Borders and Southern spikes as farm out rumours persist

Aug 20, 2014 at 12:43 pm in AIM by contrarianuk

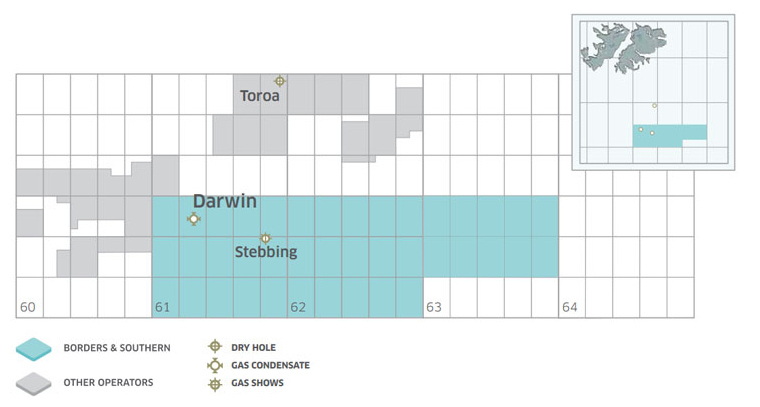

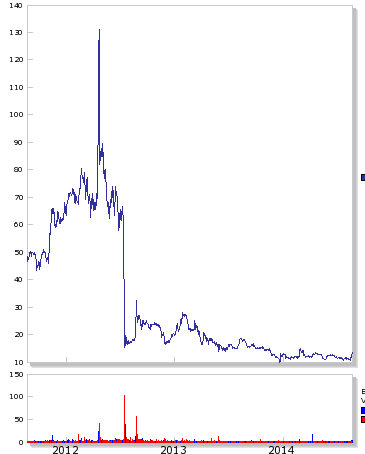

After the excitement prior to the result of the Darwin East well in April 2012, the subsequent period has been pretty painful for shareholders in the South Falklands basin oil and gas explorer, Borders and Southern (BOR). With the shares jumping to around 130p at the time, they subsequently heavily fell as the Darwin well showed gas condensate rather than the hoped for oil and a subsequent incomplete exploration well at Stebbing showed only gas in the deep water off the Southern coast of the Falklands Islands.

Subsequently the Darwin gas condensate discovery was found to have a relatively high liquid content with a recoverable resource of 130 to 250 million barrels of 46 to 49 degree API condensate and log analysis indicated that the reservoir quality is good. The well encountered 67.8m of net pay with average porosity of 22% and average permeability of 337 mD. Further analysis in 2014 produced a new base case model estimate of a wet gas in place of 2.6 tcf and the recovered condensate of 263 million barrels (assuming no aquifer support). With was due to an increase in recovered condensate from our phase 1 model to the phase 2 model is attributed to improved net pore volume and an improvement in fluid recovery.

In order to increase its potential resources in the South Falkland basin more appraisal and exploration drilling was needed and the issue was that with a cash balance as at 31 December 2013 of $23.2 million a farm out partner was needed. Unfortunately finding this partner has taken longer than hoped and fellow Falkland Islands explorers Falkland Oil and Gas and Rockhopper have taken priority in terms of further drilling which is now confirmed for early 2015. In May the company stated “that In the last quarter of 2013, in anticipation of closing out a farm-out, we initiated a rig search for a harsh environment, deep water rig for the next drilling campaign. When our farm-out negotiations broke down we passed over the lead for the rig contract negotiations to our Falkland Islands rig consortium partners. Even though we will not have secured a partner prior to the signature of the rig contract, we will be able to join the consortium at a later stage. We remain confident that a suitable partner will be secured and that we will participate in a 2015 drilling programme to appraise Darwin.”

In the last few days the price of Borders and Southern has spiked from around 10.5p to 14.25p on rumours that a farm out deal is finally a done deal and the company is set to do more drilling in 2015 after its 2012 drilling campaign. Purely speculation right now in terms of Borders, but the Falklands will be firmly back on the agenda next year in terms of drilling excitement when activity resumes that’s for sure after a prolonged quiet period down in the South Atlantic . An RNS is eagerly awaited if the Borders and Southern rumours are on the money.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.