Caza Oil and Gas production moves up in Texas but outstanding debt still an issue

Mar 25, 2014 at 11:41 am in AIM by contrarianuk

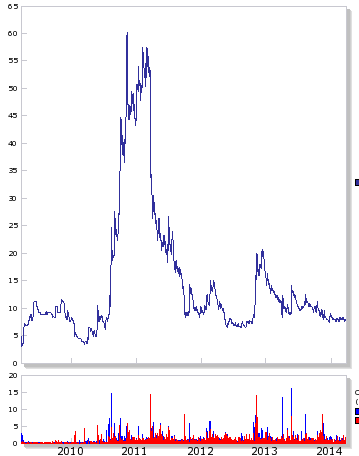

AIM favourite, Caza Oil and Gas (CAZA) published its annual results for 2013 today. The shares are 3% higher today at 8.25p to buy.

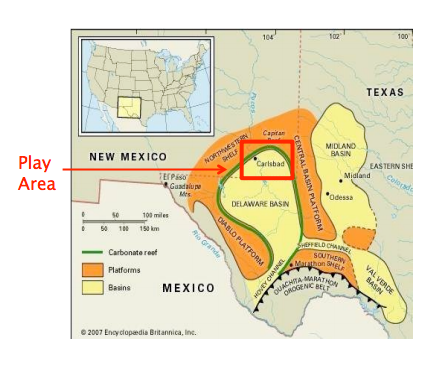

The Company is primarily focused in the Permian Basin of west Texas and southeast New Mexico with a a core asset base in the Bone Spring play with approximately 4,892 net acres of land. It is headquartered in Houston, Texas, and dual listed on AIM and the Canadian TSX.

Caza has made good progress in beefing up its oil and gas resources over the last year but proven reserves remain quite small. There are now 4.4 million barrels of oil equivalent (boe) of proven reserves (compared with 2.4 in 2012) and 14.9 m boe of probable resources compared with 8.3 m boe in 2012. There are now 33.9 million barrels of 3P reserves (proved, probable and possible).

Caza has made good progress in beefing up its oil and gas resources over the last year but proven reserves remain quite small. There are now 4.4 million barrels of oil equivalent (boe) of proven reserves (compared with 2.4 in 2012) and 14.9 m boe of probable resources compared with 8.3 m boe in 2012. There are now 33.9 million barrels of 3P reserves (proved, probable and possible).

Caza’s revenues for the 12-month period ended 31 December increased 67% to $8.31 million compared with $4.97 million in the same period in 2012, but delivered a net loss of $8.5 million (compared with a loss of $12.2 million in 2012). With revenues increasing by by 114% to $3,381,486 for the three month period compared to $1,580,214 for the three month period ended December 31, 2012.

Fourth quarter production increased by 61% to 46,270 boe as compared to 28,716 boe for the three month period ending December 31, 2013. Average production volumes for the year increased 19% to 338 barrels of oil equivalent (285 per day in 2012), with Q4 2013 production rising 114% versus Q4 2012. Caza incurred aggregate production, transportation and severance expenses of $2.3 million or an average per boe of $18.89 compared with $1.83 million or $17.58 average per boe in 2012, an increase of 8% year on year.

The company had $18.5 million of cash on the balance sheet, compared with $6.8 million in 2012. But Caza has taken on significant debt over 2013 in order to secure funding for continued drilling given ongoing losses. It now has a $36 million loan note liability with Apollo investment which is a secured debt and total financing costs were $2.5 million last year – “if in any period the Company fails to comply with any financial or performance covenants, certain mandatory payments are required. Outstanding balances under the Note Purchase Agreement are secured by first-priority security interests in all of the Company’s assets.”

Caza’s debt obligations are somewhat complex with SEDA (Standby Equity Distribution Agreement) and SEDA backed loan agreement with YA Global Master SPV Ltd., an investment fund managed by Yorkville Advisors Global which was initiated in November 2012 and then adjusted in March 2013.

During 2013 the Company received $2,154,211 for shares issued under the SEDA agreement. In 2012, Caza received an initial draw-down of $2.2 million on the Loan Agreement and may draw a second advance of $1.8 million at its discretion. The Company issued 3,846,154 common shares to Yorkville at a price of £0.13 per share for aggregate proceeds of £500,000 (US$756,451). On November 1, 2013 the Company entered into an agreement in relation to a $4.3 million convertible unsecured loan to be made available by YA Global Master SPV Ltd. The Loan consists of $3.5 million of new credit facilities along with an additional $0.84 million that will be used to repay amounts which remain outstanding under the prior loan from Yorkville.

The company entered into a Note Purchase on May 23, 2013 with Apollo Investment Corporation, an investment fund managed by Apollo Investment Management, with Caza agreeing to purchase up to $50 million of its senior secured notes. The Company received $20 million at the closing of the Note Agreement with an additional drawdown of $5 million and $1 on September 11, 2013 and December 19, 2013, respectively. As at December 31, 2013, the Company may draw additional advances up to $15 million until August 23, 2014, if at the time of the advance, the Company meets the specified minimum production and drilling cost requirements for previous wells drilled under the program that were financed with funding from the Note Purchase Agreement. The outstanding balance of the Tranche A Apollo Note as at December 31, 2013 was $32 million (net of unamortised transaction costs $2.97 million).

There are currently 190 million shares in issue (with a potential up to 236 million issued and issuable), so at 8p a share (against a 52 week high of around 14p), the company has a market cap of £15.2 million.

Caza’s share price has been hit by a total lack of interest in small cap AIM oil and gas companies but also by a constant over hang of new shares being issued to fund its operations in Texas as well as worries about how easily the company can repay its loan with Apollo. In February the company issued another 3,724,014 shares to YA Global Master SPV Ltd at 7.27p per share in connection with its November 2013 loan.

The company now has total loan notes to the tune of $36 million according to the latest results and with losses of $8.5 million last year and totalling around $50 million over the last 5 years, the Chief executive Mike Ford has much to do to continue boosting oil and gas output. With Q4 2013 production around 46,000 barrels of oil equivalent, (prices are expected to be $95.54 Nymex in 2014), an equivalent production rate of c. 200,000 barrels in 2014 would given revenues of $19 million in 2014. Profit per barrel remains resilient, with costs of around $19 a barrel.

It is frustrating for shareholders in Caza who saw their shares move over 60p in 2011 but now languish at 8p after a subdued build up in production over the last few years has meant that the company has failed to deliver a profit despite high expectations in Texas. Further good news is now needed from Bone Spring for any sort of rerating of these shares and the big worry will always been the debt due…..profits need to come and before the Apollo note is due in 2017.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.