Gulf Keystone Petroleum and Xcite Energy deliver more news to shareholders

Apr 9, 2014 at 2:34 pm in AIM by contrarianuk

Plenty of news from AIM oil and gas favourites, Xcite Energy (XEL) and Gulf Keystone Petroleum (GKP) this week.

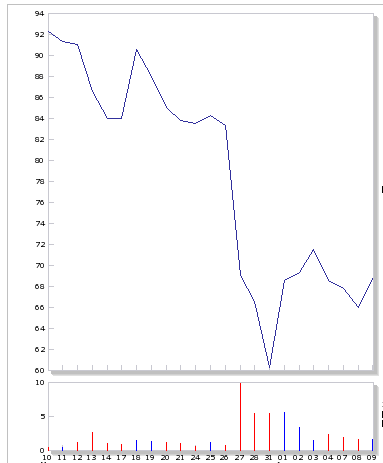

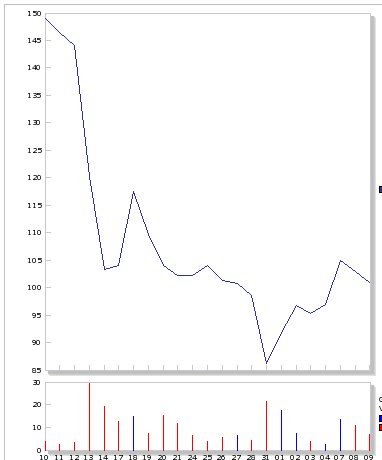

Both companies saw their shares hit multi year low’s a couple of weeks ago with Xcite Energy disappointing investors with news that it had failed to tie up a farm out deal for its Bentley North Sea field, driving the price as low as 59p. In the case of GKP it was down to 80p following a statement in their bond offering document that the $250 million bond would be needed to keep the company as a going concern given a funding shortfall in May. Prior to this a lower than expected reserves figure for its Shaikan Kurdistan field had helped to hit the shares. In a worst case scenario GKP would have been in a $20 million cash deficit by the end of May increasing to $103 million by the end of Jan 2015 meaning that the company had to get its debt issue away successfully.

Xcite Energy share price last 4 weeks

Gulf Keystone share price last 4 weeks

Sentiment surrounding Gulf Keystone also hadn’t been helped by stories from the likes of Tom Winnifrith and the shorter Simon Cawkwell that the shares were worth no more than 30p given company’s existing bonds were trading 30% below par and at junk bond levels . The shares were pretty steady this morning at 101.5p, a significant rebound since the lows of end March but a far cry from the £4 plus days in 2012.

Following the announcement of a fixed income investment road show on April 4th, GKP has today announced the pricing of its debt offering with the company raising $250 million at a coupon of 13% plus 40 million of detachable warrants with a strike price of 102p. Various news sources seem to indicate that the offer has been completed, though the latest RNS didn’t specifically confirm this.

The new coupon rate is significantly higher than the last big issue of debt by GKP in October 2012. With $275 million of senior unsecured convertible bonds due October 2017 carrying a coupon of 6.25%. So 13% versus the 6.5% underlying the fact that fixed income institutional investors now want plenty of interest to overcome the operational risks associated with the shares. Shaikan production levels need to rise and on time, no more excuses from Chief Executive, Todd Kozel. Once bitten twice shy, when it comes to GKP bonds!

On 27th March, following the release of the results for year ending December 31st 2013, Xcite Energy had been forced to admit that farming out its North Sea acreage wasn’t going to plan and that it was exploring other options, terrible news for an already battered share price. This RNS and more recent announcements during early April make it clear that they’re moving ahead with developing the asset themselves in partnership with service providers, either to actually get oil pumping out of Bentley but also potentially to flush out of a bid or get the farm out process accelerated. Many are speculating that Statoil is interested in getting involved with Xcite following its $15 million investment in the extended well test data but is either unwilling to commit or is offering too low a price for the Bentley asset.

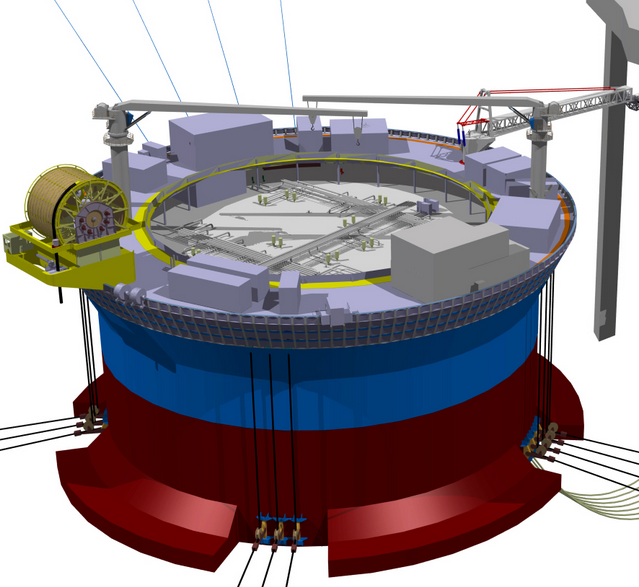

Today there was news from Xcite that the company will use Arup’s self-installing steel Ace platform for Bentley after agreeing a memorandum of understanding (MOU) with Arup and Amec. This follows on from a MOU originally signed with AMEC last June.

Earlier this week, another MOU was signed with Teekay for a cylindrical Sevan FSO (floating storage and offloading) vessel for the project, which would be able to be towed to Bentley and installed with minimal offshore support. Teekay and Xcite are now working on the FEED (front end engineering design).

The big question for XEL investors is still financing. The lack of a farm out partner means that the company needs to get financing from other sources and the MOU’s with Amec, Teekay and Arup will mean that a platform design, capital requirement and funding mechanism can be finalised over coming months prior to contract award and submission of the final Field Development Plan (FDP) to DECC.

A fake financing RNS relating to Amec was released first thing this morning on iii (before later being removed) in which Xcite had apparently given a share of the Bentley field in return for financing support from Amec.

MOU’s are all well and good but at the current 67p, not far from its recent lows, concrete news on financing is needed quickly and it was disconcerting to see an iii news report stating, “It was confirmed to Interactive Investor that the cost and its financing will be made available at the end of 2014, beginning of 2015.” Hmmm!

Avoiding more dilution with a rights issue at these depressed prices is the main thing that private investors want clarity on right now.

If Xcite do go it alone then how quickly how the rig/FSO be designed and built? Will first oil flow in 2015, or 2016? Many investors are hoping that the current 68p is the floor but anything which can allay fears of yet another placing with institutions is what will drive a rapid recovery. Until then its anyone’s guess!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.