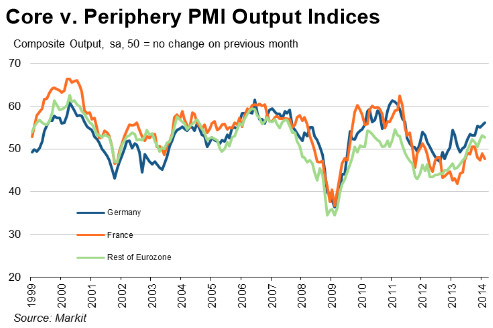

The indices are marginally down today after Markit published its review of June European economic activity in the eurozone called the “The Markit Purchasing Managers’ Index” (PMI) with its lowest rating in six months.

The index fell to 52.8 in June from 53.5 in May, with a figure above 50 indicating growth and below 50 indicating contraction. Despite decent growth in Germany, France dragged the overall number lower with a 48 and peripheral countries showed unusual strength with the highest read since mid 2007. Overall the PMI is showing the lowest reading since December 2013. Markit said that Germany’s economy is set to grow by 0.7% in the second quarter and the eurozone by 0.4% as a whole.

The composite PMI surveys purchasing managers in the services and manufacturing sectors. The reading for the dominant services industry fell to a three-month low of 52.8; for manufacturing, it dropped to a nine-month low of 51.9.

The business unfriendly approach of the French government is being blamed for France’s continued problems and it puts President Hollande under even more pressure. Too much regulation, huge bureaucracy, high taxation and social costs and inflexible labour laws all seem to be have a negative impact right now.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

France drags down European performance

Jun 23, 2014 at 12:12 pm in Market Commentary by contrarianuk

The indices are marginally down today after Markit published its review of June European economic activity in the eurozone called the “The Markit Purchasing Managers’ Index” (PMI) with its lowest rating in six months.

The index fell to 52.8 in June from 53.5 in May, with a figure above 50 indicating growth and below 50 indicating contraction. Despite decent growth in Germany, France dragged the overall number lower with a 48 and peripheral countries showed unusual strength with the highest read since mid 2007. Overall the PMI is showing the lowest reading since December 2013. Markit said that Germany’s economy is set to grow by 0.7% in the second quarter and the eurozone by 0.4% as a whole.

The composite PMI surveys purchasing managers in the services and manufacturing sectors. The reading for the dominant services industry fell to a three-month low of 52.8; for manufacturing, it dropped to a nine-month low of 51.9.

The business unfriendly approach of the French government is being blamed for France’s continued problems and it puts President Hollande under even more pressure. Too much regulation, huge bureaucracy, high taxation and social costs and inflexible labour laws all seem to be have a negative impact right now.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.