Egdon Resources zooms up as it announces farm out with Total

Jan 16, 2014 at 6:24 am in AIM by contrarianuk

A signficant impact on the share price following a decent farm out deal involving small cap oil and gas companies is far from over. With small cap AIM oil and gas investors in the likes of Bowleven and Xcite Energy waiting for their farm out news on Bonomo and Bentley, it appears that the big guys still have an appetite for an investment which can produce a very healthy return indeed for investors. Canny investors in Edgdon who sold out at the peak could have made 200% in a few days!

A signficant impact on the share price following a decent farm out deal involving small cap oil and gas companies is far from over. With small cap AIM oil and gas investors in the likes of Bowleven and Xcite Energy waiting for their farm out news on Bonomo and Bentley, it appears that the big guys still have an appetite for an investment which can produce a very healthy return indeed for investors. Canny investors in Edgdon who sold out at the peak could have made 200% in a few days!

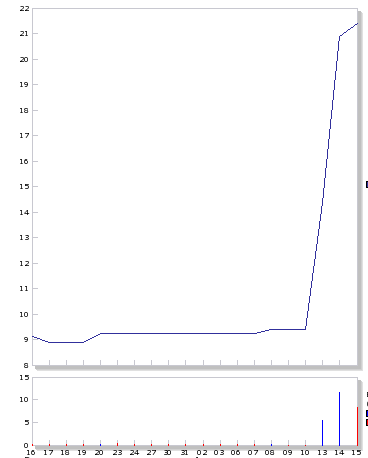

There was some big news this week from AIM listed, Egdon Resources (EDR). It announced a deal with Total E&P UK, sending it shares up from 9p to 21p, a rise of 128%. They were as high as 27p yesterday before dropping back to close at 21p.

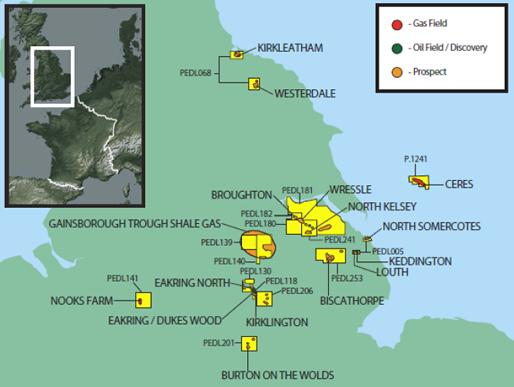

The farm out covers licences PEDL139 and PEDL140 located in the Gainsborough Trough in Lincolnshire, a shale gas play. The deal is significant as it marks the entry of the oil major into the UK shale industry.

Egdon will hold a 14.5% interest in the licences which cover an area of 240 square kilometres and are immediately adjacent to licences PEDL209 and PL161/162 where Egdon has an interest.

The acreage is also partly owned by Island Gas Limited and eCORP Oil & Gas UK and Total will earn a 40% interest in the licences through the payment of $1.6m in back costs and the funding of a fully carried work programme of up to $46.5m.

Total has the option to exit after an initial period of this work programme corresponding to a minimum commitment of $19.5m. The programme will include the acquisition of 3D seismic, the drilling and testing of a vertical exploration well and associated well pad construction, and, conditional on the success of the testing of the exploration well, the drilling and flow testing of a second appraisal horizontal well.

Europa Oil and Gas has had the initial term of its nearby PEDL181 licence increased by DECC (Department of Energy and Climate change) by 12 months to 30 June 2015, allowing it to drill the 2.9 million barrel Kiln Lane-1 prospect in the second half of 2014. Europa holds a 50% interest and is operator of PEDL 181 which covers 540 sq km in East Lincolnshire, while Egdon holds a 25% interest in the licence.

Edison said of the Total deal and value of Egdon , “Our RENAV value of 25.8p and unconventional value for PEDL 139/140 of 8.0p imply a total value of 33.8p.”

The lesson. Despairing investors in AIM oil can have hope.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.