Brent crude has spurted higher to near $114 a barrel and WTI oil rose over $107, levels today, a nine month high as the problems in Iraq and tight US inventories continue to worry oil traders. Many are wondering whether the sharp rise in oil prices could derail global economic recovery if the situation is sustained.

After weeks of calm in the equity markets, markets have fallen heavily over the last 2 days as at last a decent excuse to take profits has reared its head in the shape of Iraq. After issues with Libyan supply of oil, Iraq has taken the slack in recent months but with global demand for oil solid, a disruption of production could cause a serious spike in oil prices. The FTSE 100 is down 43 points to 6,802 and the Dow industrials fell 110 points to 16,734 last night after being within spitting distance of 17,000 earlier in the week.

Oil futures are up over 5% this week, the biggest weekly rise since July 2013 in the case of Brent crude and since December 2013 for WTI US futures.

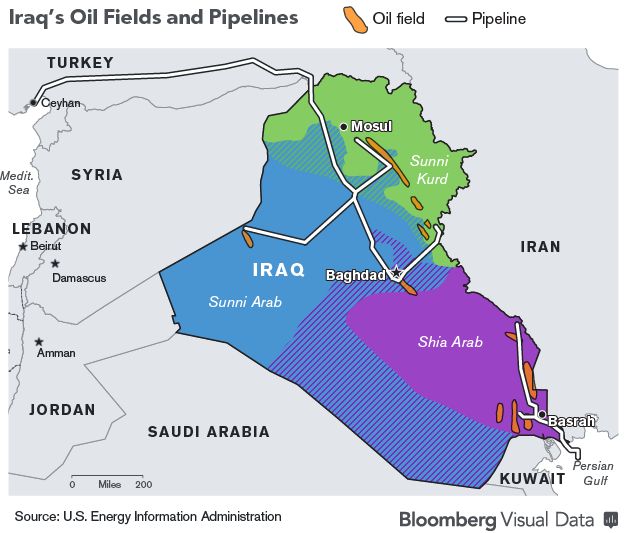

Iraq is the focus with fears that a civil war could break out after the capture of the second largest city, Mosul by ISIS (Islamic State of Iraq) militants and the move by Kurdish forces to take Kirkuk, the oil production hub in northern Iraq. ISIS are apparently making a move on Karbala and Najaf. The jihadists have advanced to towns only about an hour’s drive from Baghdad.

Iraq is the world’s eighth-largest producer of oil and second largest producer in OPEC (Organisation of the Petroleum Exporting Countries), pumping between 3-3.5 million barrels per day. If the fighting between the Iraqi government and the militants spreads to Southern Iraq that will real drive up all prices as over half of the country’s reserves are based in this area.

Iraqi prime minister Nouri al-Maliki is hoping that the US will help stem the Jihadist advances, but direct intervention won’t happen. Maliki has issued a statement calling on officers and lower-ranking recruits unable to return to their units to report to their nearest military base. Expect plenty of volatility in the oil markets until this latest crisis is resolved. A Syria type situation seems unlikely for now, but the smouldering tensions between the various Shia and Sunni Muslim factions are clearly a tinder box.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Oil spikes higher and markets finally reverse

Jun 13, 2014 at 9:32 am in Market Commentary by contrarianuk

Brent crude has spurted higher to near $114 a barrel and WTI oil rose over $107, levels today, a nine month high as the problems in Iraq and tight US inventories continue to worry oil traders. Many are wondering whether the sharp rise in oil prices could derail global economic recovery if the situation is sustained.

After weeks of calm in the equity markets, markets have fallen heavily over the last 2 days as at last a decent excuse to take profits has reared its head in the shape of Iraq. After issues with Libyan supply of oil, Iraq has taken the slack in recent months but with global demand for oil solid, a disruption of production could cause a serious spike in oil prices. The FTSE 100 is down 43 points to 6,802 and the Dow industrials fell 110 points to 16,734 last night after being within spitting distance of 17,000 earlier in the week.

Oil futures are up over 5% this week, the biggest weekly rise since July 2013 in the case of Brent crude and since December 2013 for WTI US futures.

Iraq is the focus with fears that a civil war could break out after the capture of the second largest city, Mosul by ISIS (Islamic State of Iraq) militants and the move by Kurdish forces to take Kirkuk, the oil production hub in northern Iraq. ISIS are apparently making a move on Karbala and Najaf. The jihadists have advanced to towns only about an hour’s drive from Baghdad.

Iraq is the world’s eighth-largest producer of oil and second largest producer in OPEC (Organisation of the Petroleum Exporting Countries), pumping between 3-3.5 million barrels per day. If the fighting between the Iraqi government and the militants spreads to Southern Iraq that will real drive up all prices as over half of the country’s reserves are based in this area.

Iraqi prime minister Nouri al-Maliki is hoping that the US will help stem the Jihadist advances, but direct intervention won’t happen. Maliki has issued a statement calling on officers and lower-ranking recruits unable to return to their units to report to their nearest military base. Expect plenty of volatility in the oil markets until this latest crisis is resolved. A Syria type situation seems unlikely for now, but the smouldering tensions between the various Shia and Sunni Muslim factions are clearly a tinder box.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.