Foreign exchange or FX Trading is currently the largest and most liquid trading market in the world. It basically allows you to speculate on the value of one currency against another. There are many reasons why this form of trading has become so popular, the main one probably is the ease of entry to the market due to the amount of leverage available, the fact that it can be traded 24hours appeals to part time traders and high volatility means it is possible to make large gains (or losses).

Currencies are traded in pairs, with the most popular being GBP/USD, which is also known as cable. To trade on a currency it is important to remember that you are buying if you expect the first named currency to rise and sell if your thinking it will fall. So, GBP/USD is currently being quoted at 1.6253/1.6256. You are expecting some strong economic data to be released by the U.S Government and believe the Dollar will strengthen (Sterling falls) on the back of it. It this scenario you would sell at 1.6253. The market goes the way you hoped and soon after the new quote is GBP/USD 1.6233/1.6236. You can then close the position by buying back at 1.6236 and take a 17 point profit.

As with all markets, currencies are affected by many different factors from economic to political and back again. Forex markets are open 24 hours a day and a spread betting provider like Trade Nation will quote them from 23:00 on Sunday to 21:00 on Friday.

A spread betting provider like Trade Nation will offer quotes for both the spot FX market and quarterly futures. For instance, to quote FX prices, Trade Nation subscribe to a data feed which shows the best bid and offer price in the market for any given currency pair, from several major banks. The best bid might be from one bank and the best offer might be from another bank. The spread betting provider then takes the best of each: the highest bid and the lowest offer. It then adds them together and divides by two and puts a spread around this mid-point.

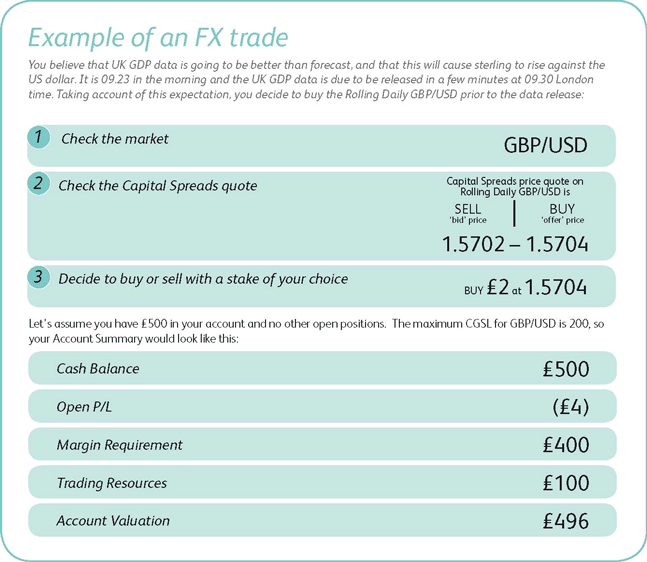

Let’s take an example of a trade with a fictitious spread betting company, say by the name of Capital Spreads:

Example of a Forex Trade

Your automatic stop loss would be placed at 80% of the Margin Requirement. With a £2 stake, this would be £400 x 80%=£320, which at £2 per point puts it 160 points away from your opening trade price, i.e. at 1.5544.

If you wished you could move this stop loss closer which would free up additional funds for trading or as you still have £100 of Trading Resources, you could move it further away. In this case, the furthest you could move it would be another £100 x 80%=£80, which at £2 per point puts it 40 points away, i.e. down to 1.5504.

However, the data released at 09.30 actually showed a lower number than expected causing the GBP/USD exchange rate to fall sharply so you decide to cut your losses quickly:

When trading FX markets, you also need to be aware of:

Do you Buy or Sell?

When buying or selling a currency pair, it is the first currency of the pair that you believe will rise or fall in value.

So, if you sell EUR/CHF, you have actually sold euros and bought Swiss francs meaning you want the euro to weaken against the Swiss franc.

If you buy GBP/USD, you have actually bought pounds and sold US dollars meaning you expect the pound to strengthen against the US dollar.

Tick Sizes

It is important that you know what figure you are trading on when you open a FX position as the tick values vary for some different FX pairs. For example, the tick size for GBP/USD is 0.0001, but for USD/JPY it is 0.01.

In general, for currency markets, the last large digit after the decimal point is the tick value on which you are dealing. FX pairs are usually priced with an extra smaller integer in the price e.g. 1.58505–1.58525, but this last digit is not the tick size.

FX Pricing

There are times when you might see FX prices on one trading platform/charting package that differ from the prices that Trade Nation is showing on its trading platform and charting package. This is because there is no single exchange on which all FX trades are transacted and cleared, so there is never an absolute single price at which a given currency pair is trading.

Bank ‘A’ might sell GBP/USD to Bank ‘B’ at 1.7750 on on FX platform, while at exactly the same time Bank ‘C’ might sell GBP/USD to Bank ‘D’ at 1.7755 on a different FX platform.

Bank ‘A’ may record its trades to a database to which data vendor ‘X’ has access, whilst Bank ‘C’ might record its trades on a separate database to which data vendor ‘Y’ has access.

For this reason it is highly possible for two different data vendors to be showing two different prices at exactly the same time in the same currency pair. All other markets that Trade Nation quote are based on prices from single exchanges so that there is always a consistent high and low from all data/chart providers.

Exposure

Working out the notional value of your trade when FX trading is as simple as the process used for equity dates. You just multiply the stake by the price and divide by the tick size (see table below).

If you were trading Forex via a Forex broker the first currency in each pair would represent the notional size of the trade and the second would be the currency in which the profit or loss is reported. With a spread betting account, your profit or loss is always reported in the currency that your stake is in.

Remember that via your spread betting account you are entering into a contract with the spread betting company and trading on their quotes. This means that at no point will you have to take any delivery of a physical asset.

Summary

As with all trading it’s important to gather as much knowledge and to be as prepared as possible as there are many factors that could affect the markets such as interest rates, unemployment figures and inflation levels to name a few. But there are many news sources available to help you. Additionally, many of the spread firms have excellent educational material and programs that will help you develop a strategy. Charting facilities are common place along with regular seminars and video tutorials.