Trading Trail #5: Week 1 Portfolio Snapshot

Nov 5, 2011 at 5:08 pm in Trading Diary by

At the end of the first week I’m pleased to report that the overall portfolio value is pretty much at break-even at £997.86, having varied on Friday between ~£986 and ~£1005.

This is a good result because — if no positions had moved at all, up or down — I would have expected the portfolio value to have been down by more than £50 simply as a result of opening 28 positions during the week with a spread of about 2 points suffered on each one. The result is lucky really, because I could not have predicted which positions would rise in value (or how far) to offset those initial spreads.

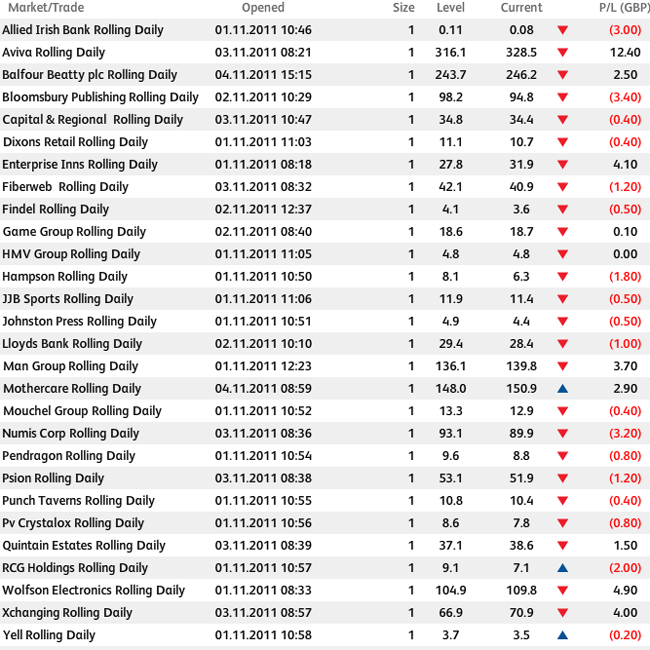

Here are the current positions:

It’s a pity that this Capital Spreads snapshot does not show the current stop order level alongside each position. It means I have to refer to a separate Order Book screen, a portion of which is shown below (because the whole thing is too unwieldy).

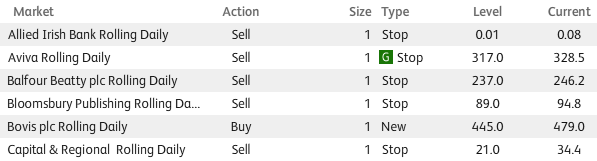

This partial Order Book snapshot is instructive in a couple of respects. Not only does it show the prevailing stop levels on my open positions, but also it shows that my Aviva stop order is now guaranteed (as I told you here) and shows that I have a new opening order in place on Bovis.

This opening order represents a potential pyramid into Bovis, because an existing Bovis position in one of my other accounts is already in profit by £150. And don’t forget that I also have a short opening order (not shown) on Homeserve, which I’m not really expecting to be triggered any time soon — if at all.

A reminder: what’s it all about?

It is worth reiterating at this point that what I’m creating here is a medium-to-long-term position trading portfolio, rather like a traditional investment portfolio — but not exactly. It’s similar because I’m prepared to hold positions indefinitely while they realise their longer-term upside potential and while I collect any dividend credits along the way. It’s different because I’m not afraid of stopping out quickly for a small loss on any new position that goes wrong, and it’s different — of course — because this is a spread betting account rather than a traditional share dealing account. I might even throw in some ‘short’ position trades, which you wouldn’t see in a regular share dealing account.

You will have noticed by now that I open all new positions at a nominal £1-per-point. This is partly to keep things simple, partly to get those stocks merely onto my radar with the lowest possible stake, and partly because I know that there should be plenty of time to pyramid the smaller 10p stocks up to more £££s-per-point en route to them becoming 1000p stocks.

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.

very interesting Tony, thanks for sharing, alot of private traders aren’t so candid and open, Robbie Burns aka the thenakedtrader is like you one of the very few, keep up the great work and posts, it will be an interesting project to follow.

regards

TSM