GCM resources goes through the roof on Bangladeshi coal policy rumours

Feb 6, 2014 at 12:01 pm in AIM by contrarianuk

The huge rise in the GCM Resources share price caught my attention yesterday. The company used to be called Asia Energy and its main focus is the Phulbari open pit Coal Project in Bangladesh. The project has been on hold for years as arguments have gone on and on within the Bangladeshi government about the environmental and economic impact of Phulbari.

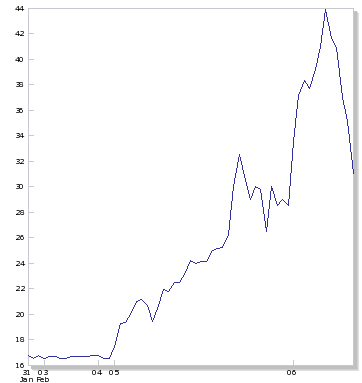

Share price last week:

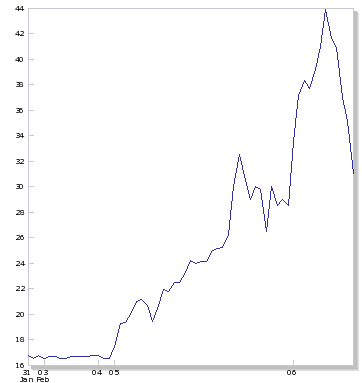

Share price last 5 years:

The project has been subjected to a full Feasibility Study including an Environmental and Social Impact Assessment but the politicians can’t seem to get their house in order.

I remember the shares well when they were called Asia Energy in 2006 since as a share holder all hell broker loose when Police shot protestors against the mine and the project was essentially moth balled by a protracted political process which ebbed and flowed as one party after another came to power. A big loss at the time left a bitter taste.

The company made a £3.2 million loss in the period to 30th June 2013 with a similar loss in the year before. In August 2013 the company raised £2.3 million through a share placing at 19.8p. Early in 2013 the previous board of directors resigned with Michael Tang being appointed as executive chairman after the resignation of Chief Executive, Gary Lye, in April 2013.

Now the crazy times seem to have returned to GCM following rumours in the Bangladeshi press that a new coal policy which would get Phulbari off the ground is close to approval.

The shares have had an incredible couple of days after languishing for months. The shares were up 73% or 12p to 30p yesterday, and first thing today they were up another 24% to 36p. In the last hour or so severe profit taking kicked in with a drop of 26% to 19p to sell and now as I type there are 14% down to 23p. Talk about volatility and I hope those speculating

At 3.37 PM yesterday, the company issued an RNS to douse the frenzied anticipation, which briefly helped take the shine off the shares, for a time anyway.

“GCM Resources plc (AIM:GCM), a resource exploration and development company, has noted today’s increased share trading volumes and share price, and knows of no reason for it other than for press speculation in Bangladesh relating to the reported imminent finalisation of the Government of Bangladesh’s Coal Policy.”

I hope those buying in at the lows have taken their 100% plus profits, since my personal experience with GCM and Bangladesh warns against anything being certain both with the company and the country given the political dimension to every decision. With a new board with limited cash resources (they had £707,000 left in mid 2013 before the £2.3 million placing) and with many years before the project would actually start producing coal there are plenty of reasons not to pile in at these prices. But of course the sky is the limit if Phulbari does ever get off the ground once the millions of dollars to develop the mine have been found, given the potential value of coal production from the mine and significant electricity generation opportunity.

GCM is about as risky as you can get given the Bangladeshi political situation. Caveat Emptor I would say but good luck to holders! 2006/2007 were enough for my nerves with this company!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.