Trading Trail #14: Dread the Spread, Into India, and Other Stories

Nov 16, 2011 at 7:25 pm in Trading Diary by

Yesterday I posted early in the day because I knew I wouldn’t be able to post an update at close-of-play as usual. So today I have a double whammy to bring you up to speed with yesterday’s and today’s trading action.

There’s a lot to get through, but I expect it to calm down soon in this account once I get ‘spent up’.

Yesterday, 15 November, Dread the Spread and Other Stories

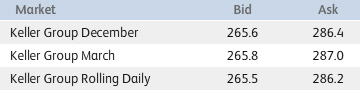

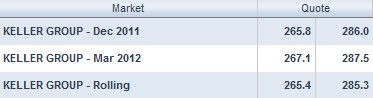

Yesterday morning I noticed that the price of Keller Group shares had fallen off a cliff when the market opened. Being the falling-knife-catching contrarian that I am, I was tempted to take a punt, until I saw the massive 20-point spread:

Of course, I double-checked with another spread betting company:

Sure enough, buying into Keller Group at that time would have cost me 20 points (i.e. £20 at £1-per-point) before the price even went anywhere. One of the trading mistakes that I made years ago was to jump right in without first checking the spread, but then I learned to dread the spread. Later in the day the spread narrowed to a more normal 2-3 points, but at the upper end of the previous bid-ask spread.

I found that falling knife, and the next one, by referring to the Yahoo! Finance Price Losers (%) web page.

Another falling knife, which I did catch yesterday morning, was Cable & Wireless Worldwide, which had a much more reasonable spread of 25.9p-26.1p. Later yesterday my new position stopped out at 24p and became mysteriously unavailable for trading — at least in “rolling” form. Or did it?

Sometime after the London market closed I noticed that my account was no longer showing my Homeserve position, that “Homeserve Rolling Daily” was no longer showing in search results (though it was showing on platform-siblings like Trade Fair), and that my trading funds had shot up to more than £400! All kinds of conspiracy theories were running through my head as to why Capital Spreads had closed my most profitable position for no good reason, yet were not showing the closure in my trade history. A call to their dealing desk prompted me to logout then log back in (I’d been logged in for several hours) to see that everything was as it should be.

In other news yesterday…

The other day I told you that I had placed an opening order on Aurelian Oil & Gas, and yesterday this order executed to take me into position at 22.3p. The initial stop order on this one is quite low at 13p (so no immediate danger of stopping out) but is within my ideal monetary risk of £10. My opening order on Bovis also executed at 445p, with a protective stop order in place at 335p.

Commerzbank stopped out yesterday at 1.51 for exactly no profit and no loss, and Admiral stopped out at 819.9p for a profit £16.90. Except that this wasn’t really a profit when you subtract the £21 (from memory) that it has cost me since I first started trading in and out of this stock. I’m more concerned about the fact that any future re-entry would be more risky now that I have lost my break-even guaranteed stop order.I will only re-enter if (but not merely because) my Stop-Out List indicates a more attractive price.

My two Home Retail Group positions stopped out at 79p for a combined loss of £12.30. I told you I was bearish!

Today, 16 November, Into India and Other Stories

I noticed that Capital Spreads offers a number on Indian shares for trading at what seem to be reasonable prices. What I mean is that a share price of 25p really does equate to £25 worth of risk on a £1-per-point position, unlike foreign shares such as Commerzbank that I discussed here.

The thing about these Indian shares, though, is that they trade from the early hours of the (UK) morning until only 10am. So they’re for early birds. This morning I was an early bird and I established new positions in Indian stocks Unitech, Suzlon Energy, and National Aluminium. They’re dog stocks like most of my others, but you can’t say I’m not diversifying internationally.

Not content with going into India, I also ventured into Sweden with Eniro AB and into Denmark with Vesta Wind Systems.

In other news today…

After stopping out of Cable & Wireless Worldwide at 24p yesterday, I was able to re-enter at a 9% better price of 21.9p this morning. Having previously stopped out of Kesa (in another account) at 93.5p, I was able to re-enter in this account today at 85.4p. Do you see how this stopping out then re-buying at a lower price (i.e. selling high and re-buying low) is meant to work?

Maybe I’ll be able to pull off the same trick with Ocado, which stopped out this morning at 81p for a loss of £6.10, Bovis which stopped out at 445.50p for a profit of £0.50, or Wolfson Microelectronics which stopped out at 105p for a profit of £0.10.

Having last stopped out of Home Retail Group at 79p, I was able to re-enter at a lower price of 75.1p, then it stopped out again at 72p.

I surprised myself a little this morning by averaging down on Game Group with a second purchase at 12.8p to complement my original purchase at 18.6p. Not that I think it is sure to recover, but because — if I wanted a £2-per-point position all along — it was better to scale into the position like this than to have gone all-in on the original purchase.

Yesterday I couldn’t buy long Keller Group because of the very wide spread. With the spread closing to a much more reasonable difference today… I actually sold short, and the following chart fragment shows why.

With the price having gapped down, then creeping back up and levelling off, I thought it was more likely that the price would fall back to the gapped-down level than to rise. It was reminiscent of what I thought here that Homeserve would do, and it did, but I missed it at the time. Anyway, on Keller Group, my stop order was too tight and my short position stopped out within the day at 307p (possibly as a result of the spread widening again). Maybe I was “shaken out”, in which case I won’t be fooled again.

“Fool me once, shame on you. Fool me twice, shame on me.”

Tony Loton is a private trader, and author of the book “Stop Orders” published by Harriman House.