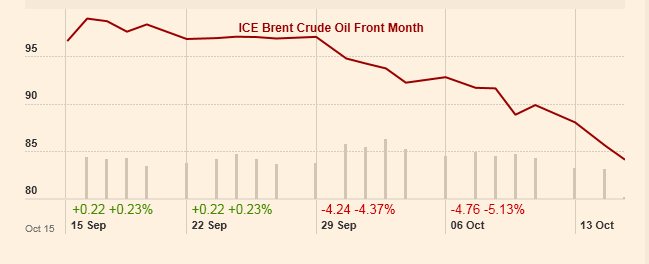

With the price of oil dropping around 25% since and currently trading at $84 a barrel things are bleak for oil related shares. With Opec and notably Saudi Arabia apparently reluctant to cut production and focused on maintaining market share and the International Energy Agency cutting forecasts for global demand the outlook looks tough right now with many expecting the price to bottom out at around $80 a barrel.

Many mid-cap to large cap oil shares have seen their price drop by at least 10% in the last month, with some like Tullow oil, dropping a whopping 28%. Small caps have faired even worse with popular private investor shares like Xcite Energy, Rockhopper and Gulf Keystone Petroleum dropping to multi year lows as the selling continued unabated.

If the oil price stays in the range around $80 a barrel it is estimated that Opec alone would lose around $200 billion in earnings and there are many shale projects in the United States that are generating marginal profits at prices around $75 a barrel. It is not inconceivable that production may be cut back in the areas like the Bakken if prices remain depressed but this would take quite a while to dent output in any meaningful way. Oil rigs in North America hit an all time high of 1,609 last week, up 17% from a year ago, according to a weekly survey by oil service firm Baker Hughes. U.S. output is the highest in 30 years, thanks to output from newly-tapped and prolific shale formations.

But a lower oil price may have a silver lining for the general global economy, with an annual saving of some $650 billion dollars for consumers of fuel and industrial users. In the US, where last year some $2,900 per household was spent on gasoline, the fall in oil could deliver a saving of just under $600 per household.

For holders of oil shares this is little consolation given the recent falls. I for one wasn’t expecting such a rout and bottom fishing is proving mighty difficult right now with the fear certainly in the air.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Oil shares plummet as crude oil price dives

Oct 15, 2014 at 8:39 am in Market Commentary by contrarianuk

With the price of oil dropping around 25% since and currently trading at $84 a barrel things are bleak for oil related shares. With Opec and notably Saudi Arabia apparently reluctant to cut production and focused on maintaining market share and the International Energy Agency cutting forecasts for global demand the outlook looks tough right now with many expecting the price to bottom out at around $80 a barrel.

Many mid-cap to large cap oil shares have seen their price drop by at least 10% in the last month, with some like Tullow oil, dropping a whopping 28%. Small caps have faired even worse with popular private investor shares like Xcite Energy, Rockhopper and Gulf Keystone Petroleum dropping to multi year lows as the selling continued unabated.

If the oil price stays in the range around $80 a barrel it is estimated that Opec alone would lose around $200 billion in earnings and there are many shale projects in the United States that are generating marginal profits at prices around $75 a barrel. It is not inconceivable that production may be cut back in the areas like the Bakken if prices remain depressed but this would take quite a while to dent output in any meaningful way. Oil rigs in North America hit an all time high of 1,609 last week, up 17% from a year ago, according to a weekly survey by oil service firm Baker Hughes. U.S. output is the highest in 30 years, thanks to output from newly-tapped and prolific shale formations.

But a lower oil price may have a silver lining for the general global economy, with an annual saving of some $650 billion dollars for consumers of fuel and industrial users. In the US, where last year some $2,900 per household was spent on gasoline, the fall in oil could deliver a saving of just under $600 per household.

For holders of oil shares this is little consolation given the recent falls. I for one wasn’t expecting such a rout and bottom fishing is proving mighty difficult right now with the fear certainly in the air.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.