Rockhopper and Premier Oil reconfigure Sea Lion Falklands development

Nov 13, 2014 at 11:39 am in AIM by contrarianuk

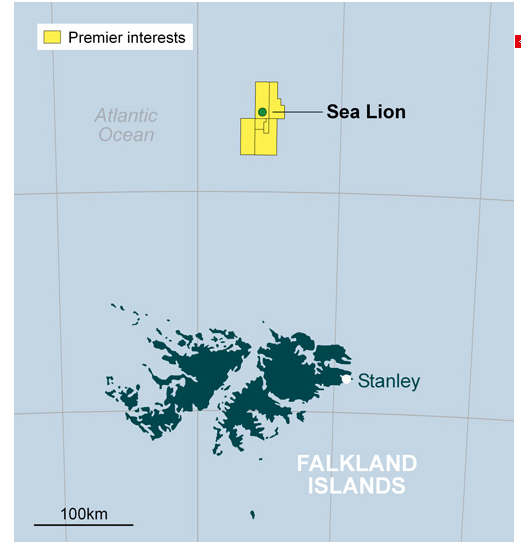

Falklands oil and gas explorer Rockhopper Exploration (RKH) has announced an unexpected update to its Sea Lion development in the North Falklands basin together with Premier Oil.

Sea Lion was originally discovered by Rockhopper in May 2010. In July 2012, Premier farmed in for 60% of Rockhopper Exploration’s licence interests in the North Falklands Basin, including the Sea Lion discovery. The transaction was completed in October 2012 and Premier assumed operatorship of the Sea Lion area development in November 2012.

After the initial farm out deal with Premier Oil, the Sea Lion project, which was the first big oil discovery in the Falklands, work was continuing on the FEED (Front End Engineering and design) for a TLP (Tension Leg Platform) solution. However with the oil price weak and the outlook poor in the short term Premier have decided to adopt a cheaper approach. Rockhopper’s shares are up 11% to 78p after showing weakness in the last few days as fears grew that Premier would decide to abandon the projects as it struggled to find a farm in partner to fund the multi billion pound capital expenditure to get first oil from Sea Lion.

Today’s RNS confirms that a farm out partner has not been found to date and that Rockhopper and Premier Oil have agreed to adopt a phased, lower cost development solution for the Sea Lion field using a leased FPSO concept (Floating Production, Storage and Offloading vessel). The initial phase to commercialise approximately 160 mmbbls oil, around half the total in the field and focus on the North Eastern part of the discovery to reduce the number of wells required but still delivering 50-60,000 barrels per day over the first 15 years. Costs to first oil on the initial phase are now estimated at less than $2 billion which can now be fully funded from internal resources.

The Sea Lion field was initially expected to produce first oil in 2017 but a number of delays and a reluctance on the part of Premier to commit to the start of the project now means this is delayed to 2019 once the project is finally approved in the first half of 2016. That means it will have taken at least nine years for oil to be flowing after Rockhopper’s initial oil strike.

Rockhopper will have access to the full $48 million Exploration Carry for the 2015 drilling campaign and contrbute 40% of pre sanction costs, currently estimated at $100 million gross. In addition, Rockhopper will retain a $337 million Development Carry for the initial phase and a further $337 million Development Carry deferred to the next phase of development.

Eirik Raude rig

The deal announced today removes plenty of uncertainty for Rockhopper shareholders and it now means that the project is pretty certain to go ahead subject to final sanction next year. The size of the initial project will be smaller but now involves less risk for both RKH and Premier given the lower initial outlay to start the field producing. With oil prices in the doldrums it looks like Premier’s management was unwilling to commit too much and risk stretching its finances. Rockhopper is now looking forward to the four wells it is involved with drilled by the harsh environment semisubmersible drilling rig, Eirik Raude, that may add significant upside to the company’s existing discoveries in the Falklands.

Premier Oil Chief Executive Tony Durrant told Bloomberg earlier this week that “There’s a reduced cost per barrel because of the economies of scale and taxes,” “U.K. tax can work out as high as 62 percent compared with 26 percent in the Falklands, where output may be three times larger than the typical North Sea field”. “Costs per barrel for Sea Lion are expected to be about $35, contrasting with the $50 to $60 for the North Sea”. So the economics of the Rockhopper discovery look very appealing even in the era of cheaper oil. Though it seems unlikely that oil will be below $100 a barrel in 2019 when Sea Lion starts producing making the project very attractive for all parties.

Plenty to look forward to in the Falklands early next year but with Brent crude oil at around $80-81, there may be time to buy into Rockhopper and fellow explorer Falklands Oil and Gas before drilling kicks off in the Q1-Q2 2015 period. I’ll be keeping a close eye on Rockhopper especially if it returns to the 70-75p range in coming months.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.