Will past blunders be forgiven by Nighthawk Energy shareholders as company swings into profit

Mar 31, 2014 at 9:30 am in AIM by contrarianuk

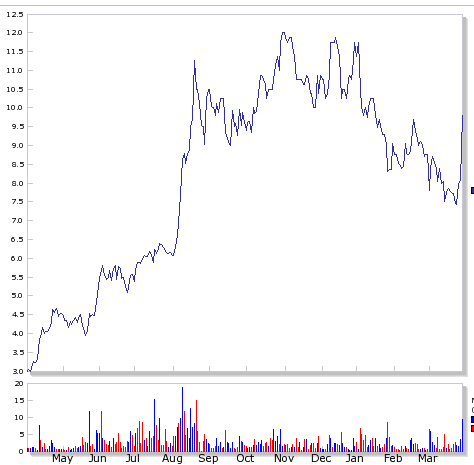

I originally invested in US focused oil and gas explorer Nighthawk Energy (HAWK) in 2009 with much anticipation given the potential of its Jolly Ranch non conventional oil and gas assets in the United States But a series of delays and broken promises by its management team led by David Bramhill (later of Wessex Exploration) meant I sold in February 2010 at 28p with a losing trade. Today the shares sit at around 9.8p.

Expectations were raised by a report by Schlumberger in 2009 which the company commissioned on its Colorado property called Jolly Ranch. The report said “The most important in terms of potential scale is the shale oil play, Jolly Ranch, in eastern Colorado. This is broadly analogous to the Bakken plays in Montana and North Dakota and is a potential company maker. In 2009 Schlumberger estimated the P50 oil-in-place fir around 2/3 of the Jolly Ranch project at 1.46 billion barrels of oil equivalent gross”

At the time Edison Investment Research Limited gave aa 12 month price target of 95p per share ($488m) with potential upside depending on news of £2 per share. But it was not to be, production failed to grow as expected and money began to run out. After years of turmoil at Nighthawk during which Bramhill was ejected after leading the company close to bankruptcy, the shares were marked 21% higher to 9.75p on Friday after the company’s full year 2013 results.

Stephen Gutteridge

Tim Heeley took over the reins in 2010 and the shares fell as low as 2.5p in 2012 as the company struggled under the burden of past failures and poor financing. The company is now managed by CFO Graham Swindells and Chairman Stephen Gutteridge, with Tim Heeley stepping down as Chief Executive and as a Director in june 2012. Today the company announced that Gutteridge was leaving the company no later than 30 September 2014 to pursue other opportunities.

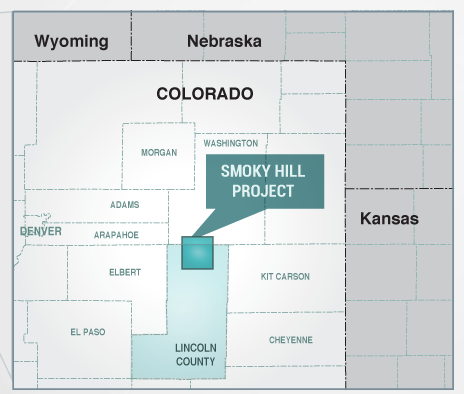

The company continues to focus on Colorado with around 250,000 acres of prospects with its major interests in the Smoky Hill and Jolly Ranch projects. Hawk acquired the remaining 25% working interest in Smoky Hill and Jolly Ranch projects in Jul 2013 from Running Foxes Petroleum Inc. for $12 million, financed by a short-term unsecured loan with 9% interest from the Company’s largest shareholder (Kattrumpan Fastighets AB, a company associated with Johan Claesson). Principal repayments of $1 million per month need to be made plus a residual payment of $6 million. Claesson was granted 30 million warrants to acquire ordinary shares of 0.25p at a price of 7.25 pence per Share which are now showing a nice profit.

In October 2013 Nighthawk farmed out 4,572 acres in the immediate vicinity of Limon, approximately fifteen miles south of Nighthawk’s Arikaree Creek oil-field with an undisclosed private, Denver-based oil and gas company with a 50% working interest. Drilling is expected to commence no later than 30 April 2014.

With 951,303,602 ordinary shares in issue (457,640,909 pursuant to the exercise of share options, warrants or convertible loan notes) Nighthawk is valued at £93.2 million at Friday’s closing price.

The preliminary results ending December 31st 2013 showed a strong turnaround in the company’s fortunes. Hawk had a profit of $14 million (£8.42 million), before exceptionals, compared to a $3.9 million loss the year before, with a positive operating cash flow of $14.4 million, following a $3.4 million outflow in 2012. Diluted earnings per share were $1.48 for the year compared with a loss of 30 cents a share in 2012. Revenues were $26.2 million, a twelve-fold increase versus the $2.2 million in the same period in 2012.

Average production increased from 280 barrels per day in January 2013 to 1,556 barrels per day by the end of 2013 with nine new wells drilled with six wells successfully brought into production and two further successful producing wells drilled after year-end. Gross oil sales from the Smoky Hill and Jolly Ranch projects in Colorado were 358,294 barrels (290,664 barrels ) compared to 29,812 barrels in 2012. Average sale price per barrel was $91 compared with $80.71 the year before. EBITDA per barrel sold increased from $26 in the first half of 2013 to $56.92 in the second half of the year (a margin of 60% in this period).

The company spent $22.4 million on drilling and development activities in 2013, compared with $12.7 million in 2012.

At 31 December 2013, the Group held cash balances of $1.7 million (31 December 2012 $2.3 million). The company is now actively considering debt financing options with various parties both to refinance existing debt commitments and to provide additional funding for development drilling. The providers of US$14.0 million of existing loans to the Group have agreed in principle to extend the maturity dates on such loans whilst debt refinancing solutions are negotiated and finalised. Since the period end financing activities have included a further loan and the sale of a WTI call option resulting in a premium being paid to the Company, collectively raising approximately US$2.5 million. Additionally, the Group entered into a factoring agreement with Amegy Bank that allows it the flexibility to bring forward oil sales revenue receipts in any particular month.

The company is planning to drill some areas with exploration potential this year.The Arikaree Creek field is scheduled to be drilled in the first half of 2014, the Mississippian formations cored and logged in the Arikaree Creek wells and at the Jackson Hole 1-32 well have identified characteristics which are indicative of a potential horizontal conventional/unconventional play across Mississippian age formations with further drilling and geo-science work, which may include a horizontal well to demonstrate proof of concept this year. The third area of potential remains the Pennsylvanian age formations such as the Cherokee, Marmaton and Morrow formations.

So after the disastrous period from 2000-2012, 2013 turned out much better for Nighthawk Energy with solid revenues and profits. Financing issues still remain with the company in discussions to refinance its existing $14 million of loans and also needing to payback the $12 million loan to Kattrumpan Fastighets AB. Production growth needs to continue and the company’s exploration prospects this year need to deliver. In January the company produced an average of 1,701 barrels a day, in February 1650 barrels a day (80% net revenue interest). With a £92 million market cap today and on a p/e based on 2013 earnings of around 11 the shares are not bargain basement and the new management team have plenty to deliver in 2014. If they can maintain production at around 1,600 a day at $90 a barrel that makes it $4.3 million a month of revenue, $3.4 net to Hawk and with a 60% margin, just over $2 million a month net profit.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.