Finally some good news from Outsourcery

Nov 20, 2014 at 12:09 pm in AIM by contrarianuk

Dragons Den’s Piers Linney has not had a great time of it lately at his company Outsourcery (OUT) with the shares collapsing from a listing price of 110p in May 2013 to just over 10p this week. Today they announced a deal with Microsoft which sent the shares up to nearly 19p at one point and see them now at 16p, up nearly 60% on the day.

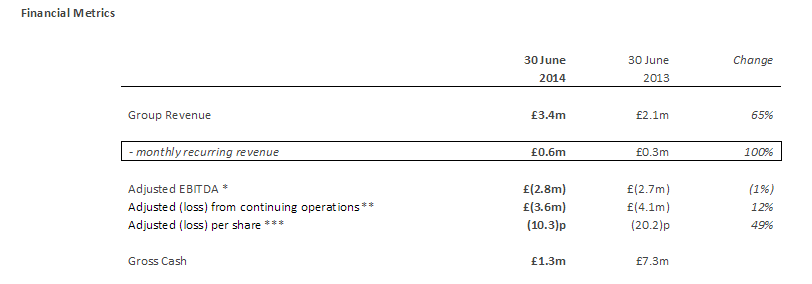

Cloud Services Provider that has struggled with poor income and a high cost base in recent months. In mid September the company issued its first half results and they weren’t great reading with the promise of future rewards for patient investors. Revenues rose 65% to £3.4 million, but adjusted losses from operations came in at £3.6 million with cash being depleted from £7.3 to £1.3 million. Linney defended the business saying that the opportunities from Cloud computing were immense and cash would eventually start rolling in from the various third party collaborations including with Vodafone.

On the 10th October the company announced a funding deal with Encore Capital, a London-based investment firm with a subscription for 5,000,000 new Ordinary Shares in the Company at 20p per share (a premium to the 16.5p share price at the time). This represented 10.6% of the enlarged total issued share capital of the Company upon admission of the new Ordinary Shares and alleviated short term funding problems.

Today Outsourcery announced its participation in the Microsoft Cloud Solution Provider Programme which allows them to provide direct billing, sell combined offers and services, as well as provision, manage and support Microsoft Cloud offerings, such as Office 365. Outsourcery will own the complete customer lifecycle, allowing it easily to sell Office 365 subscriptions and help customers take advantage of Cloud services by owning the entire billing process and directly managing support.

At this week’s 10p, Outsourcery was certainly looking cheap despite the ongoing concerns about profitability. Piers Linney now hopes that he can salvage his reputation with this latest Microsoft deal and repair the damage caused by the pummelled share price since its entry to AIM. Now customers just need to up their spend with OUT and Linney needs to keep a close eye on the cost base to deliver further shareholder value. A recovery play for those brave enough.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.