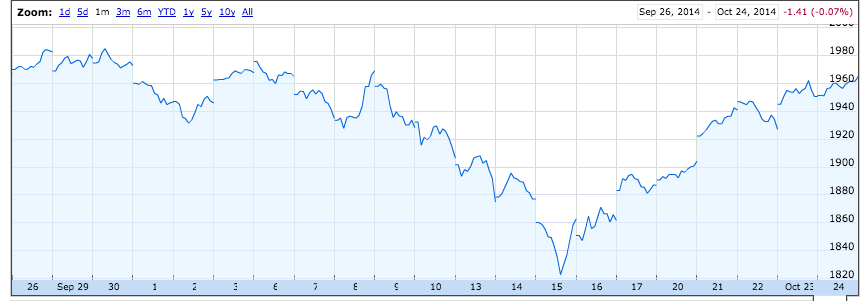

After all the selling the week before last the US S&P 500 index climbed 4.1% last week to 1,965, rising back above the psychologically and technically important 1,950 level. The Nasdaq composite did even better last week with a 5.3% gain to 4,484.

So despite all the global economic concerns, earnings from the US third quarter season have come to the rescue. Strong figures from the likes of Microsoft, 3M, Apple and Caterpillar helped offset disappointments from the likes of Amazon. The latter fell 8% on Friday as it reported that the company’s operating loss widened to $544 million from $25 million a year ago, though sales climbed from $17.1 billion in Q3 2013 to $20.58 billion in Q3 2014. Investors are beginning to lose patience with Jeff Bezos. Next week it will be the likes of Twitter, Conoco, Chevron and Merck in focus.

Continued weakness in the energy and commodity sector meant that the FTSE was more subdued last week with 1.24% rise for the FTSE 100 and 1.44% for the FTSE all share. It seems that the 9% plus correction in the US market was indeed the buying signal given the snap back.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

US markets snap back boosted by earnings

Oct 26, 2014 at 10:57 am in Market Commentary by contrarianuk

After all the selling the week before last the US S&P 500 index climbed 4.1% last week to 1,965, rising back above the psychologically and technically important 1,950 level. The Nasdaq composite did even better last week with a 5.3% gain to 4,484.

So despite all the global economic concerns, earnings from the US third quarter season have come to the rescue. Strong figures from the likes of Microsoft, 3M, Apple and Caterpillar helped offset disappointments from the likes of Amazon. The latter fell 8% on Friday as it reported that the company’s operating loss widened to $544 million from $25 million a year ago, though sales climbed from $17.1 billion in Q3 2013 to $20.58 billion in Q3 2014. Investors are beginning to lose patience with Jeff Bezos. Next week it will be the likes of Twitter, Conoco, Chevron and Merck in focus.

Continued weakness in the energy and commodity sector meant that the FTSE was more subdued last week with 1.24% rise for the FTSE 100 and 1.44% for the FTSE all share. It seems that the 9% plus correction in the US market was indeed the buying signal given the snap back.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.