Review of the IG Index Android App

Dec 30, 2011 at 9:36 am in Mobile Trading by

Following my review of the Capital Spreads Android App, in this article I review the mobile spread betting platform provided as an Android App by IG Index. Although I hold accounts with most of the spread betting companies, this app was my first foray into trading with IG Index, and I like what I see.

Logging In and Depositing Funds

You can locate and install the IG Index app by searching the Android Market for ‘IG Index’.

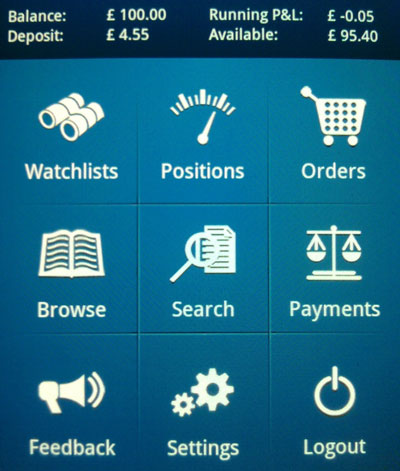

I like to keep things simple, and I like spread betting companies that keep things simple, so I was pleased to see the layout of the initial screen as shown below. It’s very straightforward, with an array of nine push buttons labelled Watchlists, Positions, Orders, Browse (for markets), Search (for markets), Payments, Feedback, Settings, and Logout.

You can return to this screen at any time by tapping the home icon — it looks like a house, and you’ll see it in some later screenshots — that is always displayed at the top-left of the screen.

Since I had to create a brand new IG Index spread betting account in order to use this app (I didn’t have an existing account with this provider) the first thing I needed to do was deposit funds using the Payments option. The good news is that you can deposit funds directly from the Android app… providing you have already registered a debit card using the IG Index web interface. You can even withdraw funds via the Android app, which is nice because some spread betting companies make it difficult if not impossible to withdraw funds even via their standard web interfaces.

Assuming you have deposited some funds, and not immediately withdrawn them, you will want to research some markets to trade.

Browse and Search

The Browse button presents you with a list o market categories including Indices, Forex, Commodities, Shares (by country), Options, and even House Prices. You can drill down through these categories, for example into UK Shares AA-AF (alphabetical).

If you know exactly which index, share, or other market you are interested in, you might find it easier to search for it via the Search button. A search for “AMR” (for example) would yield the following choices of markets to bet on:

I prefer rolling daily spread bets rather than future-dated spread bets, so I’d be interested in the entry for AMR Corp labelled DFB meaning “Daily Funded Bet”. It’s different terminology from that used on some other spread betting platforms.

Market Details, Deals and Orders

Tapping any market in the search results or browsed list takes you to a Market Detail screen as shown below. It couldn’t be clearer or simpler: you can see the current buying and selling prices, you can choose to deal now via the Deal Ticket or place an order for future execution via the Order Ticket, and you can even see a chart right there — nice!

The Deal Ticket (not shown) is pretty much the same as what you would expect to see on any trading platform. You can choose to Buy or Sell immediately at the indicated prices, and your deal can have an attached Stop (to cap your potential loss) and Limit (to take your profit at a predetermined level). As far as I can tell, the mobile deal ticket allows you to specify an attached stop order as Guaranteed but not trailing, whereas the web interface does allow you to specify a trailing stop order providing you have this facility enabled in your preferences. Unlike some spread betting platforms, the IG Index Android app — and indeed, their web platform — allows you to bet as little as £0.10 per point which is handy for small players or those just learning the ropes.

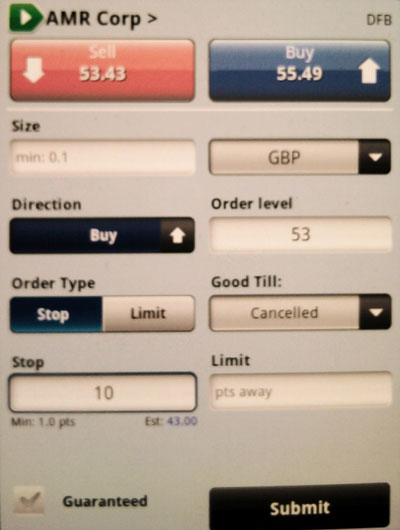

The Order Ticket (shown below) is similar to the Deal Ticket except that in this case you specify an Order level, which is the price at which you would like the trade to be executed sometime in the future as determined by your Good Till selection.

In common with some but not all trading platforms you need to tap one of the Order Type buttons to indicate whether this future opening order is a Stop order (if your Order level is above the current market price for a Buy order or below it for Sell order) or a Limit order (if your Order level is below the current market price for a Buy order or above it for Sell order). This is somewhat unnecessary because the type of order could be inferred from the order Direction and Order level, and in my mind it leads to confusion… especially when there are quite separate fields to specify the contingent (and much different) Stop and Limit distances that will be applied to the trade once it has executed.

Note: the justification for the Order Type field may be so that the platform can warn you if you made a mistake by trying to buy when you meant to sell at a particular target price.

Once your deals or orders have executed, you will have some…

Positions

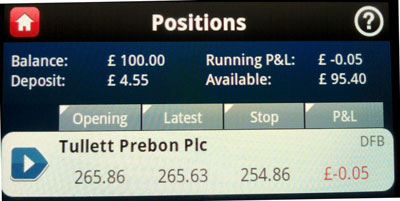

Tapping the Positions button on the home screen shown in the first figure (above) takes you to your list of open positions. In the figure below I have just one open position for clarity, and you can see how the listing includes fields for the Opening price, the Latest market price, the Stop (if there is one) level and the current P&L (Profit & Loss).

What is really interesting is that you can customise the list by tapping any of the column headings in order to change it for something else. If you prefer to see the Limit price rather than the P&L, you can simply tap the P&L column heading until it changes to Limit. If you turn your Android phone on its side, you will be rewarded with additional columns that allow you to see the P&L and Limit both at the same time.

Tapping the entry for any of your positions will take you to a Position Details screen from which you can Close Position or Edit Position. I edit my open positions periodically so as to trail my stop orders manually.

Watchlists

Many spread betting platforms and apps allow you to maintain a watch list of financial instruments that you are “watching” with a view to trading them at a later date. The problem is that it can sometime be rather cumbersome to build such a list from scratch, and the IG Index mobile app helps out here by providing some ready-made watch lists that you can access via the Watchlists button on the home screen.

The ready-made watch lists include Popular Markets, UK Banks, UK Mining, UK Retail, and (as shown below) the list of your Recently Traded markets.

You can see the list of markets on your own custom-built watch list by tapping My Watchlist, but it is not immediately apparent to me how you can actually populate this list via the Android app. It may be an oversight on my part, but if it’s not obvious to me then it may not be obvious to you either.

For the avoidance of doubt: it is perfectly possible to add items to your watch list via the IG Index web interface, and then to view them via the Android app, but you’ll have to return to the web interface in order to remove them… as far as I can tell.

The Bottom Line

The IG Index platform is a very capable spread betting platform, and the Android mobile app is a very comprehensive and user-friendly app. My small niggles about apparently not being able to specify trailing stops via the mobile deal ticket, and not being able to manage the custom watch list via the Android App are of little consequence as far as I am concerned.

The bottom line is that I could actually see myself using the IG Index Android App regularly as an alternative to — and maybe even in preference to — their web interface. It’s very clear, comprehensive, easy to use, and it looks great on my top-of-the-range Android phone that has a good size screen. On the even bigger screen of a Android tablet it would be a knockout. Well done IG Index! And most (but not all) of the reviewers on the Android Marketplace agree.

Tony Loton is a private trader, and author of the book “Stop Orders” published by Harriman House.