Position Trading #4: Pyramiding

Oct 5, 2011 at 11:37 am in Position Trading by

In my previous article on position sizing I alluded to the fact that your position size need not be static. The position size may grow over time by ‘averaging down’ on a falling stock (not recommended) or by ‘pyramiding up’ on a rising stock. In this article I’ll demonstrate my preferred pyramiding approach, and I’ll explain why it is the safer option.

An Historic Example

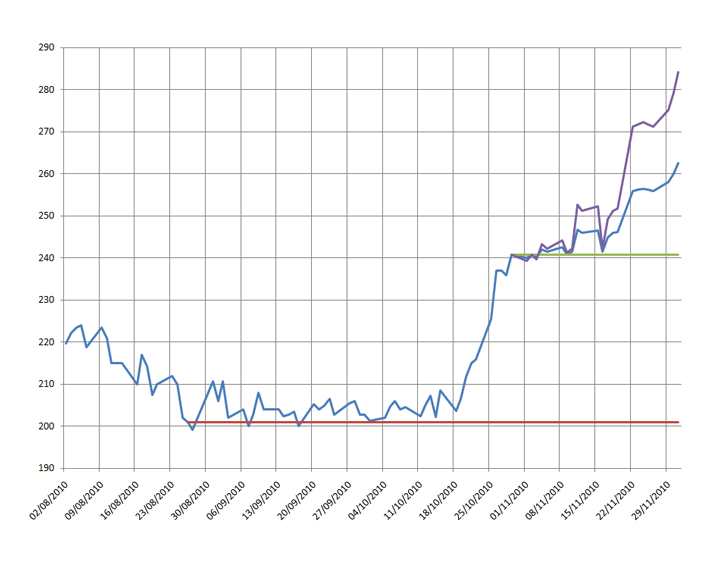

For my historic example I’ll use a real-life pyramided trade into Severfield-Rowen at the tail end of 2010. The red line represents a long spread bet placed at £1-per-point at a price of 200p on 26 August 2010, the blue line represents the unfolding market price, and the difference between the two lines represents the profit on that position. The green line represents a second spread bet at £1-per-point at a price of 240p on 29 October 2010, with the difference between this line and the blue line representing the profit on the second position. The purple line represents the combined profit on the two positions.

Obviously the profit rises at a faster rate when two positions are in play than when one position was in play, which raises a question:

Why start small?

So why didn’t I bet at £2-per-point from the very start, thereby accumulating twice the profit from the start? Well, it’s a matter or risk control. Suppose this stock had gone bust, leaving me £400 down on a £2-per-point initial bet compared with £200 down on a more modest £1-per-point initial bet. In my modest account, a £200 possible loss fell within the money management criteria and a £400 loss (or more) didn’t.

The problem with this argument is that, at the time of establishing my second position, I took on a combined risk of £200 (on my first position) plus £240 (on my second position) = £440 worth of risk. So it turns out that my supposed risk control was an illusion all along. Or was it?

Pyramiding and Stop Orders

There’s something I haven’t told you.

At the time of establishing my second position, I placed a guaranteed stop order at a price of 220p on both positions. This stop order locked-in a guaranteed £20 profit on my first position and it limited the risk absolutely to £20 on my second position; therefore at the time of pyramiding I had completely neutralised my risk while having a double position working in my favour.

For me, this underlines the most important rule of pyramiding:

“Only establish a second position when the profit on your second position covers your additional risk.”

The key to pulling off this risk-neutralisation trick is the placement of a stop order at the time of pyramiding. And, for the record, I can tell you that it is impossible to pull off the same trick when ‘averaging down’ rather than ‘pyramiding up’.

Tony Loton is a private trader, and author of the book ‘Position Trading’ published by LOTONtech.