Despite all the worries about Iraq and rising oil prices, it was comments from Federal Reserve chair Janet Yellen that soothed any nerves and gave the equity markets a strong boost towards the end of the week. Nothing seems to be able to derail the recovery in the stock indices which started in 2009 and is going strong 5 years later. Since mid 2012, the strength of the recovery in US markets has been unusual that there has been no major corrections and right now there seems to be limited catalysts to trigger a huge sell off despite plenty of reasons to think that the markets don’t look great value based on price/earnings. The chart below of the S&P 500 is startling in the indices resilience and upward trend in recent months.

S&P 500 2009-2014

The S&P 500 closed the week at 1,963 at record levels and recorded a 1.4% increase for the week, quite a rise compared with the low of 667 on March 9th 2009! The Dow Jones Industrial Average closed the week at 16,947, another record high and a 1% riser since the previous week. The Nasdaq Composite ended at 4,368 its highest finish since April 2000 with a 1.3% weekly rise.

The FTSE 100 finished on Friday at 6,827, up 0.7% on the week boosted by AbbVie’s £27 billion bid for Shire Pharmaceuticals which the company rejected as opportunistic and under valuing the company. Just like Pfizer’s failed chase for Astra Zeneca which was driven predominantly by tax savings by changing tax domicile from the US.

FTSE 100 price index changes

The Federal Open Market Committee meeting which ended on Wednesday gave investors plenty of reasons to feel happy buying equities . As expected the Fed continued the tapering of its asset purchase programme by a further $10 billion to $35 billion a month and Janet Yellen categorised inflation as benign, talking about the recent rise in inflation as “noise”.

Of course there are those who disagree with the Fed complacency but US Treasury bond yields were little changed on the week with the key 10-year Treasury ending the week at 2.62 per cent, 0.02 % higher on the week. Certainly no evidence of a rotation back into bonds.

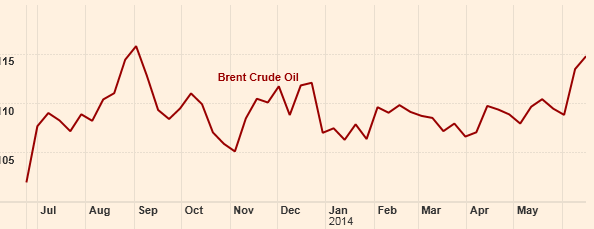

I was hoping that events in Iraq would add a bit of spice to the equity indices but it appears not. Only the price of oil has got traders excited, rising to nearly $115 and closing the week at $114.81.

Let’s see what next week brings with key housing data from the US and Chinese manufacturing data as well as the continued upheaval in Iraq! Another takeover perhaps of a UK company seeking those corporation tax savings?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Little sign of equity correction right now despite worries about oil price

Jun 22, 2014 at 2:42 pm in Market Commentary by contrarianuk

Despite all the worries about Iraq and rising oil prices, it was comments from Federal Reserve chair Janet Yellen that soothed any nerves and gave the equity markets a strong boost towards the end of the week. Nothing seems to be able to derail the recovery in the stock indices which started in 2009 and is going strong 5 years later. Since mid 2012, the strength of the recovery in US markets has been unusual that there has been no major corrections and right now there seems to be limited catalysts to trigger a huge sell off despite plenty of reasons to think that the markets don’t look great value based on price/earnings. The chart below of the S&P 500 is startling in the indices resilience and upward trend in recent months.

S&P 500 2009-2014

The S&P 500 closed the week at 1,963 at record levels and recorded a 1.4% increase for the week, quite a rise compared with the low of 667 on March 9th 2009! The Dow Jones Industrial Average closed the week at 16,947, another record high and a 1% riser since the previous week. The Nasdaq Composite ended at 4,368 its highest finish since April 2000 with a 1.3% weekly rise.

The FTSE 100 finished on Friday at 6,827, up 0.7% on the week boosted by AbbVie’s £27 billion bid for Shire Pharmaceuticals which the company rejected as opportunistic and under valuing the company. Just like Pfizer’s failed chase for Astra Zeneca which was driven predominantly by tax savings by changing tax domicile from the US.

FTSE 100 price index changes

The Federal Open Market Committee meeting which ended on Wednesday gave investors plenty of reasons to feel happy buying equities . As expected the Fed continued the tapering of its asset purchase programme by a further $10 billion to $35 billion a month and Janet Yellen categorised inflation as benign, talking about the recent rise in inflation as “noise”.

Of course there are those who disagree with the Fed complacency but US Treasury bond yields were little changed on the week with the key 10-year Treasury ending the week at 2.62 per cent, 0.02 % higher on the week. Certainly no evidence of a rotation back into bonds.

I was hoping that events in Iraq would add a bit of spice to the equity indices but it appears not. Only the price of oil has got traders excited, rising to nearly $115 and closing the week at $114.81.

Let’s see what next week brings with key housing data from the US and Chinese manufacturing data as well as the continued upheaval in Iraq! Another takeover perhaps of a UK company seeking those corporation tax savings?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.