Plenty of anticipation of news next week for Bowleven shareholders

May 31, 2014 at 4:11 pm in AIM by contrarianuk

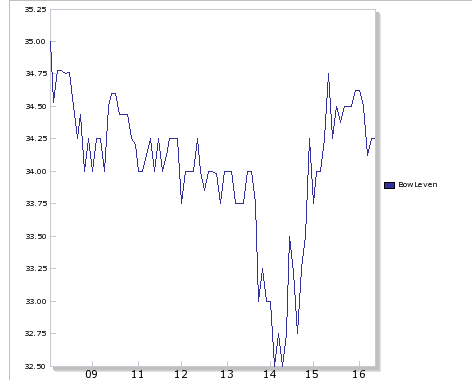

There was a huge number of shares traded in Cameroon focused oil and gas explorer, Bowleven (BLVN), on Friday. Nearly 15 million shares were traded, with a significant amount of that in the auction after the close of normal trading. It seems therefore that news is due next week if this unusual volume is anything to go by. But is it good or bad? The shares finished around 3.5% down at 33.5p after falling as much as 6% in the early afternoon, before clawing their way back and then dropping late in the session again. So far from a collapse, but if good news was on the horizon perhaps a healthy rise would have been expected. There has been speculation of a swap of shares between institutions but this is pure conjecture but firm facts remaining elusive. Will an RNS appear to fill in the gaps on Monday?

Shareholders have been waiting for some time on news of the EEAA (Etinde Exploitation Authorisation Application) which is due any time now. With the volume of shares traded does it mean that one of the larger shareholders has wind of news on the EEAA? As well as the Cameroon government authorisation news is due on the GSA (Gas sales agreement) with Germany company Ferrostaal.

Bowleven has been a disappointment since it signed the Petrofac deal for the Etinde Cameroon development because of the delays in getting approval from the government to develop the field. In part this has been thought to be due to a fall out between Bowleven’s Chief Tabetando and Cameroon Offshore Petroleum (CAMOP) which has a 25% stake in Etinde. Bowleven have taken out a court injunction to stop CAMOP speaking with government authorities or SNH, the state owned oil business.

The Final investment decision (FID) by Bowleven’s partner Petrofac in the Etinde project with the potential to access up to $500 million of investment capital with $60 million IM-5 well costs reimbursed at FID is also due mid 2014 and the farm out for their Bonomo project is also apparently imminent.

With cash running reasonably low at Bowleven ($34 million as of end February but with $16 million of this allocated to the Bonomo project), they cannot afford yet another substantial delay in the EEAA. The FID decision by Petrofac is also critical for the future financial viability of the company. A push back in the EEAA beyond the summer would put into question the Cameroon Etinde project which had so much promise after the drilling campaign of 2010/2011.

Given Friday’s share price action, it looks like something is happening after waiting for news for some time – but maybe not!?. Lets hope its good news for private shareholders who’ve seen the shares collapse from over £4 a couple of years ago to today’s lowly levels after a series of discounted placings to institutions. Will Kevin Hart, the beleaguered Chief Executive, deliver this time? I will watching Bowleven closely next week that’s for sure having sold my holding late on Friday – relief next week or disappointment on losing out on a bonanza. Hmmm…..

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

Contrarian,

Sorry you sold, eeaa just granted and boy its been a hard ride.