I was originally going to begin my new trading trail public trading run on 03 January 2012, and in a way I wish I had. I’d have been starting now with £1000 in cash rather than the current fund value of £627.78.

On the other hand, I wouldn’t have positions in forty-eight different equities which could begin to skyrocket any day now! My £372 “paper loss” could turn out to be money well spent in getting me “in position”, and even if we treat it as a real loss then it’s nothing compared with the amounts of money that some (if not most) spread bettors will have lost since 1 November 2011. Unfortunately, I understand that most spread bettors are losers 🙁

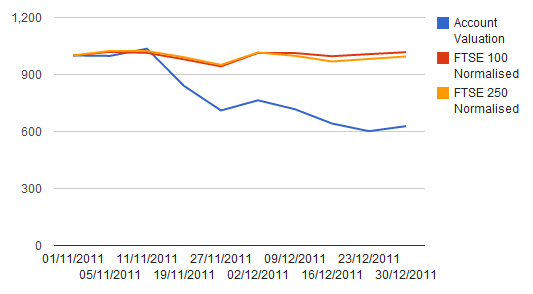

It was worse, actually. In the final trading week of 2011 the total account value dipped as low as £585 before recovering by 7.3% within a couple of days. It’s not shown in the equity curve below because I update it weekly, but it illustrates how volatile this can be — for good or for bad.

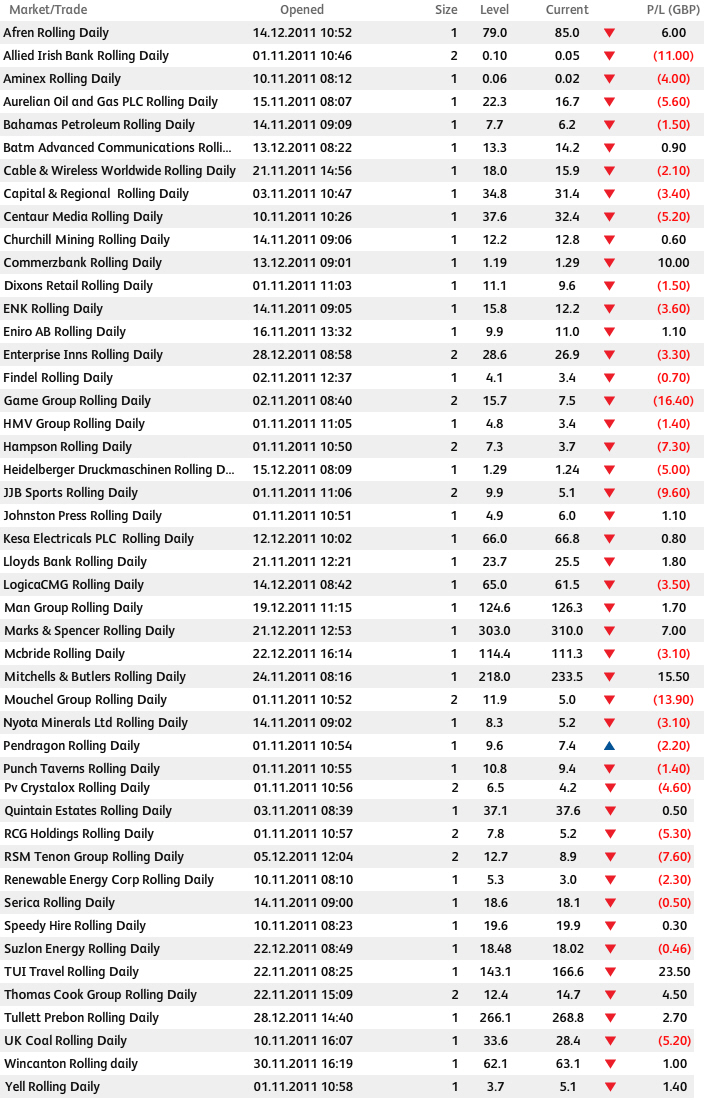

The positions that I currently have in play in this account are as follows. Notice how some of the positions have been in play since the very start on 1 November 2011, so this is no short-term day trading experiment. My preferred Position Trading approach is more like a traditional investment approach, but practised in a spread betting account and without the compulsion to hold stocks “regardless” after purchase.

So that’s how I stand (in this account, but I have others) at the start of the year 2012. There may be some doubters out there, but I will turn this sows ear into a silk purse filled with cash! You just see if I don’t.

Happy New Year!

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.

Tags: trading commentary

by

Trading Trail #27: Starting the New Year

Jan 2, 2012 at 10:44 am in Trading Diary by

I was originally going to begin my new trading trail public trading run on 03 January 2012, and in a way I wish I had. I’d have been starting now with £1000 in cash rather than the current fund value of £627.78.

On the other hand, I wouldn’t have positions in forty-eight different equities which could begin to skyrocket any day now! My £372 “paper loss” could turn out to be money well spent in getting me “in position”, and even if we treat it as a real loss then it’s nothing compared with the amounts of money that some (if not most) spread bettors will have lost since 1 November 2011. Unfortunately, I understand that most spread bettors are losers 🙁

It was worse, actually. In the final trading week of 2011 the total account value dipped as low as £585 before recovering by 7.3% within a couple of days. It’s not shown in the equity curve below because I update it weekly, but it illustrates how volatile this can be — for good or for bad.

The positions that I currently have in play in this account are as follows. Notice how some of the positions have been in play since the very start on 1 November 2011, so this is no short-term day trading experiment. My preferred Position Trading approach is more like a traditional investment approach, but practised in a spread betting account and without the compulsion to hold stocks “regardless” after purchase.

So that’s how I stand (in this account, but I have others) at the start of the year 2012. There may be some doubters out there, but I will turn this sows ear into a silk purse filled with cash! You just see if I don’t.

Happy New Year!

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.

Tags: trading commentary