Gulf Keystone Reserves disappointment causes Tsunami of selling in AIM oil and gas

Mar 15, 2014 at 3:18 pm in AIM by contrarianuk

All hell broke loose on Thursday morning in the AIM oil and gas sector after Kurdistan focused oil explorer/producer, Gulf Keystone Petroleum (GKP), issued an operational update and a competent persons report (CPR), prepared by ERC Equipoise, quantifying the company’s oil reserves which unfortunately came in below expectations.

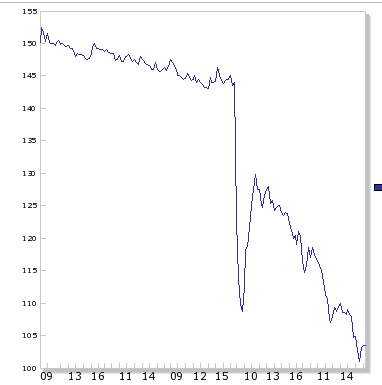

GKP shares in the last week:

The shares promptly tanked at the open on Thursday, moving as low as 102p, or 29% down in early trading with stop losses and forced margin calls on spread bets and CFD’s playing a large part in the sudden loss of liquidity. But it wasn’t just GKP that was in the firing line as many other popular shares in the AIM oil and gas space being sold off heavily as some took advantage of the fall in GKP to pick up more shares or were forced to sell by margin pressure from spread betting companies – deposit money or we force sell! Xcite Energy fell nearly 9% and Bowleven 7% in the first hour of trading.

The shares promptly tanked at the open on Thursday, moving as low as 102p, or 29% down in early trading with stop losses and forced margin calls on spread bets and CFD’s playing a large part in the sudden loss of liquidity. But it wasn’t just GKP that was in the firing line as many other popular shares in the AIM oil and gas space being sold off heavily as some took advantage of the fall in GKP to pick up more shares or were forced to sell by margin pressure from spread betting companies – deposit money or we force sell! Xcite Energy fell nearly 9% and Bowleven 7% in the first hour of trading.

GKP’s shares recovered during the course of the day and finished 23p lower at 120.25p, a 16.5% , their lowest level since August 2011. The day after the announcement on Friday the shares dropped another 14% or 17p to finish the week at 103p, just above the lows. That made it a 48p or 32% fall for the week giving the company a market cap of £917 million.

GKP’s shares recovered during the course of the day and finished 23p lower at 120.25p, a 16.5% , their lowest level since August 2011. The day after the announcement on Friday the shares dropped another 14% or 17p to finish the week at 103p, just above the lows. That made it a 48p or 32% fall for the week giving the company a market cap of £917 million.

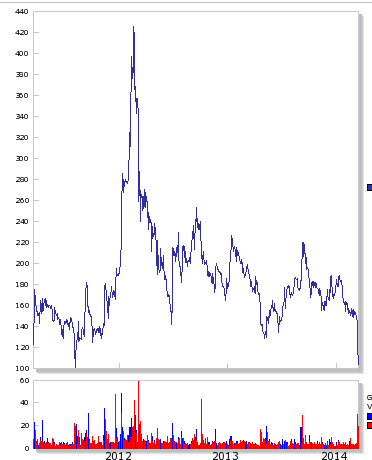

Some may say it’s yet another major miss step for the infamous Chief Executive of Gulf Keystone, Todd Kozel, who has been criticised for disposing of much of his stake in the company at much higher prices in 2012/13 and also taking a sizeable pay package which amounted to $22 million in 2012 (as well as allegations of company money being spent on lap dancing clubs and fine dining). Gulf Keystone was also in a court battle with Excalibur Ventures, a former advisor to the company during the period when it was acquiring its Kurdistan assets. Excalibur claimed it was entitled to a 30% interest in GKP’s assets but the UK courts disagreed and GKP won the case in September 2013. At the time, the company’s shares were briefly suspended pending the court announcement and they opened at 235p, over 25% higher. A far cry from today’s levels!

So what was all the fuss about with the Competent Persons Report (CPR)? The CPR was a key document for GKP in its planned move up onto the LSE’s official list from AIM on March 24th. Many were expecting the move out of the Alternative Investment Market to mark a more positive period for the company, given the added scrutiny of a main LSE market listing. Buying pressure would be expected to increase as many funds are prevented from investing in AIM stocks and it seemed a sensible sweeping up operation following all the issues surrounding corporate governance and the companies fight with M&G in 2013 and the appointment of former French Foreign Legionnaire, Simon Murray, as Chairman in July 2013. Murray must be cursing buying 160,000 shares at 196p on 27th September 2013 at a total value of £314,000. He should have noticed that Todd Kozel was selling rather than buying as illustrated by his 10 million share sale in April 2013 at £1.69, netting him nearly £17 million.

A total of 12.5 billion barrels of gross oil in place were confirmed across the company’s portfolio in the Kurdistan Region of Iraq, comprising its Shaikan, Sheikh Adi, Ber Bahr and Akri-Bijeel blocks with Shaikan delivering 9.2 billion barrels against previous estimates between 12.4 billion and possibly up to 15 billion barrels. It also confirmed just under 300 million barrels of proved and probable (2P) reserves, as well as about 920 million barrels of contingent (2C) resources against expectations of 2P reserves of 400 million barrels and a 2C figure of around 1.7 billion barrels.

A total of 12.5 billion barrels of gross oil in place were confirmed across the company’s portfolio in the Kurdistan Region of Iraq, comprising its Shaikan, Sheikh Adi, Ber Bahr and Akri-Bijeel blocks with Shaikan delivering 9.2 billion barrels against previous estimates between 12.4 billion and possibly up to 15 billion barrels. It also confirmed just under 300 million barrels of proved and probable (2P) reserves, as well as about 920 million barrels of contingent (2C) resources against expectations of 2P reserves of 400 million barrels and a 2C figure of around 1.7 billion barrels.

The 2P reserves for Shaikan are based on 26 development wells of the Shaikan FDP Phase 1, which is fewer than 25% of approximately 109 wells currently envisaged for the Shaikan full field development. Recovery factor came in at 11% versus hopes of around 16%. With a 54.4% working interest in Shaikan it means that GKP has 163 million 2P reserves at the current time. Disappointingly low given the huge gross oil in place figure. 2C contingent resources are 434 million barrels equivalent for Shaikan net to GKP and 576 million barrels equivalent for the broader portfolio of assets.

The 2P reserves for Shaikan are based on 26 development wells of the Shaikan FDP Phase 1, which is fewer than 25% of approximately 109 wells currently envisaged for the Shaikan full field development. Recovery factor came in at 11% versus hopes of around 16%. With a 54.4% working interest in Shaikan it means that GKP has 163 million 2P reserves at the current time. Disappointingly low given the huge gross oil in place figure. 2C contingent resources are 434 million barrels equivalent for Shaikan net to GKP and 576 million barrels equivalent for the broader portfolio of assets.

But those who experienced the disappointment of the first reserves report from Xcite Energy in 2011 in which TRACS gave the company 2P reserves of just 28 million barrels compared with hopes of over 200 million will remember that auditors are notoriously conservative (now upgraded to 257 million barrels 2P). Those with a suspicious mind will quite rightly say that this is an opportunity for institutions buying into the main market listing to buy in on the cheap and then watch the shares rise as further appraisal and exploration drilling moves up the reserves number and consequently the share price. Kozel said “The CPR does not take into account undrilled and untested horizons and we see a clear route for unlocking the upside to these 2P and 2C numbers through drilling more wells and thus obtaining a better understanding of the oil water contact levels and the actual fracture porosity., “Meanwhile, conversion from 2C to 2P will be driven by approval of the next phase of the Shaikan development.”

Certainly GKP needs plenty of money to increase its oil production to its stated level of 100,000 barrels per day. This level of production, up from the current 10,000 BPD will require construction of additional production facilities with gas injection and water handling capabilities, as well as the drilling of a substantial number of development and production wells. Production during 2014 is estimated to hit 40,000 BPD. Current cash estimated at around $90 million is likely to be depleted by the middle of 2014 due to ongoing drilling. The company already has $325 million in convertible bonds and is currently in negotiations for further funding which is likely to be on much harsher terms than the last fund raising given the weak share price and reduced reserves estimate.

The boys in the City certainly seem to have got their “pound of flesh” pre the main market listing of Gulf Keystone with many private investors getting a good beating this week and many, many losing lots of money if they were margin called out. Still with only 163 million barrels of proven and probable reserves and with a £917 million ($1.53 billion) market cap, even at £1.03, a multiyear low, the shares don’t appear at bargain basement levels on the basis of 2P reserves.

The company is now valued at $9.4 per barrel of 2P reserves or just over $2 a barrel looking 2C and 2P (163 mm + 576 mm). Compare this with the 257 million 2P barrels and 48 million 2C of Xcite Energy which currently languishes at 84p with a market cap of £246 million or $410.8 million making its 2P reserves in the North Sea rather than Kurdistan worth $1.6 per barrel. Or Rockhopper Exploration which is partnered with Premier Oil to develop the 356 million barrels 2C resources of Sea Lion in the North Falklands basin which is currently at 107p, valuing it at £305 million ($509 million), or $1.43 a barrel at a 2C level.

Kozel and Murray now have much to prove to restore the further tarnished reputation not only of Gulf Keystone but also of AIM oil and gas in general. Many private investors have faired poorly from the sector in recent years after the disappointments of the Falklands Island (think Desire Petroleum), Bowleven’s Cameroon adventures, Range Resources and Red Emperor in Somalia and so on.

Kozel and Murray now have much to prove to restore the further tarnished reputation not only of Gulf Keystone but also of AIM oil and gas in general. Many private investors have faired poorly from the sector in recent years after the disappointments of the Falklands Island (think Desire Petroleum), Bowleven’s Cameroon adventures, Range Resources and Red Emperor in Somalia and so on.

Of course GKP’s reserves will undoubtedly increase over time as further wells are drilled but shareholders need to be patient as auditors upgrades take time and additional wells cost plenty of money. Limited cash being raised from ongoing activities means that break even is some way off given the sizeable drilling costs the company is incurring.

As a long term bet, the company still offers plenty of attractions if the political situation improves given 434 million barrels equivalent for Shaikan and 576 million barrels equivalent for all GKP’s assets ready to be moved from contingent resources to reserves over the coming years plus there is every possibility the 11% recovery rate could be enhanced as more appraisals are completed and the reservoir models recalibrated . However, one does feel that shareholders interests in GKP would be better served by a takeover by a bigger player who can better manage the complexities of the Shaikan field but it seems unlikely that the £10-20 valuations being talked about a couple of years ago will ever be realised. I’m sure many mauled private investors would bite the hand off of an offer anything close to the £4 mark achieved in 2012 by the likes of Genel or one of the American majors.

After so much bad news from AIM oil and gas, it’s about time investors had some cheer from a good RNS. 2014 hasn’t started too well!

After so much bad news from AIM oil and gas, it’s about time investors had some cheer from a good RNS. 2014 hasn’t started too well!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.