Gulf Keystone Petroleum upside limited according to brokers

Dec 17, 2013 at 6:42 am in AIM by contrarianuk

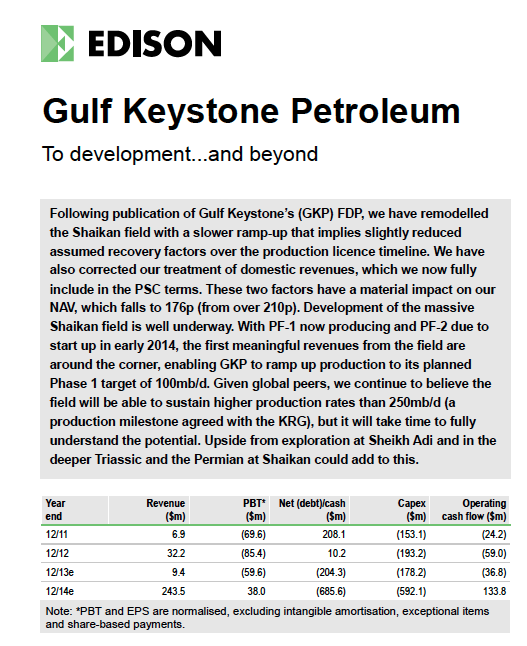

There were quite a few broker notes last week on Gulf Keystone Petroleum (GKP), with the Edison report particularly interesting because the company is a research client of Edison. They reckon the company is worth just 176p on a risked NAV basis. Many of the assumptions look conservative e.g. $50 a barrel average sales price, 20% recovery from the fields etc. However, with the shares currently at 183p, given how bullish Edison generally are about their clients a little cause for concern.

Edison aren’t alone with a sub £2 target for the shares. Canaccord Genuity also cut its target from £2.16 to £2, Westhouse Securities reiterated their neutral rating with a £1.60 target. HSBC rated GKP overweight in November with a £1.85 target.

The key for GKP remains how quickly it can gear up production from its assets and get the export revenues. A spokesperson for the Kurdish Autonomy in Northern Iraq Sevin Diyazi said, Sabah newspaper reported on Dec.16.that exports from the Kurdistan/Turkey pipeline would start in January. How quickly GKP can access the pipeline is the $64,000 question. Genel and other larger companies seem to be getting priority right now with their lighter crude oil production.

The company is due to move from AIM to the main FTSE market next year. Will it be taken over? GKP’s assets are certainly very, very large.

From Edison, “Shaikan is an anticline sitting at the north-west end of the Zagros Foldbelt approximately 85km north-west of Erbil and extends 30km from east to west and 10km from north to south. Since its discovery in 2009, the estimated size of the field has increased and now stands at 13.7bnbbls (pMean) OIP with a P10 of 15.0bnbbls. The main focus is to increase the current productive capacity of 20mb/d to 40mb/d in 2014 and then to 100mb/d and 250mb/d. This is a very significant undertaking for a relatively small company. ”

GKP’s shares fell yesterday despite a further update on its litigation with Excalibur Ventures. The company will receive £10 million towards costs and it was interesting to see the backers behind Excalibur, namely, Psari Holdings Limited, Mr Adonis Lemos, BlackRobe Capital Partners LLC, BlackRobe AEO Investors I, LLC, Platinum Partners Value Arbitrage Fund LP, Hamilton Capital LLC.

On 10 September 2013, the English Commercial Court (the “Court”) provided a summary of its decision to dismiss all of the claims asserted by Excalibur Ventures LLC (“Excalibur”) against the Company, its two subsidiaries and Texas Keystone Inc. (together the “Defendants”) and decided all issues in favour of the Defendants.

Gulf Keystone is pleased to announce today that on 13 December 2013 the Court handed down its full judgment (“Judgment”) dismissing all of the claims asserted by Excalibur and deciding all issues in favour of the Defendants. The Judgment is expected to be made public at http://www.judiciary.gov.uk/media/judgments/2013/index

Further to its announcement of 9 December 2013, the Company is pleased to reiterate that Excalibur does not propose to appeal the Judgment.

On 13 December 2013, the Court also ordered that the Defendants should recover their costs of these legal proceedings and that these costs, if not agreed, should be assessed on an indemnity basis, which is typically more generous than the standard basis. Excalibur must pay interest on the Defendants’ costs at the rate of 1.5% per annum, from the date of payment of the invoices until 13 December 2013.

The Court further ordered that the full sum of £17,500,000, which had been paid by Excalibur into the Court as security for the Defendants’ costs, be paid out to the Defendants, i.e. £10,700,000 to Gulf Keystone and its two subsidiaries and £6,800,000 to Texas Keystone Inc.

The Court further ordered Excalibur to provide an additional security for the costs of the Company and its two subsidiaries in the sum of £3,209,210 and an additional security for the costs of Texas Keystone Inc. in the sum of £2,402,800 by payment into Court by 31 December 2013, failing which the Defendants are at liberty to commence proceedings for recovery of such costs against Excalibur’s funders, namely Psari Holdings Limited, Mr Adonis Lemos, BlackRobe Capital Partners LLC, BlackRobe AEO Investors I, LLC, Platinum Partners Value Arbitrage Fund LP, Hamilton Capital LLC.

IMPORTANT

The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.