After plenty of negativity in the markets yesterday following signs of clear weakness in the European economy and a strong dollar helping to drive down miners and energy shares, it was a strong US non-farm payroll number for September which has helped a sustained rebound today.

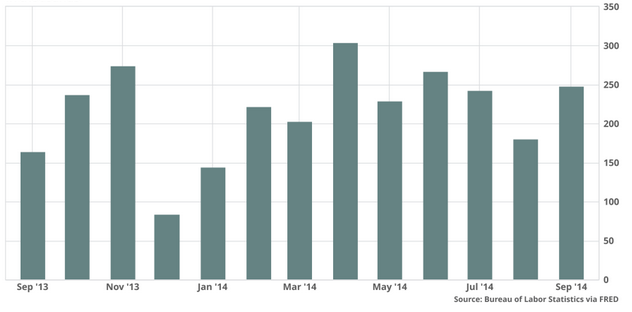

US unemployment fell below 6% for the first time since 2008 (a 0.1% drop) with 248,000 jobs created last month compared with expectations of 215-225,000 jobs.The August number was also revised higher from 142,000 to 180,000. Commentators were predicting that the unemployment rate would hold steady at 6.1%, after falling steadily this year from 6.6% at the end of last year. Average hourly wages fell a cent to $24.53, reducing the 12-month increase to 2% from 2.1%.

Monthly jobs growth has averaged 215,000 in 2014 compared with 194,000 in 2013, a 17% rise. Wall Street futures are up 114 points and gold is down $15 an ounce to below $1200 meaning that the yellow metal is back in negative territory for 2014.

Now the market is wondering what the Federal Reserve will make of the number and how quickly it may begin to raise interest rates in the face of these strong employment numbers. It is clear that the US economy seems to be doing a lot better than Europe and the Federal Reserve’s willingness to pump in liquidity into the American economy through asset purchases and low interest rates has helped reduce unemployment from around 10% in 2009 to 6% today. With volatility up, index traders are having a much more exciting time of late that’s for sure.

All eyes will soon be on the next earnings season for the US market.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Strong US employment data helps European stocks rebound

Oct 3, 2014 at 1:26 pm in Market Commentary by contrarianuk

After plenty of negativity in the markets yesterday following signs of clear weakness in the European economy and a strong dollar helping to drive down miners and energy shares, it was a strong US non-farm payroll number for September which has helped a sustained rebound today.

US unemployment fell below 6% for the first time since 2008 (a 0.1% drop) with 248,000 jobs created last month compared with expectations of 215-225,000 jobs.The August number was also revised higher from 142,000 to 180,000. Commentators were predicting that the unemployment rate would hold steady at 6.1%, after falling steadily this year from 6.6% at the end of last year. Average hourly wages fell a cent to $24.53, reducing the 12-month increase to 2% from 2.1%.

Monthly jobs growth has averaged 215,000 in 2014 compared with 194,000 in 2013, a 17% rise. Wall Street futures are up 114 points and gold is down $15 an ounce to below $1200 meaning that the yellow metal is back in negative territory for 2014.

Now the market is wondering what the Federal Reserve will make of the number and how quickly it may begin to raise interest rates in the face of these strong employment numbers. It is clear that the US economy seems to be doing a lot better than Europe and the Federal Reserve’s willingness to pump in liquidity into the American economy through asset purchases and low interest rates has helped reduce unemployment from around 10% in 2009 to 6% today. With volatility up, index traders are having a much more exciting time of late that’s for sure.

All eyes will soon be on the next earnings season for the US market.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.