Some dangers to equity investors in 2014

Dec 27, 2013 at 9:10 am in Fundamental Analysis by contrarianuk

After this year’s large equity market gains driven to a large part by highly accommodative central banks around the world using ultra low interest rates and Quantitative easing, some dangers lurk in the system for investors in 2014. Will they play out? Certainly at current valuations, many sectors – tech, pharma, housing stocks look fully valued. But is it time for a contrarian bet?

Here are some factors to think about:

1. The carry trade – quantitative easing, the asset buying programme, being used by the US Federal Reserve means that financial institutions have been happy to sell their Treasury bonds and Mortgage backed securities at inflated prices to fund investment activity at far more lucrative rates in other places in the world. Money has been put into emerging market equities and bonds. As QE begins to taper from January with predictions that it will come to an end by end 2014, this so called carry trade will stop. What then for emerging markets?

2. Emerging markets slow down – Talking of emerging markets, there are signs that the BRIC (Brazil, Russia, India, China) are perhaps past their best. The bursting of the overcapacity and housing bubbles in China could dent their thirst for resource stocks even further in 2014. A dodgy loan book and banking sector in China seems ripe for something to happen sooner or later. Brazil and India seem to be struggling to rejuvenate their economies after a poor year with rising inflation.

3. Eurozone – There is much talk of a bounce back in Europe next year driven by some of the weaker economies. Certainly the UK and Ireland seem to be back from the dead, Germany is looking robust but can we really believe that the likes of Spain, Portugal and Italy, the zombie economies will recover? Maybe. Greece seems to have gone very quiet of late…..but problems remain.

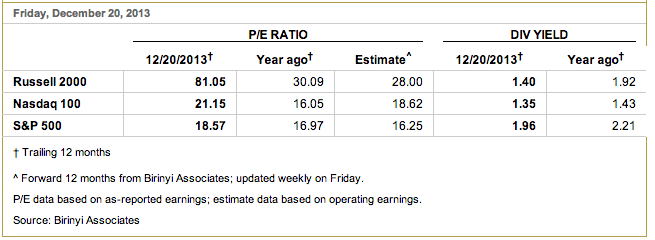

4. US market valuations. We are seeing another internet boom right now similar to the dot com crash of 2000. At $73, Twitter is now valued at $41 billion! The S&P 500 is at a price/earnings of 18.5, high by historical standards. Expectations of top and bottom line growth in 2014 are high following the Fed’s statement in December that they expect robust growth in the United States in 2014. Will Big Sam deliver??

Contrarian Investor UK

IMPORTANT

The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.