Bacanora Minerals is first junior miner to list on AIM for 3 years with a strong start to trading

Jul 26, 2014 at 9:54 am in AIM by contrarianuk

The entry of Bacanora Minerals (BCN), the Canadian resources company with assets in Mexico, onto AIM yesterday was notable in that it was the first junior miner to list on the exchange for 3 years. In addition, the shares had a healthy debut, listing at 33p and closing the day at 86p after climbing into the mid-90p range at one point. As well as being listed for the first time on AIM they have traded on the Canadian TSX-V exchange since 2009 though the company has remained largely under the radar up to now.

The company raised £4.75 million before expenses, through the issue of 14,393,940 Common Shares at the Placing Price of 33p per share with a market capitalisation of £25.8 million. The net proceeds from the Placing will be applied to general working capital purposes and in particular to fund the preparation of further work on its Mexican assets. At Friday’s closing price, the market cap had all risen to £66 million.

Bacanora is run by Colin Orr-Erwing (Chairman), a natural resources veteran and Martin Fernando Vidal Torres (President) a former executive at Rio Tinto and Shane Shircliff (Chief Executive Officer) with 15 years in the mining and resources sector.

The Company explores and develops industrial mineral projects, with a primary focus on borates and lithium. The Company’s operations are based in Hermosillo in northern Mexico and the Company currently has two significant projects under development in the State of Sonora, one being a borate project and the other a lithium project.

The two main assets of Bacanora Minerals are the Magdalena Borate Project in Sonora State, Mexico and the Sonora Lithium Project, which covers ten mining concession areas in North East Sonora State. The Company has also constructed a pilot plant in Hermosillo, Sonora State, Mexico in order to conduct detailed metallurgy on core samples and run process tests to establish the optimum ore processing methods for both the Magdalena Borate Project and the Sonora Lithium Project.

Borates are the primary source and feed stock for commercial boron compounds and these are used for applications such as glasses, heat-resistant (including fiberglass insulation & textile), detergents, soaps & personal care products; ceramics, glazes and agricultural micronutrients. Lithium is a key component in the production of batteries, and is key to the powering of electrical vehicles, smart phones and tablets.

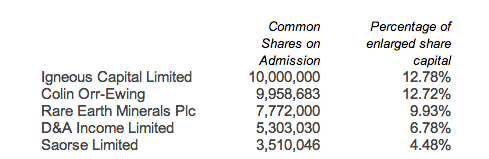

Key shareholders include David Lenigas’s Rare Earth Minerals as well as Igneous Capital and D&A income.

There’s a long way to go for Bacanora shareholders but for those getting in at the listing price a very rewarding investment given the potential of the company’s Mexican assets and growing demand for Borate and Lithium. The pre-feasibility study on the Magdalena Borate Project and work programme to establish the economic potential of the Sonora Lithium Project are now key to building further signficant gains in the share price. The AIM introduction investor presentation is an interesting read at: http://www.bacanoraminerals.com/reports/pdf/investorpresentation.pdf

After being battered for years, is the junior resource sector finally on the turn?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.