With the benefit of hindsight this is what you should have put your money into in 2013

Dec 31, 2013 at 8:24 am in General Trading by contrarianuk

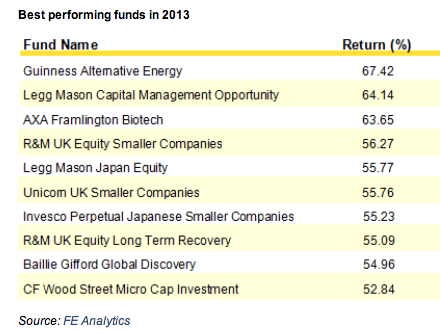

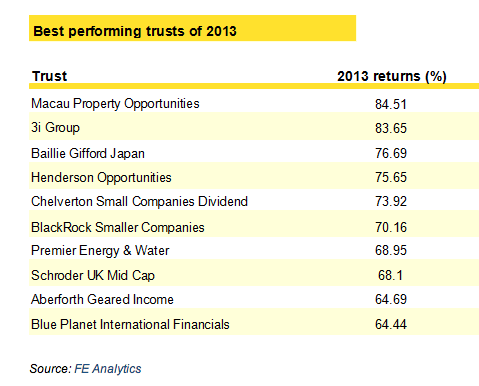

Looking at the top performing UK funds and investment trusts for 2013 for those who like their money managed throws up some fascinating facts with the benefit of hindsight. The top three top performing sectors in 2013 have been the North American Smaller Companies sector, UK Smaller Companies sector and the Japanese Smaller Companies.

The Russell 2000 index of small cap U.S. shares has risen from 849 at the beginning of the year to 1160, a rise of 36.6%. But the rise which has really caught my attention was the 53.6% rise in the Japanese Nikkei 225 index in 2013, from 10,604 to 16,291! After years in the doldrums, Shinzo Abe’s “Abenomics” programme has stirred the Japanese economy back to life with efforts to reflate the troubled economy, driving the Nikkei to a 6 year high, helping exporters in particular.

Pharma and biotechnology have also had an excellent year with many of the more speculative stocks rising strongly as they also did in 2012. The AXA Framlington Biotech fund rose over 60% this year. A series of takeovers, particularly in the U.S., driven by the need for larger companies to beef up their pipelines have helped stoke the investor fire.

Pharma and biotechnology have also had an excellent year with many of the more speculative stocks rising strongly as they also did in 2012. The AXA Framlington Biotech fund rose over 60% this year. A series of takeovers, particularly in the U.S., driven by the need for larger companies to beef up their pipelines have helped stoke the investor fire.

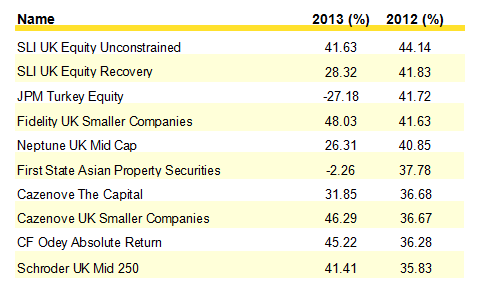

Looking at the best performing funds of 2012 vs 2013, the consistent thread is huge over performance in small and mid caps, exemplified by Fidelity UK Smaller companies and Cazenove UK Smaller companies both of which delivered 40% plus returns in both years.

What now for 2014? After the stellar gains of the UK & US small caps, biotech, Japan are would be very doubtful to see these deliver yet again in 2014, well not to the same dramatic extent anyway. The institutions seem to be keen on a European recovery next year. The big question in my mind is how emerging markets will perform. They’ve had a rough 2013 and aren’t particularly expensive on a price/earnings basis. However, will a withdrawal of liquidity result from the end of quantitative easing in the U.S. by the end of 2014? As the Federal Reserve has bought assets, the institutions have invested in emerging markets, will they pull the plug? Certainly there are worrying signs of inflation and slowing growth in major emerging markets economies such as Brazil and India.

A strengthening US dollar may also hurt commodities next year, as the dollar rises, dollar denominated assets fall.

Maybe big cap European funds are the way to go, but investing in the PIIGS (Portugal, Ireland, Italy, Greece, Spain)?? Their economies are far from fixed and many structural problems persist – high unemployment, huge debt piles, current account deficits. Do we really believe the weaker economies such as Greece are back on their feet? – NO!

The contrarian in me is struggling for that big idea right now in 2014, maybe gold if it goes to $1000, and it might well do before the end of 2014.

Contrarian Investor UK

IMPORTANT

The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.