A further crisis of confidence in the new virtual currency of Bitcoin was triggered yesterday when one of the leading exchanges, Mt. Gox went offline and removed its entire Twitter history. On other Bitcoin exchanges, the price of a bitcoin was down heavily as investor fears mounted that the problems of Mt Gox were the tip of the iceberg and potentially even the end of the emerging currency.

Mt. Gox was the biggest trading platform for bitcoin. The firm started operations as a bitcoin exchange in July of 2010, but it began in 2009 as an online exchange for trading cards for Magic: The Gathering (thus, Mt. Gox is an acronym of Magic: The Gathering Online Exchange). In 2011, Jed McCaleb, who started the site, sold it to the Mark Karpeles and his company Tibanne. By 2013, it was handling 70% of all bitcoin trading.

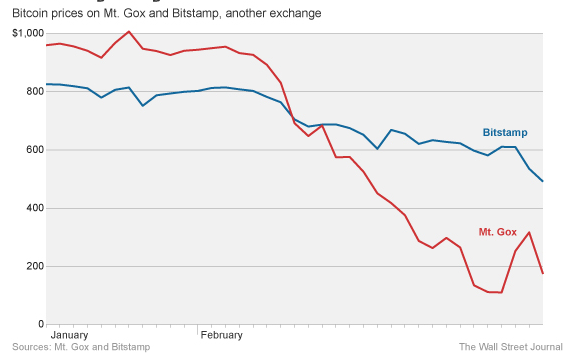

On Tuesday the price of bitcoin fell below $500 compared with over $1,200 in December. On Mt. Gox, the price had fallen as low as $131.71 before the exchange went down. In early 2013, bitcoins changed hands for $20.

Rumours are circulating that Mt Gox has lost 744,000 bitcoins to hackers, around 6% of the total 12.44m coins in circulation. In January the leading exchange based in the Shibuya district of Tokyo, suspended Bitcoin withdrawals blaming a technical flaw in the Bitcoin protocol which caused issues tracking buy and sell transactions, though a bug in the company’s own software was probably the more likely culprit.

If Mt Gox is destined never to reemerge it is clearly bad news for the many speculators who bought bitcoins through the exchange, but many involved in the new currency will not mourn the demise of the company itself.

The chief executives of six major bitcoin exchanges and businesses pledged to coordinate efforts to assure customers of the security of their funds in response to mounting concern about the future of Mt. Gox.

Detractors of the whole Bitcoin system are saying this is the Lehman brothers moment but ultimately it may lead to a stronger technical platform and perhaps even regulatory oversight. It sure underscores the huge risk of the currency right now which remains the domain of speculators for now. The intense volatility right now means that as an online transactional vehicle it remains suspect – why would an online retailer take it when the price moves 10-20% in minutes?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Mt.Gox site disappears, Bitcoin’s virtual currency future in doubt

Feb 26, 2014 at 6:44 am in Market Commentary by contrarianuk

A further crisis of confidence in the new virtual currency of Bitcoin was triggered yesterday when one of the leading exchanges, Mt. Gox went offline and removed its entire Twitter history. On other Bitcoin exchanges, the price of a bitcoin was down heavily as investor fears mounted that the problems of Mt Gox were the tip of the iceberg and potentially even the end of the emerging currency.

Mt. Gox was the biggest trading platform for bitcoin. The firm started operations as a bitcoin exchange in July of 2010, but it began in 2009 as an online exchange for trading cards for Magic: The Gathering (thus, Mt. Gox is an acronym of Magic: The Gathering Online Exchange). In 2011, Jed McCaleb, who started the site, sold it to the Mark Karpeles and his company Tibanne. By 2013, it was handling 70% of all bitcoin trading.

On Tuesday the price of bitcoin fell below $500 compared with over $1,200 in December. On Mt. Gox, the price had fallen as low as $131.71 before the exchange went down. In early 2013, bitcoins changed hands for $20.

Rumours are circulating that Mt Gox has lost 744,000 bitcoins to hackers, around 6% of the total 12.44m coins in circulation. In January the leading exchange based in the Shibuya district of Tokyo, suspended Bitcoin withdrawals blaming a technical flaw in the Bitcoin protocol which caused issues tracking buy and sell transactions, though a bug in the company’s own software was probably the more likely culprit.

If Mt Gox is destined never to reemerge it is clearly bad news for the many speculators who bought bitcoins through the exchange, but many involved in the new currency will not mourn the demise of the company itself.

The chief executives of six major bitcoin exchanges and businesses pledged to coordinate efforts to assure customers of the security of their funds in response to mounting concern about the future of Mt. Gox.

Detractors of the whole Bitcoin system are saying this is the Lehman brothers moment but ultimately it may lead to a stronger technical platform and perhaps even regulatory oversight. It sure underscores the huge risk of the currency right now which remains the domain of speculators for now. The intense volatility right now means that as an online transactional vehicle it remains suspect – why would an online retailer take it when the price moves 10-20% in minutes?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.