Trading Soft Commodities

Soft commodities are products that are normally grown (or reared) or processed from such products as opposed to mined or drilled for (and their derivatives).

Common soft commodities are corn, wheat and coffee but there are others such as soybeans which are the processed product.

Underlying futures markets in soft commodities were created so that suppliers, such as farmers, could sell their produce long before it was harvested in order to guarantee the price they would receive for their crop and so that processors such as Tate and Lyle (sugar) or Nabisco (wheat, corn etc) could have surety of supply.

This has all changed now with participants in these futures markets more frequently being investors/traders looking to profit from movements in the prices for their own sake. These participants have no interest in the physical product and have no intention of taking delivery of a ton or two of sugar or coffee.

If you trade in these markets using a spread bet you will fall into the second category!

When traders trade soft commodities in the underlying markets on the different exchanges, they have to adhere to standardised quantities and qualities. But with a spread betting provider like Ayondo for instance, you will merely be trading in your stake size per underlying unit of price movement or tick size.

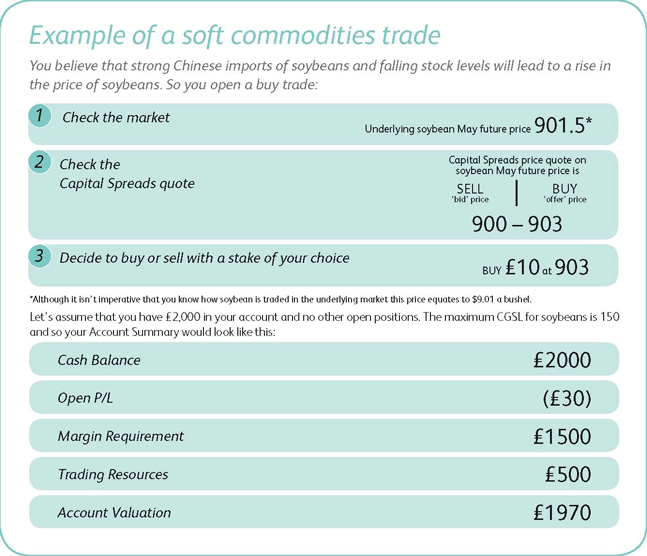

Let’s take an example of a trade with a fictitious spread betting company, say by the name of Capital Spreads:

Example of a Soft Commodities Spread Bet

Note that CGSL refers to computer generated stop loss. Your automatic stop loss would be placed at 80% of the margin requirement. With a £10 stake, this would be £1,500 x 80%=£1,200, which at £10 per point puts it 120 points away from your entry level, i.e. at 783.

If you wished you could move this stop loss closer which would free up additional funds for trading or as you still have £500 of Trading Resources, you could move it further away. In this case, the furthest you could move it would be another £500×80%=£400, which at £10 per point puts it another 40 points away, i.e. down to 743.

However, contrary to your view that price will rise, global demand for soybeans does not drive prices any higher and unfortunately for you, good weather in Brazil leads to a bumper harvest which increases supply. As a result, the soybean price falls and you decide to close your trade: