Diversification: When Many Baskets are Only One

May 12, 2012 at 7:23 pm in Risk Management by

Over on another financial web site I was reading an article in which the writer was considering buying shares in the company Tissue Regenix. One of the comments on that article suggested that…

‘You can spread your bets a bit by investing in IP Group (IPO.L) instead, which has a 16% interest in Tissue Regenix as well as a host of other similar university research spin-off companies such as…’

To my mind, this form of diversification is all wrong. You’re not really ‘spreading your bets’ because you would still be placing a single bet, albeit on a company that invests in a number of other companies. At best this may reduce the volatility of your holding, and at worst it condemns you to never doing any better than the ‘average’ performance of the constituent companies.

The FTSE Fallacy

It’s the same when people invest in a FTSE tracker fund or Exchange Traded Fund (ETF), or when they place a spread bet on the UK 100 index. They are placing just one bet and not 100 separate bets. All of the eggs are in just one basket, which by definition will enjoy only ‘average’ performance. There’s nothing wrong with investing in a FTSE tracker or spread betting the UK 100 index, but don’t go thinking you’re diversifying. If the FTSE falls (on average) then you will lose money on your single bet, and if it rises (on average) you will make money on your single bet, and it’s as simple as that.

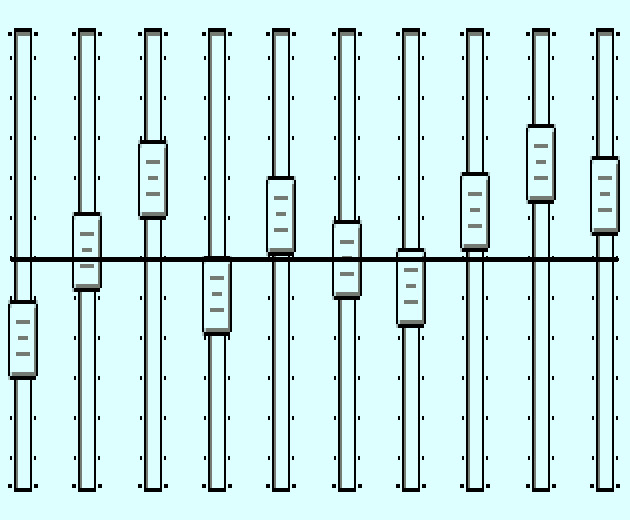

With a FTSE flutter you can never benefit from the out-performances of particular stellar stocks within the index, because you can’t unpick them from the whole. In the following picture I use a graphic equaliser as an analogy for the FTSE 100 index, to show that — while some stocks rise to a profit and some fall to a loss — the index average in this case has not moved at all.

If only you could bank the profits from those risers, eh? Or, perhaps even better, ditch the losers while leaving the winners to run? But you can’t do this, because you’ve put all of your eggs into the one FTSE 100 basket.

If you want to be able to either bank the winners while waiting for the losers to recover (usually not recommended) or run the winners while ditching the losers (usually recommended) then you have no choice but to truly spread your bets (and your eggs) across the 100 separate baskets by placing entirely separate bets on the constituent stocks.

Many Baskets, and Watch Them Carefully

Some say that we should spread our eggs across many baskets. Some say that we can put all our eggs into one basket as long as we ‘watch it carefully’. I say that we should spread our eggs across many baskets and watch them all carefully.

Watching many baskets sounds like hard work, which is probably why many people are talked into lazily spreading their risk by investing in the pseudo-single-basket of the FTSE 100. Lazy people don’t make money unless they are simply “lucky” — but we all want an easy life, don’t we?

One way to lessen the effort involved in monitoring many simultaneous truly-diversified investments or spread bets is to apply stop orders and to trail them periodically. Let those stop orders do most of the day-by-day or minute-by-minute careful watching for you, so that you don’t have to be glued to your computer screen all the time.

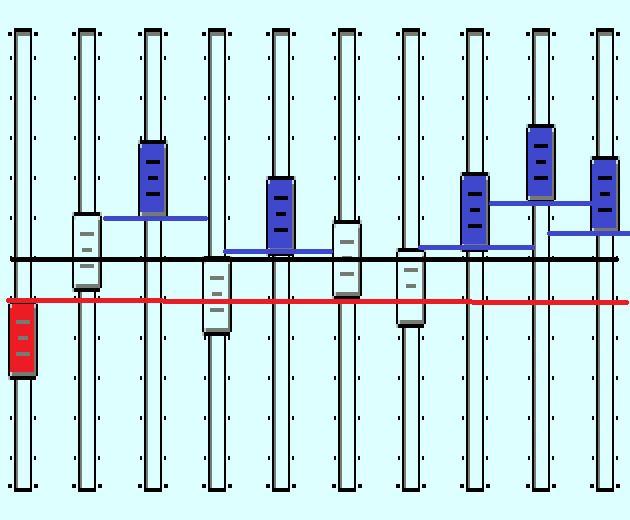

In my revised picture below, see how the better performing constituent stocks have their profits assured by the trailed stop orders (blue lines) while being allowed to run even higher. Notice also how the single dog stock has already stopped out — before it can do any more damage — thanks to the protective stop order indicated by the red line.

You can’t pull off this trick of “running the winners and cutting the losers” with a spread bet on the UK 100 index because one bet on one basket means one stop order across the whole shebang.

The Bottom Line

Putting all your eggs in just one basket (however internally diversified, like a stock index), and simply ignoring it, is plain stupid. Putting your eggs in one basket and watching it carefully is better, but is not enough.

Put your eggs into many baskets and watch them all carefully. Which is not as labour-intensive as you might think if you let your stop orders do the watching for you.

Tony Loton is a private trader, and author of the book “Stop Orders” published by Harriman House.