Swing Trading: Getting Into the Swing, Part 3

Oct 12, 2011 at 12:33 pm in Swing Trading by

Getting Into the Swing, Part 3

In my earlier article series I described my preferred position trading approach, which is a trend following approach in the sense that any stock position will be held as long as the price keeps trending (usually upwards); the position then stopping out of its own accord when the trend comes to an end.

In my last two articles I looked at the shorter-term swing trading approach and introduced the idea of switching automatically from swing trading to trend following.

In this article I look at how the original position trading approach might be enhanced to benefit from the shorter-term swing as well as the longer-term trend.

Capturing the Swing and the Trend

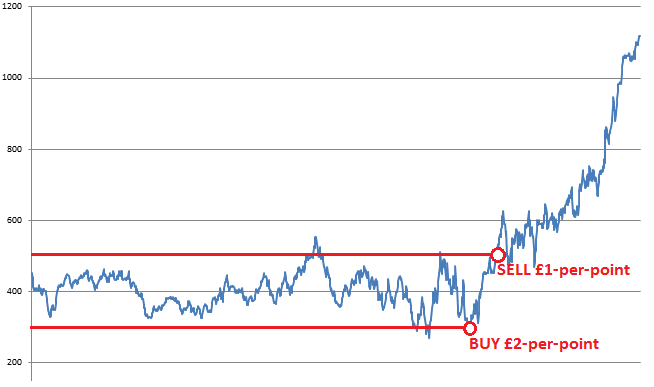

The enhanced approach to position trading would involve establishing a double position – let’s assume £2-per-point — at the bottom of a trading range, with a view to selling half at the top of the trading range (to capture the swing profit) while retaining half just in case the price breaks out of the trading range and into a sustained up-trend. This idea is illustrated in the following chart.

Having observed the price moving sideways, oscillating within a trading range, the trader establishes a £2-per-point position at what he judges to be the bottom of the trading range. At what he judges to be the top of the trading range he sells £1-per-point on the basis that one of two things will happen:

- The price will fall back towards the bottom of the trading range, losing just half the profit on the downswing that was gained on the upswing. Or…

- The price will continue to rise (as indeed it does), breaking out of the prior trading range and securing yet more profit on the residual £1-per-point position.

The Bullish Bias

Just like in the standard swing trading scenario, the initial long trade at £2-per-point would of course be protected by a stop order placed at some distance below the entry price. Unlike the standard swing trading scenario, in this case the original long position is not reversed at the top of the trading range. This alternative approach allows the trader to benefit from the transition from swinging to trending but in this case without risking the accumulation of whipsaw losses that result from calling the swing-to-trend transition incorrectly.

So why did the trader implement this alternative swing-to-position trading approach in this case?

Answer: because he was fundamentally long-term bullish on this stock all along — but not bullish enough to establish the original long position without a protective stop order and not bullish enough to miss out on capturing some profit on the swing as soon as he gets the chance.

Positions and Pyramids

Now imagine this trading pattern played out over a diverse range of stocks as per the original position trading strategy, with the ultimately successful positions being pyramided as their prices embark on sustained uptrends.

This could truly offer the best of both (the swing trading and position trading) worlds. It really could be the Holy Grail of trading, except that — as we all know — there is no such thing!

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.