Tesco's shares more highly than Morrison's.

That's hardly surprising. Tesco has a track record of delivering bumper profits, while Morrison has endured a series of profit warnings.

P/Es vary from sector to sector. Growth industries such as technology will have a higher average P/E's than stable sedentary arenas such as the grocery market.

There's two ways you can make money from owning shares. The first is most obvious, namely an increase in value. This is known as capital growth.

Companies also dole out a proportion of their earnings via a dividend. People who pick stocks because they yield a large dividend are known as income investors.

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.