Gold Spread Bet | Gold Spread Betting

Ever since King Midas said, “Hey, look what I did” gold has been traded, primarily as a method of payment, but also to back currencies (the gold standard). Gold is much more than just a show-pony; its unique physical and chemical properties mean that it’s well used in industry and dentistry. So let’s take a 10-minute look at where it comes from, who wants it and how we can make money by trading it.

Why Gold?

Gold is generally seen as the ultimate safe haven and a more stable asset class than equities and bonds. It has physical properties that survive war, natural disasters, currency devaluations, inflation, recession and banks that tell lies. When markets become uncertain, there is often a flight to gold by professional traders and investment funds.

The 2008-09 banking crisis really brought home to investors that, just like the small print says, prices can fall as well as rise, and boy did they fall. This prompted a re-think of investment policies which saw many funds diversifying risk away from stock and bond markets, and into commodities including gold. Gold is also bought as a hedge against Dollar weakness, though this relationship does break down from time to time.

The small print should also warn that although gold is viewed as a more stable investment, its price can, and does, fall like other investments.

Where Does Gold Come From?

Apart from big holes in Africa, and Mike Tyson’s dentures, there are three recognised suppliers:

- Production: The top 5 gold producing countries are South Africa, USA, Australia, China and Peru. But despite the runaway price of gold, production has fallen steadily since 2001. One reason for this is the massively long lead time for exploration and production, which all but died off following the depressed prices of the 1990s. Also mining costs are high and new deposits hard to find, leading to fewer viable projects.

- Recycling: Yes, you may scoff, but melting down gangsters’ teeth and auntie’s ear-rings is big business. This supply reacts to sudden changes in the price, but also to economic circumstances; an economic downturn will see a rise in recycled jewelery.

- Central Banks: Historically the world’s central banks held large stocks of gold, which were used to back their currency. Over the past few years they’ve been ongoing sellers, but more recently steady buying by Russia and China have turned central banks into net purchasers. Separately the IMF continues to sell gold to raise funds. Central bank sales are regulated so as not to undermine the market price.

All paper (fiat) currencies are ugly and history shows that governments around the world will always debase their currencies, hence the appeal of hard assets such as gold and silver.

Where Does It Go?

There are 3 main sources of demand:

- Jewelery – this accounts for just over 50% of demand

- Industry and dentistry – around 11%

- Investment – 38% and rising

A big factor of how well gold does is the price of the US Dollar, if the dollar is strong it makes gold more expensive to foreign buyers as gold is mainly traded in US Dollars.

How Do We Trade Gold?

Gold is traded 24 hours a day around the world in OTC (Over The Counter) markets; the main centres are London, New York and Zurich. However it is also traded through futures exchanges like COMEX (part of the Chicago Mercantile Exchange) and CBOT. It is the futures contract from COMEX that Capital Spreads use to derive their Gold Rolling Daily prices.

There are also some exchange traded funds like the GDX (or Market Vectors Gold Miners ETF) which track the price of gold by including a number of gold and silver shares in one basket, in a bid to track the NYSE Arca Gold Miners Index (^GDM). These offer traders a leveraged way to get exposure to the shiny metal and is available to trade on most of the bigger spread betting providers.

Another (riskier) way of betting on gold is by trading companies which have extensive gold mining interests, like Barrick Gold, Anglogold and Randgold Resources. However production margins and hedging policies mean that mining shares can be far more volatile than the underlying metal. Also company-specific news can affect a share price in a way that wuold leave the gold price unchanged.

Investing in physical Gold and investing in Gold mining shares are two different animals. Just because actual Gold prices go up it doesn’t mean that Gold Mining shares will go up.

What To Watch Out For When Trading

Trading gold half-heartedly is a risky business; its price can be influenced by a mixture of news, economics and weather:

- Geopolitical events – a major terrorist event, an escalation in Middle East tension or a coup in the Far East are all likely to push the price higher.

- Economic news – during the 2008-09 credit crunch and the 2010 Greek debt crisis investors rushed into gold, where they saw more stability and ‘safe haven’. Also the price of gold usually (but not always) moves in the opposite direction to the US Dollar, so keep an eye on US economic data.

- Interest rates – gold may be a store of value, but it’s not too hot on regular payouts. The lack of interest/dividends makes it less attractive if interest rates are high and more attractive in a low interest rate environment.

- Central bank gold sales and foreign exchange reserve news releases. The trouble here is that these bankers tend to trade first and announce after.

- Mining companies may report they have found a new ore deposit, opened a new mine, or run into geological problems that have caused production issues. Companies may also announce forward sales (production hedges) of mine output.

- Seasonality. Gold usually performs well in the final quarter of the year in the run-up to a number of religious and ‘gift-giving’ festivals including Christmas and Diwali. Also many Indian weddings occur in November and December with the gold given as part of a dowry usually purchased after the harvest in September.

- Weather events – this one may seem a bit strange but we’re talking specifics here, not a wet weekend in Bognor. India accounts for about a quarter of all gold consumption with most of it bought after a good harvest by peasant farmers. Equally, these farmers might then sell it in a tough year when a bad monsoon or typhoon wipes out their crops.

Major players in the metals markets include speculators and those who actually have a real demand for the commodity in their day-to-day business activity.

For example, in the case of silver, a jewellery manufacturer may want to use the futures market to lock in a price for the metal after receiving a significant order from a major retailer. Imagine the manufacturer has quoted a price for the finished article to the retailer but one of the major cost components of the product will be the actual price of the physical silver in the jewellery. The manufacturer does not want its profit margin ruined by a sudden surge in the price of the commodity. So the manufacturer buys a futures contract to cover this risk.

Unlike this manufacturer, you will be trading in the hope that the price of the commodity will rise or fall to match your view.

Trading commodities can be exciting, but at the same time risky due to their volatile nature. There are a number of factors that can make the prices of commodity markets move such as geopolitical events, underlying supply and demand, weather conditions, currency fluctuations and investor sentiment.’

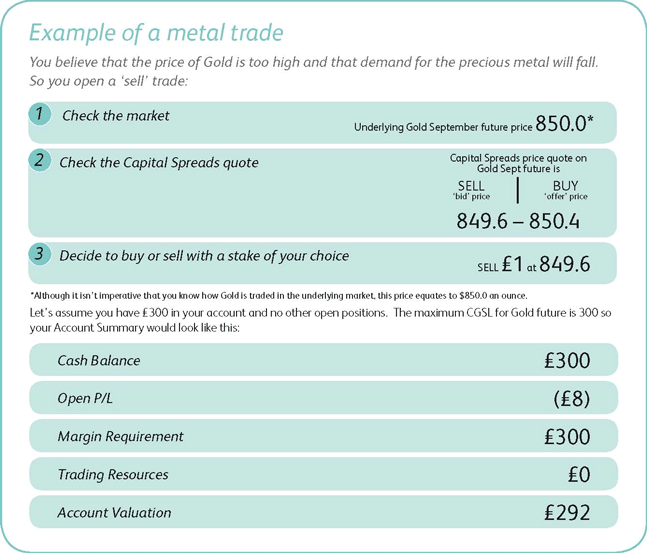

Let’s take an example of a trade with a fictitious spread betting company, say by the name of Capital Spreads:

Example of a Gold Spread Bet. You can trade gold at Trade Nation

Your automatic stop loss would be placed at 80% of the maximum CGSL. The maximum CGSL for Gold Sept is 300 (in this case the same as the funds you have available) so the stop loss will be placed at £300 x 80%=£240, which at £1 per point puts it 240 points away, i.e. at 873.6. The margin requirement would be £300 (300 x £1).

You would be able to move your stop loss nearer, which would free up funds and increase your Trading Resources, but you would not be able to move it further away as you have no Trading Resources left.

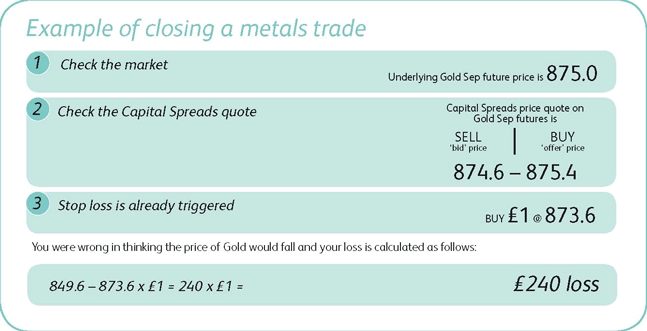

However, tensions in the Middle East later increase and as a result, traders buy into precious metals as a protection against more poor news.

The price for gold rises higher than your stop loss order at 873.6. The stop loss is therefore triggered and your position is automatically closed:

Another Example of a Spreadbet on Comex Gold

Let’s say you think gold is going to rise in price over the coming days or weeks and you want to bet that this will happen

In most cases this can be done online or by telephone, and you can trade in sterling, euros or US dollars. The dealer will quote two prices: a buy and a sell price. If the quote on gold is $1371/$1372.50, you buy at the second price, $1372.50. You decide to place a £10 per tenth of a dollar bet, so you would buy £10 at 1372.5. This means that for every tenth (or point) the price of gold rises, you win £10, and your potential profits are unlimited

You also need to place a stop which will prevent you from losing too much money if you are wrong. In this case you might place the stop at $1360, 125 tenths lower than the price at which you placed the bet. So even if gold tumbles to $1300, your maximum loss would be 125 X £10 = £1,250.

Two weeks later gold moves to $1405 and you want to take your profit. You are quoted $1404/$1405.5, so you sell at the lower price to close the bet.

The price has moved up by 315 tenths, so on this bet at £10 per tenth, you would have made £3,150 tax-free profit.

London Metal Exchange

Some spread betting providers trade the London Metal Exchange. I would like to warn you of some bizarre things that makes the LME a strange beast and will save you a great deal of headaches. Note: Only some use the LME as a strict guide, when you sign up with one of the spread betting companies I outline later – please read their booklet they supply before trading. Don’t worry however, I do point out which Financial Bookmaker is good for beginners, moving up to the more advanced trader.

The LME contracts for none-ferrous metals such as -:

- ALUMINIUM ALLOY

- ALUMINIUM

- COPPER

- LEAD

- NICKEL

- TIN

- ZINC

- NASAAC

They run from 90 consecutive days and not 3-month contracts to which we have become accustomed. This can cause confusion. As when you open a 90-day LME contract then a week later you decided to close by either buying or selling a 90-day contract – you would be opening a new contract and not selling/buying the old one to close.

That is why when trading the LME markets you make a note of the contract date to which you are closing. When you go to close that contract you chose the contract date for which you are closing and not buying/selling to close on a new 90 day contract. Sounds difficult, but only a handful of the professional league Financial Spread Betting firms trade using the LME as a guide. You can get the best data from the horse’s mouth, direct from the LME: https://www.lme.com/Metals/Precious-metals/LME-Gold