Why I Don’t Follow The Trend

Apr 21, 2012 at 2:11 pm in Swing Trading by

I’m a big fan of the Trend Following approach to trading advocated by Michael Covel and others. I have no problem with the key idea of holding onto a financial instrument for as long as possible while a trend develops, in order to “run” the profit. I have no problem with selling out — usually by stopping out — when a trend reverses, even if this involves taking a limited loss soon after establishing a position. What I do have a problem with is waiting for a trend to develop before taking the position in the first place, and here’s why:

Look at the following chart for a particular stock — it’s Cable and Wireless Worldwide, but that doesn’t matter — which looks to have bottomed-out and begun a new up-trend. With the new trend firmly underway, you would think that now should be the best time to establish a long position at 80 (trust me if you can’t see the price) with a protective stop order somewhere below the low-point — let’s say at 55.

You may already be thinking to yourself that from 80 down to 50 is an awfully long fall and a big percentage loss if you turn out to be wrong, and on that point you’d be right. The following chart shows how the price subsequently falls, oscillates for a while, and then eventually breeches the stop level indicated by the horizontal line. I have used a thick vertical line to show the loss suffered by the “trend follower”, and another thick vertical line to show the comparatively smaller loss suffered by the “bottom fisher” who managed to catch it just right before the apparent trend started to develop.

You may already be thinking to yourself that from 80 down to 50 is an awfully long fall and a big percentage loss if you turn out to be wrong, and on that point you’d be right. The following chart shows how the price subsequently falls, oscillates for a while, and then eventually breeches the stop level indicated by the horizontal line. I have used a thick vertical line to show the loss suffered by the “trend follower”, and another thick vertical line to show the comparatively smaller loss suffered by the “bottom fisher” who managed to catch it just right before the apparent trend started to develop.

I know that a bottom fisher will rarely catch it just right, but he could have had about four failed attempts in this case for the loss suffered by the trader who waited for the supposed trend to develop.

I know that a bottom fisher will rarely catch it just right, but he could have had about four failed attempts in this case for the loss suffered by the trader who waited for the supposed trend to develop.

My point is that we can never really be sure that a trend will continue, and it could reverse at any time, but we can be sure of how much risk-to-stop we are taking. Waiting for a trend to firmly establish means taking a bigger risk-to-stop with no more likelihood that the trade will succeed.

By the end of the chart, the price has recovered to the stop level, so neither trader need have stopped out at all and both traders might be tempted to “get even” with the market by going in again. Both will have suffered a whipsaw loss, but the trend follower’s whipsaw loss will have been much bigger.

In the alternative “happy” scenario of the original trend continuing, both traders could have run their profits by holding with the trend (nothing wrong with that) but even in this happy scenario the trend-follower would have made less money — because he waited for some of the trend to play out before jumping aboard.

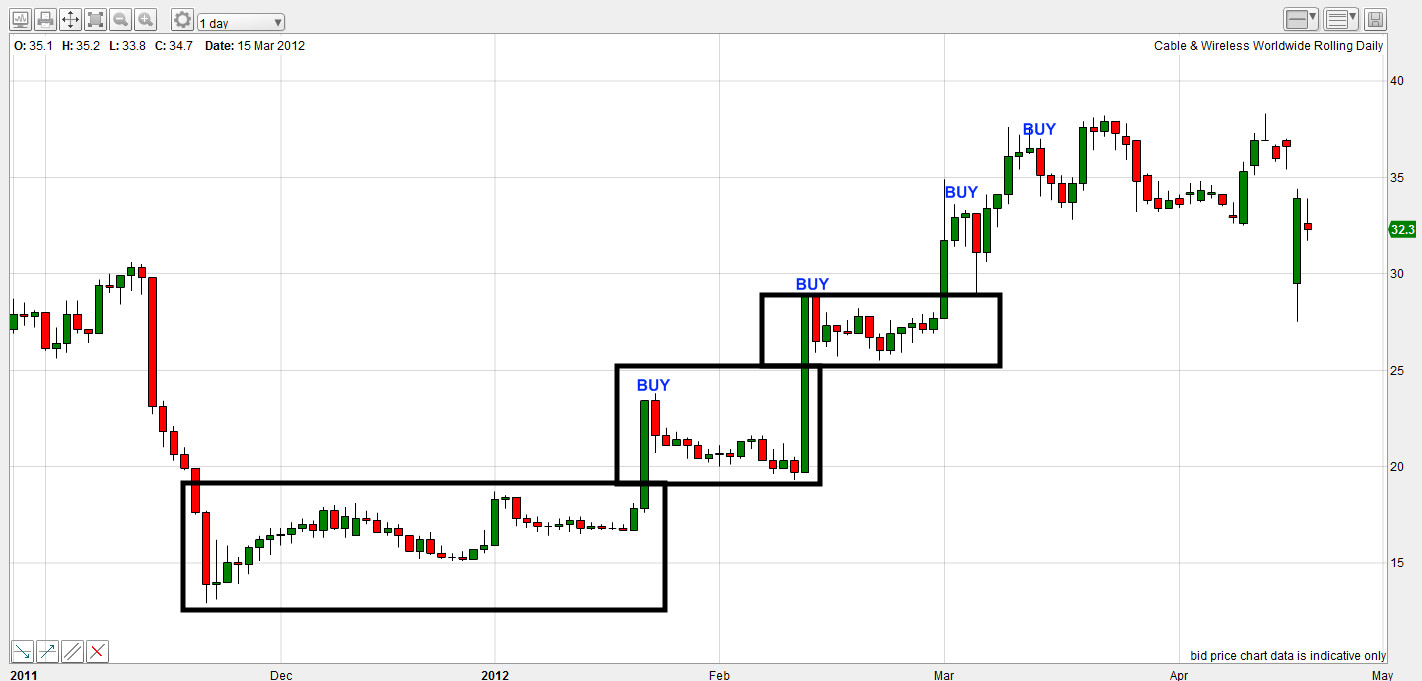

A subsequent chart for the same stock some months later shows how even a true trend-follower would have had several opportunities to enter a new up-trend, even on a new high price (except the last one), without fear of stopping out for a significant whipsaw loss. But why take the risk when you might just as well buy into the trend on the counter-trend dips, each time for a lower risk-to-stop than the guy who looked for the new highs?

Conclusion

I’m all for holding or trading in line with an established trend, but I would do so by establishing positions always at the lowest possible price with the smallest risk-to-stop; which at least means buying on the dips and sometimes means (as in my first example) trying to catch a trend before it even develops.

Controversial, I know, but by the time you’ve waited long enough to see a trend truly develop, you might be too late and find that it’s just about ripe for reversal.

And now for something slightly different…

Something caught my eye in my final chart. I noticed that each time the price ramped up to form a new peak, the new high price acted as support for the next wave of price action. I believe that this is what Nicolas Darvas had in mind when he formulated his “box theory” of price action. So I had a go at superimposing some Darvas boxes onto the chart, like this:

Maybe there’s something in this, or maybe I’m just seeing what I want to see.

Tony Loton is a private trader, and author of the book “Stop Orders” published by Harriman House.

Tony, I think you’re misrepresenting trend following in this example (the chart isn’t the clearest). Wouldn’t a trend follower have bought on the breakout at the beginning of September when it broke resistance at 68/69, and not at 80? Once this was, say, 10% in profit the stop could be moved to break even so nothing would be lost when the trend reversed.

Andy,

Thanks for your comment. You make a valid point, and of course I had to exaggerate my example somewhat in order to illustrate the folly of waiting too long for a trend to be apparent.

However, your “trend follower” would still have performed more poorly than my “bottom fisher”, since the latter could have trailed his stop to break-even much sooner and would have made a profit upon trailing his stop to your trend follower’s break-even 😉

I think the subsequent charts show that (in this case) you would be right about buying on the breakouts; and I would be right about buying when the price fell back to those breakout levels 🙂

Thanks again for your comment.

Tony,

Once again, from the perspective of a newbie, you seem to get it right. I just finished Dave Landry’s book The Laymen’s Guide, so I see your point. The problem I have with your system is that it has got to be very labor-intensive. At least that appears to be the case. You hold over 20 positions and each need daily attention. Personally, I am not up to the task!

At any rate, you do mention this aspect in your books, but it might be helpful to discuss in more detail.