Trading Trail #31: The Recovery Continues

Jan 28, 2012 at 12:32 pm in Trading Diary by

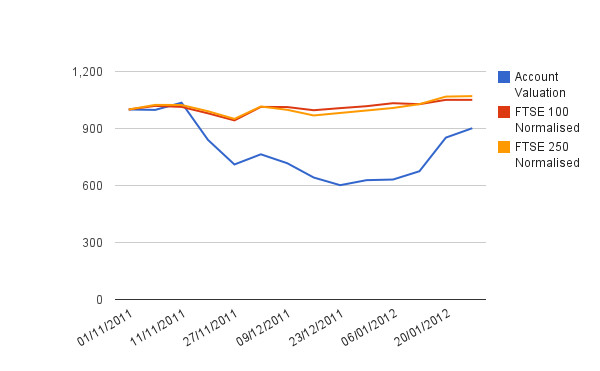

I committed to updating on the performance of the “trading trail” longer-term spread bet portfolio once per week, and it’s now been just over a week. I’m pleased to report that the account valuation is now just over £900 (and it was higher mid-week), so since last week it is closing in even more on the wider FTSE 100 and FTSE 250 performances as shown in the latest equity curve below.

I was tempted to draw some trend lines to show the steeper trajectory of the account valuation relative to the somewhat flatter trajectories of the FTSEs, with a view to predicting the crossovers in the near future — but I won’t tempt fate. In any case, more important than beating the FTSE is simply getting into profit.

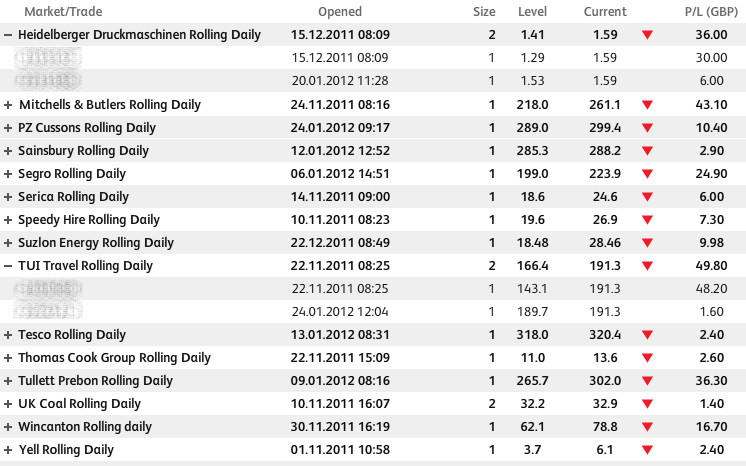

The partial portfolio snapshot below shows that the recovery has been led by some of the more recent higher-priced purchases rather than the original token penny share punts.

I’ve highlighted these particular positions — and there are still some losers not shown, so don’t be fooled — so that I can make two additional points:

- I’m having a go a pyramiding Heidelberger and TUI Travel.

- The stop orders on my higher-priced (therefore higher risk) positions in Mitchells & Butlers, PZ Cussons, Sainsbury, Segro, TUI Travel, Tesco, and Tullett Prebon are all guaranteed.

“Buy and Hope”

A few weeks ago, someone commented to me that this portfolio resembled what might be described as a “buy and hope” portfolio. With the portfolio now reasonably well established and the markets in a more bullish phase, I’ve not being doing quite so much buying as before, and I hope the performance continues like this.

Tony loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.