Shares in Pier’s Linney’s Outsourcery company falling off a cliff

Jul 29, 2014 at 2:45 pm in AIM by contrarianuk

Dragon’s Den stat Piers Linney may be splashing the cash on the BBC2 programme but as co-founder of AIM listed Outsourcery (OUT) he might be a little concerned by the 79% fall in the company’s share price in the last year as troubles about the long term financial sustainability rear their head. Like the show he probably wishes that he was saying that “I’m out” of this one as co-Chief Executive.

The company’s web site says that “We’re one of the UK’s leading providers of cloud-based IT and business communications solutions and we have been delivering cloud services to partners and customers of all sizes since 2007. Outsourcery employs approximately 150 people across four offices across the UK and is a founder member of the Cloud Industry Forum (CIF).” Its cloud platform bundles together Microsoft cloud applications such as online video conferencing, file sharing and storage and Microsoft Office programmes. Services are then charged out for a monthly fee. Outsourcery has partnered with companies like Vodafone to sell Outsourcery’s services but with the middleman taking a cut of the deal.

Outsourcery was co-founded by Linney and Simon Newton in 2007 and it seems the entrepreneur has had a less than perfect history of business ventures over the last few years according to plenty of articles circulating on the web. The company was listed on AIM in 2013 raising £13 million at 110p a share with a further £4.2 million placing in December 2013 at 112p. Today the shares stand at 25p.

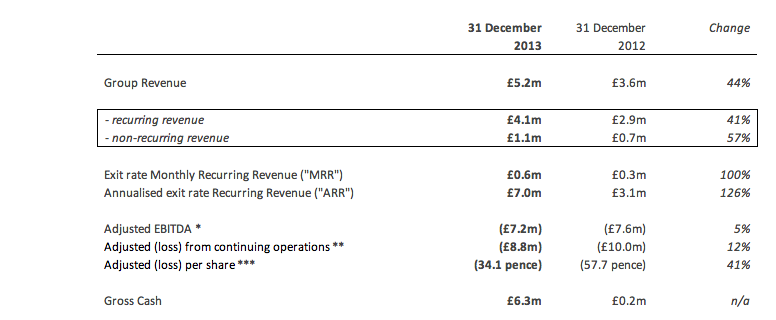

The preliminary result for 2013 were published in March and showed revenues of £5.2 million and a loss of £8.8 million with £6.3 million of cash at the end of the period.

The company had a trading update in June and it wasn’t pretty reading. “We have continued to experience steady progress in generating revenue from our partners in the Small and Medium sized Enterprise (“SME”) space. As outlined in our Preliminary Results announcement of 19 March, however, it is the activation of revenue generation from our strategic Enterprise partner base and from our ‘Secure O-Cloud’ pipeline (formerly IL3) that will have the most material impact on revenue growth over the medium-term.

In recent months we have completed, as planned, a number of on-boarding and integration processes with large Enterprise. We are pleased to report that we now have increasing visibility on a growing pipeline of opportunities from both their large Enterprise and mid-market end-customers, some of which we expect to see close in the coming weeks. At the same time we are in discussions with new potential strategic partners with large customer bases, significant sales forces and material revenue opportunities.

However, in spite of the pipeline, and certain important contract wins that have taken place in the period, the large-scale pipeline build of our strategic partner channel has taken longer to ramp up due to delays finalising the necessary organisational, system and their sales force readiness. This will have an impact in the short term on the growth of our Monthly Recurring Revenue (“MRR”) during the year and, consequently, an impact on our reported revenue result for this financial year.”

“The Board believes that the Group has sufficient cash resources for its immediate needs. The Board expects that the Group will achieve monthly cash flow breakeven during the course of H2 2015, at which point the Group should become strongly cash generative and see margins expand due to the high operational leverage inherent in the Group’s business model at scale.”

The company said that it was also exploring financing options including debt facilities, an investment by a strategic partner or equity finance and would update the market in July. It seems the falling share price in recent days indicates that either a deeply discounted placing is planned or an investor is coming in demanding a steep discount to the current share price.

The company needs to generate revenues of around £20 million to break even because of its cost base, a tall order right now especially after the tepid trading update back in June although in that month the company signed up its first major order with Lloyd’s register – “With a total order of 8,500 users worldwide and commencing from May 2014, the first phase of the win is for the deployment of 1,500 users of Lync, Outsourcery’s full enterprise voice server for Lloyd’s Register’s UK operation. The second phase is for the deployment of 7,000 Lync users, to complete the customer’s world-wide roll out.” On the 24th July this was followed up a second order with an unnamed party, “The first significant contract win by a key partner has a five year term and during which time it is expected to deliver at least £70,000 in monthly recurring revenue (MRR) or £840,000 annually once fully deployed. We expect MRR to reach approximately £10,000 by the year-end with full roll out expected during Q1 2015. The opportunity exists to further grow this figure, in time, should the end-customer choose to exploit additional services. A one-off and non-recurring revenue item of approximately £40,000 for the design and integration phase of the contract is expected to be recognised over the next few months.”

In an Edison note they said “Pre-launch preparation has taken longer than anticipated at Outsourcery’s strategic partners and consequently the pipeline build into large enterprises has slipped. We revise forecasts and now expect EBITDA break-even in FY16, which leaves a funding requirement of up to £5m; this is reflected in the EV/sales rating of 1.0x. Management is reviewing financing options and plans to update investors later in July.”

So Outsourcery is starting to win some new contracts but the revenue impact remains relatively limited for now. This month’s news on funding will be key and Piers has got his work cut out given more scepticism amongst investors in putting fresh cash into this operation. If Linney really is a business guru he will need all his skills to get Outsourcery into some semblance of health in coming months. Buying shares in this business right now seems a high risk proposition and like the Dragons you might be better saying “I’m out!” for a while longer. Today the shares are down 16% to 25p….good news doesn’t seem to be around the corner. With a market cap now less than £10 million, a £5 million cash raise is a tough call.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.