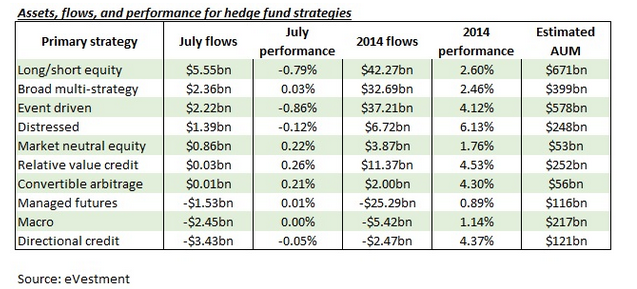

It has been a mixed picture for the hedge fund industry in 2014 with Macro funds struggling in particular. Up to the end of last month, the Preqin Hedge Fund All Strategies benchmark posted a gain of 3.47%, below the 4.45% gain for the S&P 500. In the past 12 months ending in July, the S&P 500 rose 14.5%, whilst the Preqin Hedge Fund All Strategies benchmark rose just over 9%. In 2013, the average fund returned just 9% percent, according to HFR, compared with a 32.4% gain in the S&P 500, after accounting for dividends.

Howard Wang, a former analyst at Ray Dalio’s Bridgewater Associates LP, says most hedge fund performance mirrors the broader market, failing to justify the high fees with investors paying an average of 1.5% of assets and 18% of profits.

Like everyone else, hedge fund managers are finding it difficult to generate alpha returns and many are finding it harder to justify super size fees against an unspectacular performance against major benchmarks. Some star managers like George Soros and Ray Dalio of Bridgwater Capital continue to out perform but these seem to be against the grain. John Paulson, famous for making billions out of the sub prime mortgage crisis has struggled recently after outsize bets on gold and gold miners which fell heavily in 2013.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Hedge fund performance mixed so far this year

Aug 25, 2014 at 11:03 am in Market Commentary by contrarianuk

It has been a mixed picture for the hedge fund industry in 2014 with Macro funds struggling in particular. Up to the end of last month, the Preqin Hedge Fund All Strategies benchmark posted a gain of 3.47%, below the 4.45% gain for the S&P 500. In the past 12 months ending in July, the S&P 500 rose 14.5%, whilst the Preqin Hedge Fund All Strategies benchmark rose just over 9%. In 2013, the average fund returned just 9% percent, according to HFR, compared with a 32.4% gain in the S&P 500, after accounting for dividends.

Howard Wang, a former analyst at Ray Dalio’s Bridgewater Associates LP, says most hedge fund performance mirrors the broader market, failing to justify the high fees with investors paying an average of 1.5% of assets and 18% of profits.

Like everyone else, hedge fund managers are finding it difficult to generate alpha returns and many are finding it harder to justify super size fees against an unspectacular performance against major benchmarks. Some star managers like George Soros and Ray Dalio of Bridgwater Capital continue to out perform but these seem to be against the grain. John Paulson, famous for making billions out of the sub prime mortgage crisis has struggled recently after outsize bets on gold and gold miners which fell heavily in 2013.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.