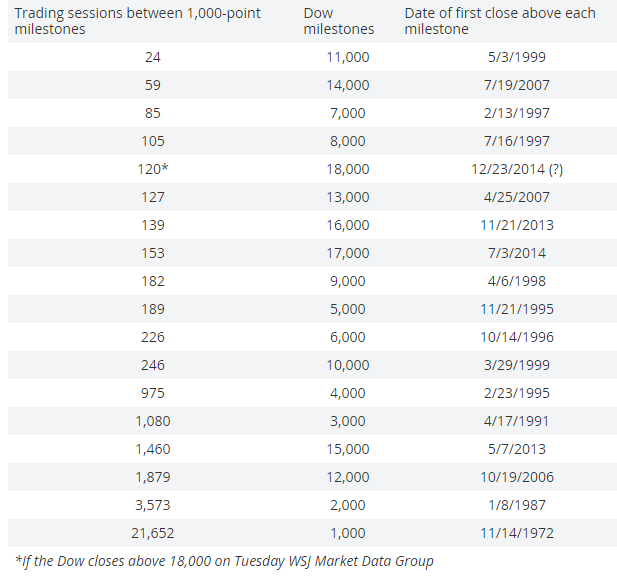

The US markets are hitting all time highs once again as third quarter GDP growth came in at an annualised rate of 5% and better than expected sending the equity indices and dollar up. The Dow is currently at 18,040 and the S&P 500 is at 2,083 with the Dow’s rise from 17,000 to 18,000 the fifth fastest 1000 point rise in the index’s history and assuming the Dow holds at these levels it will have taken just 120 days given that it hit 17,000 on July 3rd 2014.

The Dow industrials finished 2013 at 16,577, and is up 8.8% since January 2nd. That compares with a 2.29% fall in the FTSE 100 at 6,593 and a 12.7% rise in the S&p 500 over the same period. Anyone piling into S&P 500 trackers in the last few years must be feeling very happy with themselves!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Dow Jones Industrials glide through 18,000 level for first time

Dec 23, 2014 at 4:14 pm in Market Commentary by contrarianuk

The US markets are hitting all time highs once again as third quarter GDP growth came in at an annualised rate of 5% and better than expected sending the equity indices and dollar up. The Dow is currently at 18,040 and the S&P 500 is at 2,083 with the Dow’s rise from 17,000 to 18,000 the fifth fastest 1000 point rise in the index’s history and assuming the Dow holds at these levels it will have taken just 120 days given that it hit 17,000 on July 3rd 2014.

The Dow industrials finished 2013 at 16,577, and is up 8.8% since January 2nd. That compares with a 2.29% fall in the FTSE 100 at 6,593 and a 12.7% rise in the S&p 500 over the same period. Anyone piling into S&P 500 trackers in the last few years must be feeling very happy with themselves!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.