Bets You Should Have Placed in January

Feb 6, 2012 at 10:08 am in Trading Diary by Andy

I don’t know if you noticed, but in January the markets embarked on something of a bull run. I noticed because of the positive effect on my Trading Trail portfolio, and I even read somewhere that this has been the best start to a year for eighteen years. According to a popular market saying “As January goes, so goes the year”, and I hope that’s true.

In this article I thought I’d share with you some of January’s best performing stocks, with a view to figuring out if there’s anything we can learn from them. These particular stocks are on my radar because I benefited from their price rises, but you know better than to take them as my recommendations for your future purchases (or sales). Don’t forget the disclaimer and risk warning.

I’ll start with a selection of the best percentage performers (which rose by high percentages) and then move onto the best points performers (whose higher prices meant that they rose by more points though a lower percentage).

Some Percentage Performers

One of the best percentage performers in January was Petroplus Holdings AG, which almost six-bagged from a price of 19 to a price of 112. But it only worked out so well for me because I bought this stock at a historic low price in the last week of January, and sold out on the third day of February. Anyone who had bought in on 3 January and sold out on 30 January would have suffered a very hefty loss, since this was also one of the worst performers in January… if you got your timing wrong.

In traditional investing terms. Lloyds Banking Group was a good percentage performer in January, rising by 22% from 27p-per-share on 3 January to 33p-per-share on 26 January. From a spread betting perspective you would have needed a high £££s-per-point bet to make any decent money on this low price stock, and of course this performance should be taken in the context of the massive destruction to the Lloyds share price over the past few years.

Speedy Hire did better than Lloyds Bank, rising by 31% between 3 January and 30 January. Again it’s a historically beaten-down stock, and again you would have needed a big £££-per-point bet to have made any real money from the otherwise impressive percentage rise.

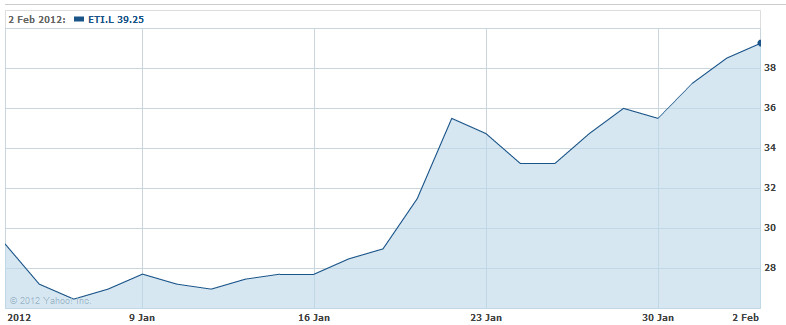

Other stocks that underwent similar percentage rises over the same period were Wincanton and Enterprise Inns. Both were trading at historic low prices which — despite the impressive percentage increases — have barely budged when viewed on a chart over the longer 5-year perspective. You can see what I mean in the two charts below for Enterprise inns over one month and over five years.

Some Points Performers

Some Points Performers

Another low-price decent performing stock in January was Heidelberger Druckmaschinen, which rose by 22% from 1.35 to 1.65 between 3 January and 30 January and which had been higher earlier in the month. But don’t let the low price deceive you, for this is one of those foreign stocks where on many trading platforms a £1-per-point bet is equivalent to a £100-per-point bet. Put another way, it was like betting £1-per-point at a price of 135 rising to 165, thereby capturing 30 profit points.

My “points performers” therefore are those stocks that rose by a lower percentage during the month just gone, but which generated an absolute (not percentage) higher profit by rising a higher number of points (or pips). In other words, you would have gotten more bang for your £££-per-point buck than on the percentage performers.

A case in point is Mitchells & Butlers which rose by a more modest 14.5% during January but which in doing so put on some 35 points, thereby generating more profit per £1-per-point bet than the bigger percentage risers such as Lloyds Banking Group, Speedy Hire or Enterprise Inns.

I make this point to highlight an essential difference between a traditional investment of say £1000 in each and every stock (whereby the percentage increase is most important) and a nominal £1-per-point spread bet stake in each and every stock (whereby the points increase is most important). Traditional investors who transition to spread betting need to grasp this essential difference in how profits accrue, and adjust their spread bet position sizes according to the price of the instrument being bet. To make a same-size investment in a lower price stock, you need to bet more £££-per-point.

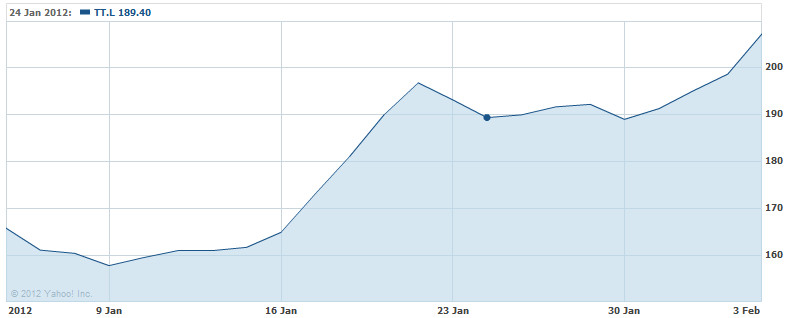

Other higher-priced stocks that enjoyed more modest percentage increases but useful points increases in January included Segro and TUI Travel. Some of the stocks mentioned — including TUI Travel, shown below — underwent a minor correction in late January thereby affording the opportunity to “buy on the dip” an additional pyramided position which could have generated more profit into February.

What do the best performers have in common?

The rising tide of the FTSE lifted all boats in January, but these particular boats rose faster than the FTSE. So what did they have in common?

The answer is that they were either stocks that were trading at historically low beaten down prices, or stocks which had undergone a significant downward correction, or both. Stocks at historic low prices often move up (and down) by larger percentages, as they need to if they are ever going to recover their former glory. Stocks that fall a long way in a short time will likely bounce back by a large number of points… or not, which is why a protective stop order (ideally guaranteed) on any prospective purchase may be of the utmost importance.

This small selection of best performers represents a subset of those that were on my radar because I was trading them. If you trawl the markets you will likely find more and better ones, and then you just need to figure out why they performed the way they did. So you can benefit next time around.

Tony Loton is a private trader, and author of the book “Stop Orders” published by Harriman House.