Oil forecast for 2014 remains bullish

Jan 2, 2014 at 8:48 am in General Trading by contrarianuk

A November monthly survey of 27 analysts projected Brent crude oil would average $104.10 a barrel in 2014, down from this year’s closing average price of $108.50. October’s poll saw Brent averaging $105.40 in 2014. Expectations from the same analysts are for Brent to average $102.60 in 2015. Raiffeisen Bank International had the highest Brent forecast at $115 for 2014, while Capital Economics had the lowest forecast at $90 a barrel.

A November monthly survey of 27 analysts projected Brent crude oil would average $104.10 a barrel in 2014, down from this year’s closing average price of $108.50. October’s poll saw Brent averaging $105.40 in 2014. Expectations from the same analysts are for Brent to average $102.60 in 2015. Raiffeisen Bank International had the highest Brent forecast at $115 for 2014, while Capital Economics had the lowest forecast at $90 a barrel.

In mid 2008, Brent peaked at $147, before dropping like a stone during the financial crisis to less than $40 a barrel.

The poll forecast U.S. light crude, West Texas Intermediate (WTI), would average $97.30 a barrel in 2014, down from $99.80 in last month’s survey. Brent is seen trading at an average of $6.80 per barrel higher than U.S. crude below the $10.30 average seen in 2013.

Since 2011 oil prices have remained relatively steady despite a host of geopolitical events and technical advances in extraction e.g. Iran, the Arab Spring, the U.S. shale revolution. Good news for those countries that rely on high and steady prices such as the OPEC cartel and Russia.

The forecast for 2014 has been proving a contentious issue. With U.S. production now at a 25 year peak, some believe this will finally tip the balance and overwhelm growing global demand.

Others believe that the growth in non-conventional oil and gas production in the U.S. will be short lived given the short production profile of shale oil wells and high costs of production. Much of the increased North American production is also land locked given export restrictions and refinery capacity.

Continued potential supply disruptions in non-Opec countries is seen as keeping a floor on oil to least $100 a barrel. Even an easing of Iran’s oil exports has plenty of strings attached.

One thing seems to be certain is that global growth in demand is robust and the IEA predicts an increase of around 1.2 million barrels per day in 2014.

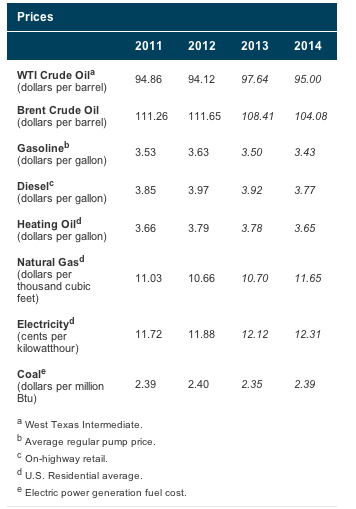

The EIA December 2013 is as follows:

Brent crude oil spot prices fell from a monthly average of $112 per barrel in September 2013 to $108 per barrel in November. EIA expects the Brent crude oil price to continue to weaken as non-OPEC supply growth exceeds growth in world consumption. The Brent crude oil price is projected to average $108 per barrel in December 2013 and $104 per barrel in 2014.

Brent crude oil spot prices fell from a monthly average of $112 per barrel in September 2013 to $108 per barrel in November. EIA expects the Brent crude oil price to continue to weaken as non-OPEC supply growth exceeds growth in world consumption. The Brent crude oil price is projected to average $108 per barrel in December 2013 and $104 per barrel in 2014.

The forecast WTI crude oil spot price, which averaged $106 per barrel during September, fell to an average of $94 per barrel in November. EIA expects that WTI crude oil prices will average $96 per barrel during the fourth quarter of 2013 and $95 per barrel during 2014. The discount of WTI crude oil to Brent crude oil, which averaged $18 per barrel in 2012 and then fell to below $4 per barrel in July 2013, averaged $14 per barrel during November. EIA expects the WTI discount to average $12 per barrel during the fourth quarter of 2013 and $9 per barrel during 2014, as new pipeline capacity is added from Cushing to the Gulf Coast.

In addition to an increase in the WTI discount to Brent, U.S. Gulf Coast crude oil grades reached record discounts to international benchmarks in November. Prior to this autumn, discounted crude oil prices had generally been limited to the U.S. Midcontinent, where crude oil production growth had outpaced the capacity of pipeline infrastructure to bring that production to refining centers on the U.S. Gulf Coast. However, pipeline capacity expansions and pipeline reversals have alleviated transportation bottlenecks from the Midcontinent to the Gulf Coast for the time being, causing greater convergence of LLS and WTI prices. This additional infrastructure, continued growth in U.S. light crude oil production, and a seasonal decline in crude oil runs at U.S. Gulf Coast refineries resulted in increases in the net availability of domestic crude oil in the U.S. Gulf Coast. This situation is applying downward pressure to crude oil prices in the U.S. Gulf Coast market, which requires increasingly fewer crude oil imports to balance. The spot discount of LLS, a key Gulf Coast light sweet crude oil grade, to Brent increased from an average of $3 per barrel in September to almost $11 per barrel in November. Likewise, the discount of the Mars spot price, a medium Gulf Coast crude oil grade, to international marker Dubai increased from an average of $4 per barrel in September to $13 per barrel in November.

Energy price forecasts are highly uncertain, and the current values of futures and options contracts suggest that prices could differ significantly from the forecast levels (Market Prices and Uncertainty Report). WTI futures contracts for March 2014 delivery traded during the five-day period ending December 5, 2013, averaged $96 per barrel. Implied volatility averaged 19%, establishing the lower and upper limits of the 95% confidence interval for the market’s expectations of monthly average WTI prices in March 2014 at $82 per barrel and $112 per barrel, respectively. Last year at this time, WTI for March 2013 delivery averaged $89 per barrel and implied volatility averaged 28%. The corresponding lower and upper limits of the 95% confidence interval were $71 per barrel and $113 per barrel.

http://www.eia.gov/forecasts/steo/report/prices.cfm

Contrarian Investor UK

IMPORTANT

The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.