After the huge growth in the fine wine market in 2011 many investors in alternatives were rubbing their hands with glee. However, today on the whole the froth has very much been removed after the Chinese brought in controls on hospitality and gifting in 2012 which hit some of the top wines from Bordeaux and Burgundy in particular which were desirable in Chinese diplomatic and government circles .

Chinese wine consumption was around 1.25 billion bottles in 2013 and it is now the largest consumer of Bordeaux in the world. But only a tbird of Chinese wine drinkers said they drank it because they liked the taste (Wine Intelligence 2013 report). There have been stories of Chateau Lafite being drunk with with Coke Cola.

The peak of the fine wine market coincided with the October 2010 Hong Kong auction hosted by Sotheby’s in which three bottles of Châteaux Lafite-Rothschild 1869 were sold at a price of $232,692 a bottle – 29,000 a glass.

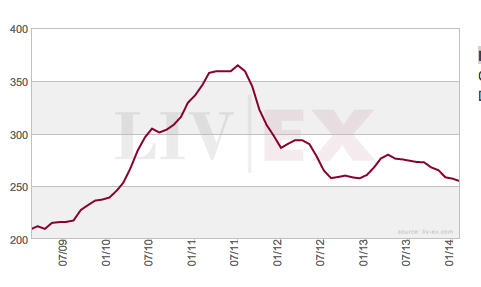

The Liv-ex Fine Wine 100 Index shows that the market for fine wine doesn’t look like its rebounding right now. The index represents the price movement of 100 of the most sought-after fine wines for which there is a strong secondary market and is calculated monthly. The majority of the index consists of Bordeaux wines – a reflection of the overall market – although wines from Burgundy, the Rhone, Champagne and Italy are also included.

At the current level of 254, the index is some way off the peak of 365 reached in June 2011. However there have been some notable expections to the overall story. Domaine de la Romanee-Conti Monopole Grand Cru 1999 at £9,555 a bottle has delivered a growth of 158% and Chateau Lafite Rothschild Pauillac Premier Cru 2001 at £449 a bottle, has risen by 110%.

The best performing investment wines have traditionally been French, notably wines from Bordeaux and Burgundy. A classification system in Bordeaux established in 1855 is key – the “Les Grands Cru classes”. This established the so called “first growth” estates of Lafite Rothschild, Latour, Margaux, Mouton-Rothschild and Haut-Brion. Burgundian wines from Domaine de la Romanee-conti are particularly sought after.

Investment in the fine wine market has always been somewhat opaque with little regulation and limited transparency in pricing. Then of course there have been the recent big stories about fake wine.

In December 2013, Rudy Kurniawan, 37, was convicted on two counts of wire and postal fraud in federal court in a New York Court after he was accused of selling up to $1.3m (£793,257) in counterfeit bottles from 2004-12. Kurniawan was once considered one of the leading fine wine experts in the world and in 2006 alone, it was believed he sold up to 12,000 bottles at auction.

Thousands of labels for fine Burgundy and Bordeaux wine along with full, unlabelled bottles were found in Kurniawan’s home in California. He produced at least 1,000 fake bottles in his kitchen, his so called “magic cellar”.

The big question is whether buyers of top Premier Cru or Deuxieme Cru growth vintages from France are due a big return. With the advent of electronic platforms rather than just face to face auctions and greater market transparency the most sought after wines are a relatively liquid investment but the spread between the purchase and selling price with many merchants remains at around 20% taking a considerable slice out of potential profits.

Equities have outperformed wine indices over the last 5 years after the bubble burst in late 2011 and prices have failed to bounce. Certainly investing in a fine Bordeaux is a lot tastier than buying shares in Shell or Tesco should you wish to open the cork! Though it might be a very expensive sip!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Fine wine investment still off the boil compared with 2011 bubble

Feb 24, 2014 at 6:39 am in Market Commentary by contrarianuk

After the huge growth in the fine wine market in 2011 many investors in alternatives were rubbing their hands with glee. However, today on the whole the froth has very much been removed after the Chinese brought in controls on hospitality and gifting in 2012 which hit some of the top wines from Bordeaux and Burgundy in particular which were desirable in Chinese diplomatic and government circles .

Chinese wine consumption was around 1.25 billion bottles in 2013 and it is now the largest consumer of Bordeaux in the world. But only a tbird of Chinese wine drinkers said they drank it because they liked the taste (Wine Intelligence 2013 report). There have been stories of Chateau Lafite being drunk with with Coke Cola.

The peak of the fine wine market coincided with the October 2010 Hong Kong auction hosted by Sotheby’s in which three bottles of Châteaux Lafite-Rothschild 1869 were sold at a price of $232,692 a bottle – 29,000 a glass.

The Liv-ex Fine Wine 100 Index shows that the market for fine wine doesn’t look like its rebounding right now. The index represents the price movement of 100 of the most sought-after fine wines for which there is a strong secondary market and is calculated monthly. The majority of the index consists of Bordeaux wines – a reflection of the overall market – although wines from Burgundy, the Rhone, Champagne and Italy are also included.

At the current level of 254, the index is some way off the peak of 365 reached in June 2011. However there have been some notable expections to the overall story. Domaine de la Romanee-Conti Monopole Grand Cru 1999 at £9,555 a bottle has delivered a growth of 158% and Chateau Lafite Rothschild Pauillac Premier Cru 2001 at £449 a bottle, has risen by 110%.

The best performing investment wines have traditionally been French, notably wines from Bordeaux and Burgundy. A classification system in Bordeaux established in 1855 is key – the “Les Grands Cru classes”. This established the so called “first growth” estates of Lafite Rothschild, Latour, Margaux, Mouton-Rothschild and Haut-Brion. Burgundian wines from Domaine de la Romanee-conti are particularly sought after.

Investment in the fine wine market has always been somewhat opaque with little regulation and limited transparency in pricing. Then of course there have been the recent big stories about fake wine.

In December 2013, Rudy Kurniawan, 37, was convicted on two counts of wire and postal fraud in federal court in a New York Court after he was accused of selling up to $1.3m (£793,257) in counterfeit bottles from 2004-12. Kurniawan was once considered one of the leading fine wine experts in the world and in 2006 alone, it was believed he sold up to 12,000 bottles at auction.

Thousands of labels for fine Burgundy and Bordeaux wine along with full, unlabelled bottles were found in Kurniawan’s home in California. He produced at least 1,000 fake bottles in his kitchen, his so called “magic cellar”.

The big question is whether buyers of top Premier Cru or Deuxieme Cru growth vintages from France are due a big return. With the advent of electronic platforms rather than just face to face auctions and greater market transparency the most sought after wines are a relatively liquid investment but the spread between the purchase and selling price with many merchants remains at around 20% taking a considerable slice out of potential profits.

Equities have outperformed wine indices over the last 5 years after the bubble burst in late 2011 and prices have failed to bounce. Certainly investing in a fine Bordeaux is a lot tastier than buying shares in Shell or Tesco should you wish to open the cork! Though it might be a very expensive sip!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.