AIM oil and gas favourites languish near lows

Feb 14, 2014 at 7:11 am in AIM by contrarianuk

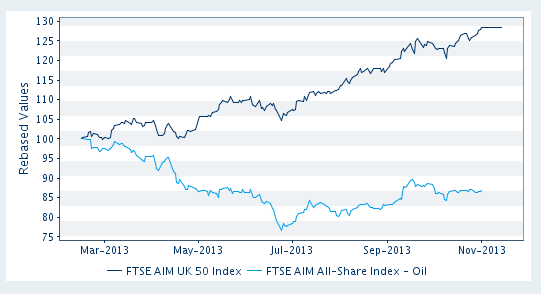

It’s been a disappointing start to the year to say he least for investors in AIM oil and gas companies, with many favourites like Gulf Keystone Petroleum, Bowleven, Xcite Energy, Rockhopper Exploration at rock bottom. Pretty depressing for owners of these AIM favourites! Bowleven down 56% in the last 12 months and Rockhopper/Gulf Keystone down around 25%. Many are asking how low can these shares go given the apparent total lack of interest from big hitting institutional investors in the sector. Consumer discretionary, biotech and technology are the sectors in favour right now and any resource related stocks are having a very tough time indeed.

The small cap oil sector has not been alone in falling off a cliff, FTSE 250 favourites like Tullow Oil and Ophir Energy have also suffered badly over the last 12 months. At 758p, Tullow Oil is now down 50% in the last year after disappointing earnings and a duster in Mauritania this week!

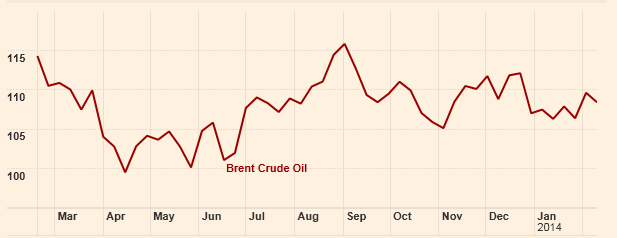

The collapse is somewhat surprising given that Brent crude is staying within a relatively tight range between $105-110 in recent months.

But sentiment has not been helped by lack of M&A news and stated intentions by the oil majors to dump some assets and reign in capital spending in recent months. In addition regional factors like the Scottish independence referendum has further added to worries in the North Sea and the political battle between Kurdistan and the Baghdad government in Iraq has not been helpful for investors in GKP.

Last week Statoil announced it was cutting back on capital spending by around $5 billion.Yesterday Royal Dutch Shell announced the sale of three of its assets in the North Sea as the company plan to divest $15bn (£9bn) of assets – the Anasuria, Nelson and Sean North Sea fields.

Takeover activity at big premiums have been relatively absent in the AIM oil and gas space in recent times apart from Coastal Energy’s acquisition by Compañía Española de Petróleos, S.A.U. (“CEPSA”) in January 2014 for $2.3 billion. Certainly battles between heavyweights illustrated by the long running battle for Cove Energy culminating in the Thai state oil firm PTT Exploration & Production $1.9 billion offer for the East Africa-focused firm winning over offers from Royal Dutch Shell has evaporated.

On Wednesday, the Organisation of Petroleum Exporting Countries (Opec) said that projected output from the UK’s North Sea region in 2014 could fall to an average of 800,000 barrels a day (b/d) of crude, a fall of 70,000 b/d from 2013 when output hit its lowest average since 1977.

The lack of interest in the North Sea is not helping companies like Xcite Energy, Faroe Petroleum, Ithaca Energy and others. Xcite investors have been waiting with baited breath for news of a farm out and reserves based lending deal for months. With the shares at 93p, worries are rising that a deal won’t materialise given the uncertainty of the Scottish situation.

The Falklands dream seems to have sour with Rockhopper Exploration and others like Falkland Oil and gas suffering from worries about Argentine agitation and in the case of the former whether partner Premier Oil will pursue its development of the Sea Lion development with a new Chief Executive being recruited.

What will turn this dreadful sentiment? Certainly a big takeover deal or decent farm out would help. An institutional rotation back into the sector would be most welcome and with prices this low the time will come at some point especially if Brent crude stays above $100 and all forecasts indicate that this will be the case in 2014. I am sure many investors in the big names in AIM oil and gas had sold out in 2012 and piled into biotech shares. But things can turn. Just look at my recent article on African Barrick Gold which has risen from less than £1 last summer to £2.72 yesterday and that’s with the gold price still far from the highs and with the tapering of quantitative easing ongoing. The outlook for AIM oil and gas looks a little hazy this year but lets see where we are by the end of the year. Come on, we badly need some excitement in this sector – an Xcite Energy, Bowleven or Gulf Keystone Petroleum takeover would be rather handy!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.