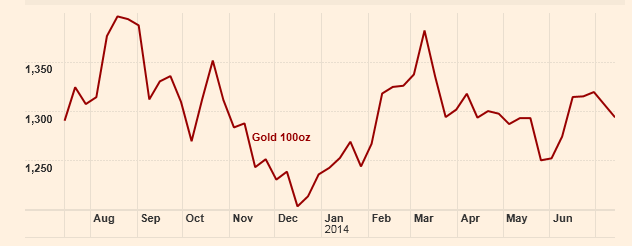

After rallying in the last couple of months from around the $1240 a troy ounce level in early June, gold has been under pressure this week, dropping over $30 or 2.3% on Monday as speculators took the yellow metal off the table in the face of fears about the demand for physical gold in Asian markets and whether central banks will continue buying after adding around 180 tonnes in the period between January and May. This week’s fall was the largest drop this year. Today gold is down another 0.7% to $1,297 a troy ounce after coming in with a 9.2% rise for the first half of 2014.

Indian demand for gold has been hampered by a 10% import duty on gold and silver but has remained relatively resilient this year. Last week Goldman Sachs published a very bearish report on the metal with some speculating that the big drop last week was orchestrated in tandem with the report. According to Jeffrey Currie, Goldman Sach’s global commodities research head, prices will probably end lower this year which suggests that prices could collapse in the second half of this year after recent gains. Heavy selling on the futures market when there was no breaking news or market-moving developments led to sharp price falls yesterday with nearly $1.5 billion of gold futures contracts being dumped COMEX market at the start of trading This heavy selling snow balled as stop losses were triggered.The selling appeared to be focused on to the paper market as physical gold sales remained subdued.

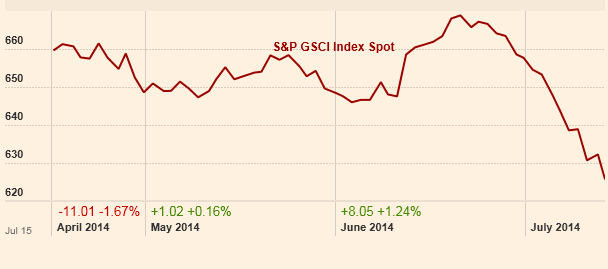

Commodity prices in general have been under some pressure in the last few weeks with the Goldman Sachs commodity index showing real weakness. With so much outperformance in gold versus other commodities, it was inevitable that profit taking would kick in at some point.

It will be fascinating to see how gold performs in the coming months after such a strong start to 2014. If equities come under pressure, the metal’s hedging potential against risk may come into play. But Goldman in common with other investment banks has been surprised by the bounce and time will tell whether predictions of a big fall actually occur.

In part, the actions of the Federal Reserve and any signs of inflationary pressure in the United States will dictate the more speculative side of trading in the metal. If US interest rates rise faster than expected then gold may be under further pressure since this normally dampens inflationary pressures. Fed Chair Janet Yellen said today at the Senate Banking Committee meeting that “If the labour market continues to improve more quickly than anticipated by the committee, resulting in faster convergence toward our dual objectives, then increases in the federal funds rate target likely would occur sooner and be more rapid than currently envisioned,”but “likely would be more accommodating than currently anticipated” if economic performance is disappointing. No idea then!?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Gold drifts below key $1300 an ounce level

Jul 15, 2014 at 5:19 pm in Market Commentary by contrarianuk

After rallying in the last couple of months from around the $1240 a troy ounce level in early June, gold has been under pressure this week, dropping over $30 or 2.3% on Monday as speculators took the yellow metal off the table in the face of fears about the demand for physical gold in Asian markets and whether central banks will continue buying after adding around 180 tonnes in the period between January and May. This week’s fall was the largest drop this year. Today gold is down another 0.7% to $1,297 a troy ounce after coming in with a 9.2% rise for the first half of 2014.

Indian demand for gold has been hampered by a 10% import duty on gold and silver but has remained relatively resilient this year. Last week Goldman Sachs published a very bearish report on the metal with some speculating that the big drop last week was orchestrated in tandem with the report. According to Jeffrey Currie, Goldman Sach’s global commodities research head, prices will probably end lower this year which suggests that prices could collapse in the second half of this year after recent gains. Heavy selling on the futures market when there was no breaking news or market-moving developments led to sharp price falls yesterday with nearly $1.5 billion of gold futures contracts being dumped COMEX market at the start of trading This heavy selling snow balled as stop losses were triggered.The selling appeared to be focused on to the paper market as physical gold sales remained subdued.

Commodity prices in general have been under some pressure in the last few weeks with the Goldman Sachs commodity index showing real weakness. With so much outperformance in gold versus other commodities, it was inevitable that profit taking would kick in at some point.

It will be fascinating to see how gold performs in the coming months after such a strong start to 2014. If equities come under pressure, the metal’s hedging potential against risk may come into play. But Goldman in common with other investment banks has been surprised by the bounce and time will tell whether predictions of a big fall actually occur.

In part, the actions of the Federal Reserve and any signs of inflationary pressure in the United States will dictate the more speculative side of trading in the metal. If US interest rates rise faster than expected then gold may be under further pressure since this normally dampens inflationary pressures. Fed Chair Janet Yellen said today at the Senate Banking Committee meeting that “If the labour market continues to improve more quickly than anticipated by the committee, resulting in faster convergence toward our dual objectives, then increases in the federal funds rate target likely would occur sooner and be more rapid than currently envisioned,”but “likely would be more accommodating than currently anticipated” if economic performance is disappointing. No idea then!?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.