In Section 2 we discussed the four stages of the markets and why they occur. It is important to be able to recognise which phase the market is in so that we can form an opinion. If you are unfamiliar with the concept of the four stages of markets return to section 2 for an overview.

Glancing at the above chart the four stages appear obvious, but very often these phases do not become apparent until they are well underway. As an anticipatory trader we need to take a position at the start of a move, rather than joining half way through where the risk will be higher. To make consistent gains our strategy also needs to be different for each phase. It is possible to profit in all of the phases but in general terms the opportunities are greatest when trading in the direction of trend, but how can we know there is a trend?

Pivot Points and Trend Trading

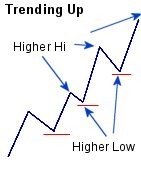

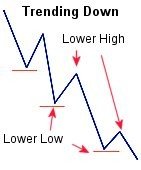

We can use Moving averages (Ma’s) to show trends but they do not tell the whole story as they give equal weight to events that have happened in the distant past as to the present. However we know that markets react the most to events that have either just taken place or occurred in the recent past. Here in lies the paradox of this frequently misunderstood indicator. For identifying short-term trends we should use a less subjective method noting the Higher Highs and Lower Lows:

An up-trend can only exist when a new high is made that is higher than the previous high and when a new low is made that is higher than the previous low. We call this a higher hi / higher low or HH/HL.

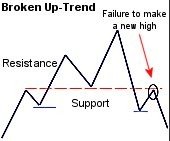

The opposite is true for down-trends When a new low is made that is lower than the previous low and a new high is made that is lower than the previous high we have a down-trend. We call this a lower low / lower hi or LL/LH. The moving average should confirm this and any break of these simple rules calls the integrity of the trend into question. One very common characteristic of a trend that has failed is the inability of the market to make a new high. Analysts call this a failed upswing and it is a good indicator of a potential reversal.

I find it helpful to think of an up-trend as an old rickety staircase which you climb carefully. Each tread supports your weight on the way up but when you are near the top and step on the next tread it breaks and you fall through. There is no longer a stair to support your weight and you continue to fall until being stopped by next floor down. The same is true for markets because at each step on the staircase traders are asking themselves, ‘is the market good value at this price?’ If most traders agree that it is there will be buying support but if they do not, support can break and the price will fall until there are enough people willing to buy at the new lower price.

Looking again at our chart with the benefit of 20/20 hindsight we can see that the market moved out of accumulation in late September forming a higher high. Is this ‘early mark-up’? At this stage the long red candle following the new high shows a rejection by traders at the new higher price. This is not as negative as it first seems. If we look at the start of October we can see that after making a higher high a higher low has also formed. This is the first completed step of our up-trend. The subsequent bar closed above the significant 4600. We know that if 4600 fails to hold up then the trend is broken, and this represents the technical point at which we know we are wrong, if we were to be buyers. We get a bullish engulfing candle at 4600 and this is another confirmation of buying pressure.

At first glance the only clues to the subsequent up-move was the higher high which was rejected and the price action crossing over to trade above the longer term MA which at this stage is flat. So how could we know that there would be a rally? The answer is that we could not be certain, but there was one other indicator suggesting that the smart money was accumulating buy contracts. Take a closer look at the volume of transactions shown at the bottom of the chart. We can see that on the low prior to the move up, volume increased significantly and formed what is sometimes referred to as a ‘volume climax’ or a peak. The price volume relationship will be explained in detail in a later lessons but for now all we need to know is that if the market is trading close to support and the volume suddenly increases, we have another trading clue about direction. The bullish engulfing candle closing above 4600 is also a clue. When these indicators are added together and we look at where they happen the picture starts to make sense. When we start to recognise these these patterns, which occur over and over again we are truly starting to read the market. In the next lesson we will look at the concept of support and resistance and then go on to discus how candlesticks and other chart based indicators can flag up great opportunities. However before we go on to talk about other indicators lets take a brief look at how we spot ‘Swing Trade’ opportunities by identifying pivot points.

Pivot Points and Trend Reversal

Pivot points are technical indicators used to determine potential turning points when market sentiment could switch from bullish to bearish. They are computed as the average of the high, low and close from the previous trading session and are used by traders as markers of support and resistance.

It is in the nature of markets to move from one extreme to another and although there may be longer term trends the short term traders expect to make their money quickly. This can not be achieved by joining a move late, so it naturally follows that the lowest risk and best opportunities are going to be found at the turning points. The professional short term traders devote nearly the whole of their effort to identifying the signs of a significant reversal of direction. All four stages of the market offer opportunities to trade profitably but by far the best opportunities are to be found in early mark-up and early and early decline stages trading with the trend. It is possible to profit when the market is in accumulation and distribution also as the pattern of trading can be ordered. However the profit targets will be much smaller as each time the market trades close to the top of the range we know that there will likely be retracement. With this in mind we need to be especially careful to ensure that the risk to reward ratio remains in our favour.

Knowing this should be enough to allow you to trade even in the most challenging conditions. It should be obvious that each of the phases require a different approach as a trader who solely uses a trend following system is going to have a difficult time in stages 1 (accumulation) and stage 3 (distribution).

The chart on the right taken from Dec Futures 2004 is reasonably typical of the type of trading we have been seeing for most of the year with this index. There is an established up-trend and the retracements are falling back on support which had been previous resistance. This type of ordered trading is easy to read and we can see that as the market falls back to 4740 at 11:00am a bullish engulfing candle forms. We could be buyers with very little difficulty and have a logical place for our stop loss just below the low. The trading is ordered as the market climbs and stumbles slightly as the previous high is reached. We know from the 60 minute chart (not shown) that we can expect resistance at 4750 as this is where the market found resistance last time around. The market forms a failure candle pattern at the high and the RSI also moves into overbought territory. We can now place a stop order to go short two contracts and reverse or swing our long position if the market moves down from 4750. After our trade is triggered there are two further up-swing failure patterns which confirm our bearish stance. Our target is 4740 which is back where we started. When we close out our position the market has not moved from where we started but we have taken 15 points with simple trades in what turns out to be range bound conditions.

Some contra traders frequently try to sell each new high in strong bull markets and this is something I would not recommend. This has to rate as rampant stupidity as a trader who sells short in these conditions is ignoring what the fundamental price action is telling them. They use subjective language such as ‘it can’t go any higher’ or ‘it is too expensive’. They will frequently post comments on bulletin boards boasting how they are going to short the stock down to the ground, mistakenly thinking that markets are driven by logic rather than the actual engine of fear and greed. The professional traders however quickly recognise the type of market that they are in and adopt the right approach for the conditions. Being a contra trader does not mean that every time there is a rally we have to go out and try and sell it. It means that we look for signs of weakness in the rally and buy in on a pull back or a dip. Only when a rally becomes significantly overextended and is trading up to known resistance do we think about trading it short. As you can imagine this is a big subject but keeping in mind that the simplicity of the market is it’s greatest disguise we need not over complicate the process.