Warren Buffett’s Berkshire Hathaway released its annual letter to shareholders over the weekend and confirmed it had made $19.5 billion (£11.6 billion) in 2013, up from $14.8 billion (£8.8 billion) in 2012.

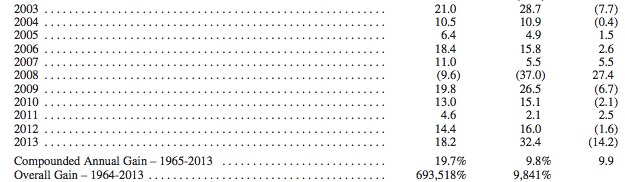

Berkshire’s book value per share, Buffett’s preferred measure of valuation, increased 18.2% in 2013 or $34.2 billion, a superb return in most years but still 14.2 points behind the 32.4% total return delivered by the S&P 500. It the second straight year and fourth of the last five that Berkshire has under performed on that measure. “We have underperformed in 10 of our 49 years, with all but one of our shortfalls occurring when the S&P gain exceeded 15%.”

Over the last 49 years book value has grown from $19 to $134,973, a rate of 19.7% compounded annually.

They had two large acquisitions, spending almost $18 billion to purchase all of NV Energy and a major interest in H. J. Heinz. “With Heinz, Berkshire now owns 81⁄2 companies that, were they stand-alone businesses, would be in the Fortune 500. Only 4911⁄2 to go.”

The company increased its stake in Coca-Cola, American Express, IBM and Wells Fargo but reduced its ownership in the UK retailer Tesco 5.2 to 3.7%. Berkshire has sold selling nearly 115m shares in the company last year. Buffett has had a stake in the supermarket group since 2006. The shares sales and the fall in Tesco’s market valuation over the last 12 months mean Berkshire Hathaway’s stake in the grocer at the end of last year was worth around a billion dollars less than in the year before i.e. around $2.5 billion.

Though Buffett may be behind the soaring market in the last 5 years, his call to “buy America” in 2008 seems to have been very sound advice indeed. He repeated his maxim in that year to “Be fearful when others are greedy, and be greedy when others are fearful.”

He said in 2008 “Most certainly, fear is now widespread, gripping even seasoned investors,” “But fears regarding the long-term prosperity of the nation’s many sound companies make no sense. These businesses will indeed suffer earnings hiccups, as they always have. But most major companies will be setting new profit records 5, 10 and 20 years from now.”. During the peak of the financial crisis Buffett bought $3 billion in General Electric Co.’s preferred shares, with a 10% percent dividend and $5 billion in preferred shares of Goldman Sachs Group Inc., also with a 10 percent coupon and warrants to purchase another $5 billion in common shares at about $115 each.

“Let me be clear on one point: I can’t predict the short-term movements of the stock market,” he wrote. “I haven’t the faintest idea as to whether stocks will be higher or lower a month — or a year — from now. What is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up. So if you wait for the robins, spring will be over.”

Buffett’s advice was clear, when the market has a big sell off, buy, buy, buy. Outsize gains similar to the period post the last financial crisis are certainly harder to come by as his recent performance clearly indicates. The big question is, when will Buffett finally leave Berkshire and who will run the business?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Buffett’s Berkshire Hathaway lags US indices yet again in 2013 but it was one hell of a year!

Mar 2, 2014 at 2:38 pm in Market Commentary by contrarianuk

Warren Buffett’s Berkshire Hathaway released its annual letter to shareholders over the weekend and confirmed it had made $19.5 billion (£11.6 billion) in 2013, up from $14.8 billion (£8.8 billion) in 2012.

Berkshire’s book value per share, Buffett’s preferred measure of valuation, increased 18.2% in 2013 or $34.2 billion, a superb return in most years but still 14.2 points behind the 32.4% total return delivered by the S&P 500. It the second straight year and fourth of the last five that Berkshire has under performed on that measure. “We have underperformed in 10 of our 49 years, with all but one of our shortfalls occurring when the S&P gain exceeded 15%.”

Over the last 49 years book value has grown from $19 to $134,973, a rate of 19.7% compounded annually.

They had two large acquisitions, spending almost $18 billion to purchase all of NV Energy and a major interest in H. J. Heinz. “With Heinz, Berkshire now owns 81⁄2 companies that, were they stand-alone businesses, would be in the Fortune 500. Only 4911⁄2 to go.”

The company increased its stake in Coca-Cola, American Express, IBM and Wells Fargo but reduced its ownership in the UK retailer Tesco 5.2 to 3.7%. Berkshire has sold selling nearly 115m shares in the company last year. Buffett has had a stake in the supermarket group since 2006. The shares sales and the fall in Tesco’s market valuation over the last 12 months mean Berkshire Hathaway’s stake in the grocer at the end of last year was worth around a billion dollars less than in the year before i.e. around $2.5 billion.

Though Buffett may be behind the soaring market in the last 5 years, his call to “buy America” in 2008 seems to have been very sound advice indeed. He repeated his maxim in that year to “Be fearful when others are greedy, and be greedy when others are fearful.”

He said in 2008 “Most certainly, fear is now widespread, gripping even seasoned investors,” “But fears regarding the long-term prosperity of the nation’s many sound companies make no sense. These businesses will indeed suffer earnings hiccups, as they always have. But most major companies will be setting new profit records 5, 10 and 20 years from now.”. During the peak of the financial crisis Buffett bought $3 billion in General Electric Co.’s preferred shares, with a 10% percent dividend and $5 billion in preferred shares of Goldman Sachs Group Inc., also with a 10 percent coupon and warrants to purchase another $5 billion in common shares at about $115 each.

“Let me be clear on one point: I can’t predict the short-term movements of the stock market,” he wrote. “I haven’t the faintest idea as to whether stocks will be higher or lower a month — or a year — from now. What is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up. So if you wait for the robins, spring will be over.”

Buffett’s advice was clear, when the market has a big sell off, buy, buy, buy. Outsize gains similar to the period post the last financial crisis are certainly harder to come by as his recent performance clearly indicates. The big question is, when will Buffett finally leave Berkshire and who will run the business?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.