Tangiers Petroleum fails to break losing streak in AIM oil and gas exploration in Morroco

Aug 6, 2014 at 8:53 am in AIM by contrarianuk

Tangiers Petroleum Limited the ASX and AIM listed oil and gas exploration company with assets offshore Morocco has had a rough few weeks. Its shares are down around 70% in the last week and 83% in the last month to just over 2p. Today it announced that the company’s shares are temporarily suspended due to a forthcoming announcement and given the recent drilling news it probably won’t be good news. The company now has just a £6 million market cap and was trading as high as 18p in June when its Moroccan well started drilling.

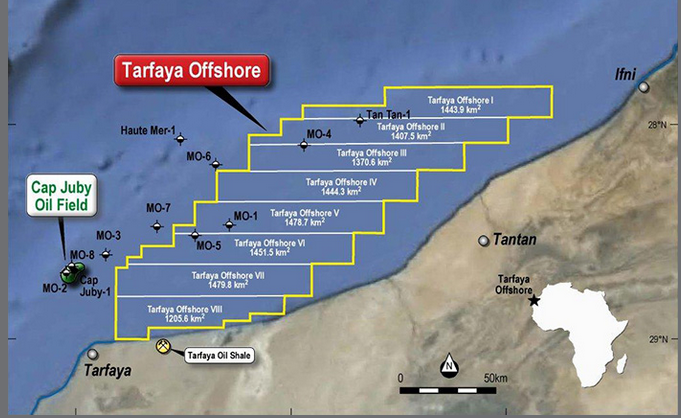

The reason for Tangier’s calamitous fall was the result from the TAO-1 exploration well located in the Tarfaya Offshore Block, Morocco. The drilling programme was designed to test up to three stacked objectives; Assaka (Upper Jurassic), Trident (Middle Jurassic), and TMA (Lower Jurassic, contingent upon success of Trident/Assaka).

The well was drilled to a total depth of 3,518m and unfortunately did not encounter favourable reservoir quality at Trident according to an RNS on August 4th and a previous RNS on 28th July 2014 reported no hydrocarbon shows were encountered at Assaka the younger secondary objective in the Upper Jurassic.

Back in late June the Ralph Coffman jack-up rig had commenced operation with the company saying that the “The TAO-1 well is a potential company-maker for Tangiers with 190m barrels of net best estimate unrisked prospective resource [or a] gross unrisked best estimate 758m barrels.” Tangiers Managing Director, Dave Wall, said: “It is a very large structure located in shallow water within a proven play fairway and adjacent to an existing oil discovery. All the ingredients required for exploration success are present in the region, giving Tangiers, and its shareholders, a good chance of success at TAO-1.” Tangiers has a 25 per cent participating interest in the Tarfaya Offshore Block, which is being operated by Galp Energia with a 50 per cent interest. The remaining 25 percent interest is held by ONHYM (Morocco’s National Office of Hydrocarbons and Mines), which is carried through the exploration phase.

So despite the company’s high hopes it was not to be with no hydrocarbon shows and no proven reservoir leaving it with little to show for its efforts and without a major fund raising limited prospects for now. Things are looking pretty bleak with no producing assets and cash reserves seriously depleted by the TAO-1 well. Any hint of a placing would need to be at very low price meaning hideous dilution for existing shareholders and that’s assuming the institutions want to pump in more.

This latest duster for Tangiers Petroleum follows similar dramatic falls in the share price of Fastnet oil and gas which fell over 40% in May when its FA-1 well in the Foum Assaka Offshore block offshore Morocco also proved dry. The high hopes of a bonanza around Morocco have so far proved fruitless and expensive for AIM investors that’s for sure. For those buying back in June hoping that Tangiers would deliver on its promises its been another painful lesson that wild cat drilling is very high risk even if the management team are saying “All the ingredients required for exploration success are present in the region, giving Tangiers, and its shareholders, a good chance of success”. Caveat Emptor!

On the subject of drilling, Salamander Energy’s forthcoming well result North Kendang-2 exploration well (NK-2) is expected by the end of the month, a re-drill of the North Kendang-1 (NK-1) well in the South East Sangatta PSC. looks quite interesting with a high chance of success versus standard wild catting. The reason for the higher confidence was the NK-1 well which encountered a high pressure wet gas kick in the Upper Miocene, which led to it being plugged and abandoned on 13th April 2013 as the rig was unable to deal with the pressure. Fingers crossed for Salamander!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.