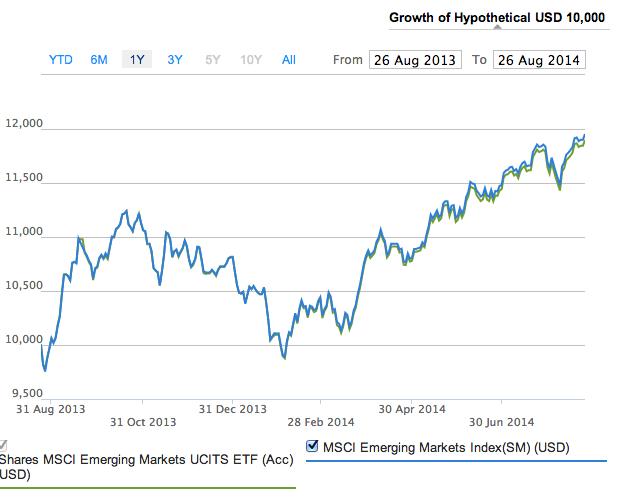

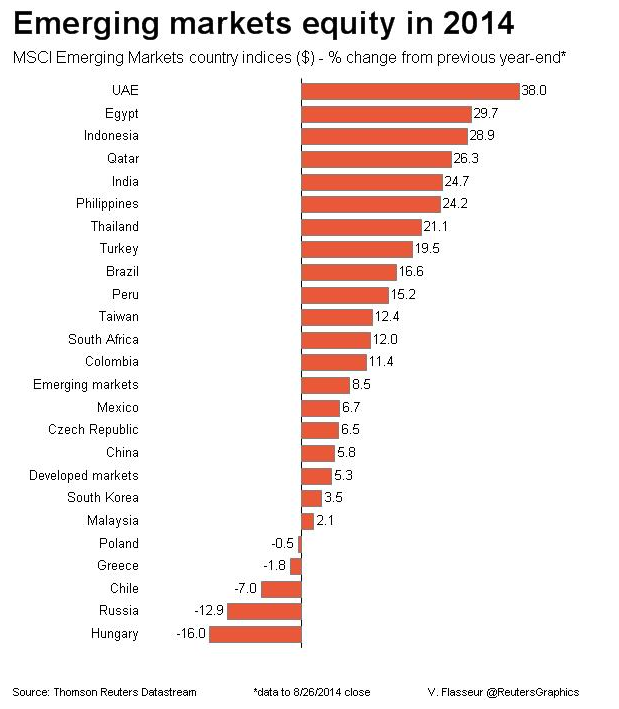

The MSCI Emerging markets index has had a strong run since a sharp sell off between the end of 2013 and February 2014. The index is up nearly 15% in the last 12 months, though only 0.3% in the last 3 years. Country by country performance in the emerging markets as a whole has been markedly variable with Russia being the stand out poor performer of the so called BRIC (Brazil, Russian, India, China) with a 12.9% fall year on year as a result of the Ukrainian crisis.

Inflows into emerging markets have been strong as investors use low interest rates in developed markets to seek out higher returns. Rising rates around the world, particularly in the United States, could cause money to be pulled out of emerging markets as the disparity of returns between the developed and undeveloped world diminishes to some extent. However, expectations of rising interest rates around the world in 2015 has been tempered in Europe (exc. UK) by anemic growth and a European Central Bank determined to prevent deflation. A stronger dollar would also erode the appeal of holding emerging market currencies. Continued worries about some of the larger emerging markets economies such as Brazil, China and Russia in terms of growth and inflationary pressures are also worrying some less bullish commentators.

The Templeton emerging market investment trust run by Mark Mobius said in its recent investment review that it remained bullish on longer term prospects and that the sector is now too big to ignore:

“A key driver of the out performance of emerging markets in recent months has been the positive reform programmes announced by various major emerging markets governments. We believe that the radical reform as outlined by the 10-point programme issued by the leadership in China could unleash dramatic improvements in China’s economy and capital markets. Similarly we think the election of Mr Modi as India’s prime minister will put that country on the path to much higher growth. In Brazil, there is tremendous pressure on President Dilma Rouseff to take measures to curtail corruption and bureaucracy. In Russia, the fall of the market and the ruble opens up opportunities for investors such as the Templeton Emerging Markets Group that are looking for investment opportunities that have the potential to grow in value over time. Moreover, it is important to remember that emerging markets now represent more than 30% of the world’s market capitalization. Most investors are severely underweight emerging markets. Therefore, investors are also realising that this underweight position must be corrected. In addition, the buildup of excess reserves in banks around the world, which up until now has not been lent out but instead used to purchase government bonds, is gradually being released into the markets. This could be additional fuel for a capital market resurgence in emerging markets around the world.

The long term investment case for emerging markets has not dramatically changed. Three key themes remain in place: emerging markets’ economic growth rates in general continue to be markedly faster than those of developed markets; emerging markets have much greater foreign reserves than developed markets; and the debt-to-GDP ratios of emerging market countries generally remain much lower than those of developed markets. Of course, there are notable outliers given the many and varied emerging countries, but we believe those basic facts augur well for the emerging markets’ long term prospects.”

When the Federal Reserve does finally stop its asset purchase programme and interest rate expectations are clearer there may be a big sell off but for now the investment case for the sector looks relatively solid. However, significant further gains look unlikely in the remainder of 2014 in the absence of a major catalyst.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Commentators a little more cautious on emerging markets after strong run

Aug 27, 2014 at 9:54 am in Market Commentary by contrarianuk

The MSCI Emerging markets index has had a strong run since a sharp sell off between the end of 2013 and February 2014. The index is up nearly 15% in the last 12 months, though only 0.3% in the last 3 years. Country by country performance in the emerging markets as a whole has been markedly variable with Russia being the stand out poor performer of the so called BRIC (Brazil, Russian, India, China) with a 12.9% fall year on year as a result of the Ukrainian crisis.

Inflows into emerging markets have been strong as investors use low interest rates in developed markets to seek out higher returns. Rising rates around the world, particularly in the United States, could cause money to be pulled out of emerging markets as the disparity of returns between the developed and undeveloped world diminishes to some extent. However, expectations of rising interest rates around the world in 2015 has been tempered in Europe (exc. UK) by anemic growth and a European Central Bank determined to prevent deflation. A stronger dollar would also erode the appeal of holding emerging market currencies. Continued worries about some of the larger emerging markets economies such as Brazil, China and Russia in terms of growth and inflationary pressures are also worrying some less bullish commentators.

The Templeton emerging market investment trust run by Mark Mobius said in its recent investment review that it remained bullish on longer term prospects and that the sector is now too big to ignore:

“A key driver of the out performance of emerging markets in recent months has been the positive reform programmes announced by various major emerging markets governments. We believe that the radical reform as outlined by the 10-point programme issued by the leadership in China could unleash dramatic improvements in China’s economy and capital markets. Similarly we think the election of Mr Modi as India’s prime minister will put that country on the path to much higher growth. In Brazil, there is tremendous pressure on President Dilma Rouseff to take measures to curtail corruption and bureaucracy. In Russia, the fall of the market and the ruble opens up opportunities for investors such as the Templeton Emerging Markets Group that are looking for investment opportunities that have the potential to grow in value over time. Moreover, it is important to remember that emerging markets now represent more than 30% of the world’s market capitalization. Most investors are severely underweight emerging markets. Therefore, investors are also realising that this underweight position must be corrected. In addition, the buildup of excess reserves in banks around the world, which up until now has not been lent out but instead used to purchase government bonds, is gradually being released into the markets. This could be additional fuel for a capital market resurgence in emerging markets around the world.

The long term investment case for emerging markets has not dramatically changed. Three key themes remain in place: emerging markets’ economic growth rates in general continue to be markedly faster than those of developed markets; emerging markets have much greater foreign reserves than developed markets; and the debt-to-GDP ratios of emerging market countries generally remain much lower than those of developed markets. Of course, there are notable outliers given the many and varied emerging countries, but we believe those basic facts augur well for the emerging markets’ long term prospects.”

When the Federal Reserve does finally stop its asset purchase programme and interest rate expectations are clearer there may be a big sell off but for now the investment case for the sector looks relatively solid. However, significant further gains look unlikely in the remainder of 2014 in the absence of a major catalyst.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.