Final nail in the coffin for Tangiers Petroleum shareholders

Sep 25, 2014 at 9:31 am in AIM by contrarianuk

Moroccan focused, AIM and ASX listed, oil and gas explorer Tangiers Petroleum (TPET) finally came back from suspension yesterday and as expected the various RNS’s didn’t contain much good news for beleaguered shareholders.

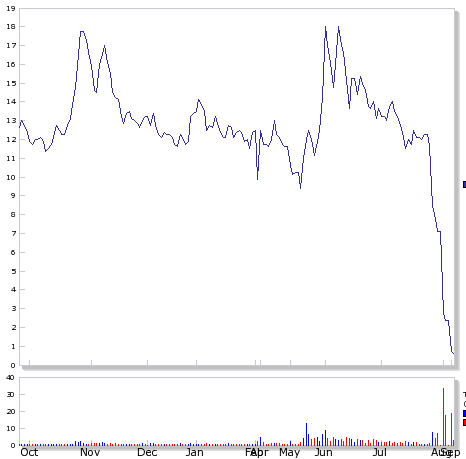

On the 4th August Tangiers severely disappointed investors when it announced the result of the TAO-1 well located in the Tarfaya Offshore Block, Morocco.The well was drilled to a total depth of 3,518 metres and did not encounter favourable reservoir quality at the Trident objective and no hydrocarbon shows were encountered at Assaka the younger secondary objective in the Upper Jurassic. The company had bet everything on this wildcat well and it was always a high risk, high reward prospect. Unfortunately it was not to be for the management and the company then suspended the shares on the 6th August to clarify its financial position. The shares collapsed on the TAO-1 result.

Yesterday the company’s financial position was made clear and it wasn’t good. TPET issued its Half Year Accounts, and lifted its suspension on the trading of the Company’s shares on both ASX and AIM.

The TAO-1 well had come in at a total cost of $18.56m. “This has been funded by the Company’s cash position and leaves Tangiers with a cash balance of approximately A$1.25m. The final cost of the TAO-1 well was in excess of the Company’s internal budget. This was largely due to factors not associated directly with the drilling, which was completed safely and efficiently. Unfortunately, several of the costs were not fully quantified until after the well had reached total depth, at which time it was not possible for Tangiers to issue additional equity. ”

TPET had an obligation to pay a third of the cost of TAO-1 beyond an initial $33 million covered by its farm out partner Galp Energia. Drilling was expected to be around $75 million with a potential maximum cost of $94 million. Unfortunately the company seems not to have taken the possibility of much of a budgetary over run into their financial planning despite the fact that the $18.56 well cost was actually only 19% over budget and less than the 25% that it could have been. For whatever reasons, the management team believed that the well costs could be covered without additional fund raising before the TAO-1 well result, an expensive mistake.

Then there were the real stings in the tail, with the company deciding to exit from the Tarfaya offshore blocks and raise funds through an institutional placing which was announced on the 19th September. On Tarfaya, ” as part of the finalisation of its obligations, Tangiers has undertaken to exit the Tarfaya Offshore Block either: by assigning its 25% interest to Galp Energia (Galp), Tangiers’ partner and the Operator of the block, for consideration of US$3.4m; or by withdrawal when the permit expires in February 2015.”

In relation to the placing, to so called sophisticated investors, even with a significant discount it seems surprising that anyone would want to pour more money into this company. The RNS read, “The Company has received firm commitments for a placement to raise A$1.2m at $0.006 per share to sophisticated investors in order strengthen its balance sheet, as announced on 19 September 2014.”

Why TPET and its Managing Director, Dave Wall, would bet the house on the TAO-1 well with the benefit of hindsight is an interesting question especially given the risks associated with these type of wild cat wells. Yesterday the company said that “Whilst we are now starting from a low base, the Board is confident that we have the right ingredients in place to build a successful oil and gas business.” A low base indeed when you look at the decimated share price and it seems unlikely that the right ingredients are in place given the limited resources of the company even after the heavily discounted placing.

Dave Wall and the rest of the management team are sitting pretty in their board room, but this is a another classic AIM oil and gas stock which seems to be have been severely mismanaged. The shares are now sitting at 0.6p, after trading around 18p before the TAO-1 well announcement, a 97% drop. Yesterday’s placing announcement and loss of Tarfaya seem to be the final nails in the TPET coffin and an expensive mistake for many small cap investors. Ouch!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.