Weak iron ore price outlook bad news for global miners

Dec 29, 2014 at 11:40 am in General Trading by contrarianuk

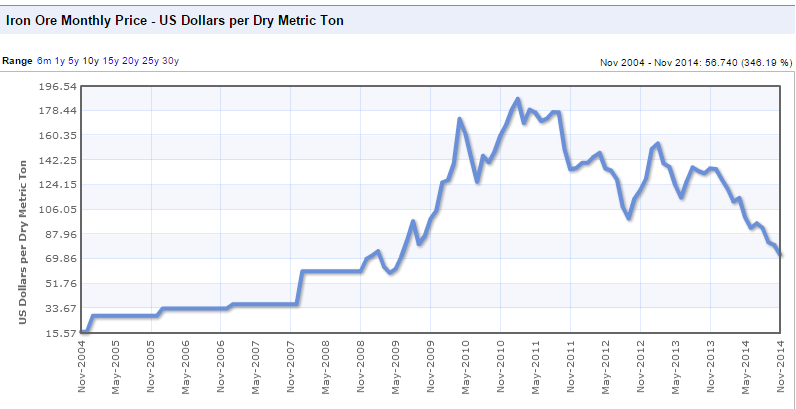

There has been plenty of focus on the plunging oil price this year, with Brent Crude currently trading at $60 a barrel, but the 50% fall in the price of iron ore to $67 a tonne, the lowest level for 5 years, shouldn’t be forgotten. Things look set to get even worse next year for iron ore with new low cost, high production volume mines coming on stream in the Pilbara area of Western Australia, further adding to the glut of supply in the face of weakening demand.

For much of this year there was talk that the large global iron ore miners like Rio Tinto, BHP Billiton and Vale were focusing on improving shareholder returns and maximising capital efficiency with the prospect of increasing dividends or capital returns. These hopes have faded as the price of iron ore continues to deteriorate.

The major iron ore producers have significantly increased production this year just as demand growth in China has evaporated. The country is the world’s largest consumer and importer of iron ore as the product is a key component in the manufacture of steel. A slowing house building industry in the country has hampered the appetite for iron ore after the boom years of 2009-2012 were triggered by an unprecedented investment in the country’s infrastructure by the Chinese government with multi-billion yuan investments in roads, housing and rail.

BHP and Rio Tinto will add another 70 million tonnes of capacity in 2015, whilst Fortesque metals and Roy Hill and others will make the total close to 100 million tonnes. The surplus will reach 300 million tons by 2017, because Chinese steel production is unlikely to expand fast enough to absorb the excess supply, Goldman Sachs said in a November 2014 report. The majors are betting that their operations operating at low costs will drive higher cost producers out of the market. Rio Tinto estimates 125 million tonnes of capacity will close this year with the drop coming from countries such as Iran, Indonesia and Mexico, as well as high-cost privately-owned mines in China. Around 22 projects have been cancelled or suspended since the middle of 2014 and according to HSBC Chinese output will drop 15% this year to 339 million tons from 400 million in 2013, before dropping to 236 million in 2015. But with many Chinese mines in government hands, even with prices of iron ore at such low levels, unprofitable mines will be kept mining to protect jobs.

The outlook looks bleak for iron prices for 2015 and 2016 and Morgan Stanley thinks 2015 will mark the peak in Chinese steel consumption and production with growth turning negative as the country tries to reduce its reliance on building infrastructure to a more consumptive model. The weak will struggle to survive in this environment and like the oil industry it looks like a lower pricing environment will sort the wheat from the chaff. It may be a little early for a contrarian bet on the mining sector right now in the face of this picture.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.