Trading Trail #40: Looking at Leveraged Losses

May 24, 2012 at 7:46 am in Trading Diary by

Question: When is big loss not a big loss?

Answer: When it’s a leveraged loss.

Suppose you put down a £10,000 deposit in order to secure a mortgage on a £100,000 house — if you can find one at that price. If house prices fall by 5%, do you think…

- Oh no! I just lost a whopping 50% of my deposit. Or…

- My house is still worth £95,000 and it will take only a 16% increase in house prices for me to have doubled my ‘equity stake’ from £10,000 to £20,000.

This is what I want you to keep in mind as you read on.

The ‘Trading Trail’ Update

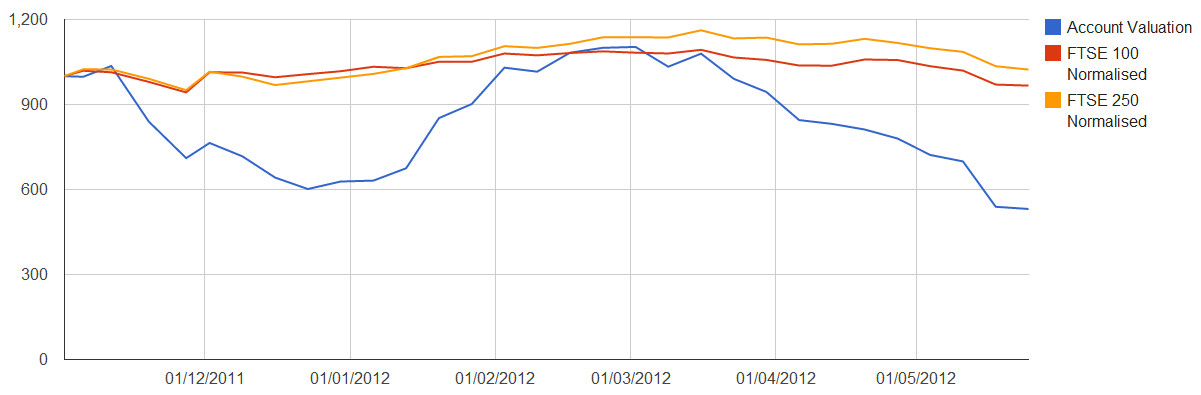

I’ve not posted an update on my Trading Trail demonstration position trading account lately, which is hardly surprising since I prefer to sing when I’m winning and things haven’t been going so well. No doubt you’ve seen what has happened to the FTSE recently, and when the FTSE falls, my portfolio falls further. As you can see here…

The ‘Glass Half Full’ View

With the total account value (positions + cash) having drawn down (again) to a liquidation value of almost £500 from an initial cash deposit of £1,000, you might be thinking that the glass is now half empty. Well, I’m a ‘glass half full’ kind of guy and my optimistic outlook is justified by a number observations.

First, this account is now more than six months old. If it were the first spread betting account I had ever run, I could feel pleased that I had already exceeded the life expectancy of a spreadbettor. And on this performance I could yet ‘stay in the game’ for another six months! I’m being semi-serious here because of course it’s nothing to shout about, but the first rule of spread betting should be simply ‘staying in the game’.

Second, while anyone who lost 50% of their life savings would rightly be crying into their soup, I’m not exactly off to the soup kitchen. Most of us can stand a £500 (hopefully temporary) loss in exchange for the prospect of multi-bagging an initial £1,000 deposit up to several times that amount. I see spread betting as a mechanism for turning a small amount of cash into a large amount of cash, and not dying trying, rather than using spread betting as a wealth preservation vehicle.

Third, from a leveraged perspective this could arguably be viewed as a mere 3% drawdown rather than the 50% drawdown that it appears to be. A typical holding in my portfolio has been Tesco, which at the time of writing would require a margin deposit of only £17 in order to establish a £1-per-point position at 314p-per-share. An equivalent “investment” of £314 (because that’s how much I would lose if the company went bust) would therefore cost me just £17 as a spread bet, which — if scaled across the whole portfolio — means that my initial £1,000 deposit afforded me something like £18,000 worth of “investment” power. Rather like how the £10,000 deposit allows you to invest in a £100,000 house.

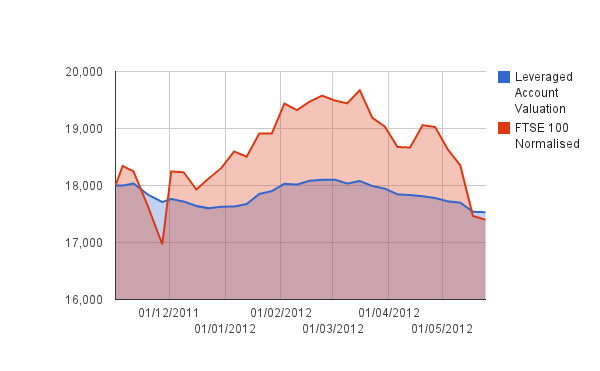

A drawdown of £500 from £18,000 worth of investment power is perfectly tolerable since it represents only a 2.8% leverage-adjusted drawdown. As a picture, it looks like this (with the FTSE 100 performance shown for comparison)…

That doesn’t look so bad, does it? And it’s much different from the equity curve that I presented earlier; yet still potentially ‘true’ — if you accept my assumption that a £1,000 spread betting deposit buys £18,000 worth of investment power.

The end of my chart shows that a £18,000 traditional ‘investment’ in a FTSE 100 fund would have lost you £600 (ignoring dividends) over the past six months whereas an equivalent “investment” in my leveraged position trading fund (if it was open to the public) would have lost you only £500. As a fund manager, I would be shouting from the rooftops about how my fund had lost less money than the FTSE 100 tracking benchmark.

The best thing is: in order to “invest” £18,000 in my hypothetical fund, I would have asked you to deposit only £1,000 in the first place. You would have been free to invest the remaining £17,000 elsewhere; perhaps in a FTSE 100 tracking fund!

What am I demonstrating?

The purpose of this article is to demonstrate two things:

- How interim spread betting losses don’t look so bad if we view them in the same way that we view a mortgaged investment in a house.

- How easy it is to massage the figures and spin the truth — yes fund managers, I’m looking at you — to convince investors that they’re onto a good thing.

My recasting of the equity curve (first picture) in the leveraged-adjusted context (second picture) is just a “thought experiment” with a few assumptions built in, and it’s up to you to decide which representation you really believe.

Where to from here?

I don’t know where the global markets will go from here, and nor do you. But I do know three things:

- I can only lose £500 more, or £1,000 in total, and it should take me at least six more months do do that! Or my portfolio could stage a spectacular recovery, like it did midway, and then go on to shoot to the moon (and a several thousand pound profit) as has happened to me on previous occasions from such humble beginnings.

- Unlike a day trader who, when in this position, would truly have lost £500, what I have to show for my drawdown is a portfolio of 42 separate equity positions — each of which has vastly more upside than downside potential.

- I only need an 8.5% increase in my notional total investment of £18,000 (now notionally worth £17,500) in order to have doubled my deposit from £1,000 to £2,000. Then I can say it’s a 100% return-on-investment within a year 😉

No, I don’t know what will happen from here. But it will either be spectacularly good or not too bad. I can cope with either.

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.