Trading Trail #38: An Exception That Proves The Rule!

Mar 20, 2012 at 4:22 pm in Trading Diary by

Despite the demise of WorldSpreads this week, my trading continues in my other spread betting account(s) including in my Capital Spreads “trading trail” account. At the time of writing, this reference position trading account is still above water at liquidation value of about £1060.

Although I’ve not been documenting my trades recently — but I might, when things really pick up — I did make a trade this morning which is notable by the fact that it is an exception that proves the rule about never ‘buying higher’ something that I last ‘sold lower’. This rule is the one that Andy queried in my Ones That Got Away update and which I answered theoretically in my Never Say Never update.

According to my Stop-Out List of equities that I have previously sold by “stopping out”, I last sold Severfield-Rowan (in a different account) at a price of 149p, which — according to the chart below — places my sale at the end of September 2011. Despite the price falling by some 8% today, my general rule should have prevented me from re-buying at the higher price of 185p. But it didn’t, so that’s why this trade has become ‘an exception that proves the rule’.

The rising trend line shows why I was tempted enough to buy this dip. It confers no guarantee of success, of course, but it may tilt the balance of probabilities in my favour. And my protective stop order will take me out of position for a manageable loss of about £10 if this turns out to be more than a dip.

How can an exception “prove” a rule?

It always used to puzzle me that an exception can ‘prove’ a rule, because surely the opposite must be true. That was until I read somewhere about the word ‘prove’ in old English originally meaning to ‘test’. So ‘the proof of the pudding is in the eating’ would mean that ‘the test of the pudding is in the eating’. In this way, my trading exception serves to “test” my general rule.

Wikipedia explains it rather differently, insofar as a rule can be implied by its exceptions. Implicit in the statement that “parking is permitted on Sundays” is the more general rule that “parking is not permitted on other days”. So my documenting this higher-than-last-sold purchase as an exception positively reinforces the rule that… I wouldn’t normally do it!

Latest Equity Curve

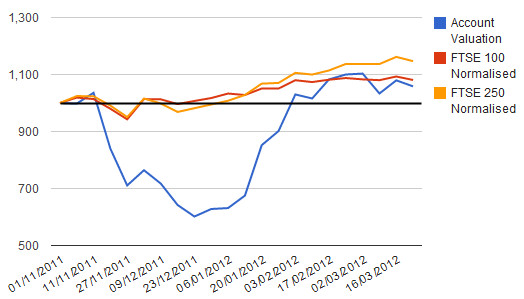

Well, I can’t let a trading trail update go by without sharing my latest equity curve as of 10:15am on 20 March. I’m under the FTSE 100 and 250 indices, but still over the waves of the water line.

Maybe my latest “exception that proves the rule” position is Severfield-Rowan will be the one that makes the difference to my equity curve; or maybe not.

Tony Loton is a private trader, and author of the book “Stop Orders” published by Harriman House.

It turns out that this “exception” proved the rule in another way. It proved that I should not have broken my own rule, because the newly-established position in Severfield-Rowan subsequently stopped out for a loss of £10.

Having stopped out at 175.2, and with the close-of-play buying price back up at 182.5, this is one of those occasions where I will NOT — I repeat “NOT” — be repurchasing at the higher price. Because that’s the road to whipsaw losses.

If it falls again tomorrow, as I think it might just do, I might have another go. If it heads ever higher, I’ll just let it go.